Cryptocurrency tips and strategies for investors, traders, and beginners. Learn how to buy, sell, and trade Bitcoin, Ethereum, altcoins, and NFTs securely. Get insights on crypto wallets, DeFi, blockchain technology, market trends, and price predictions. Whether you're a long-term holder or day trader, this blog helps you make smarter crypto moves. Discover new coins, profitable platforms, and proven tools to grow your digital portfolio. Crypto isn’t the future—it’s now.

Cryptocurrency Tips

👉 Discover the strategy that helped early adopters multiply their earnings.

Monday, January 31, 2022

Sunday, January 30, 2022

Saturday, January 29, 2022

White House to pursue crypto regulation as a matter of national security

Under the leadership of US President Joe Biden, the White House is likely to release an executive order–assigning federal agencies to approach the cryptocurrency sector as a matter of national security.

According to the source familiar with the White House’s plan, the national security memorandum is expected to be released in the next few weeks, Barron’s reported.

Executive order in prep

The memorandum would task government bodies to analyze the crypto space and design a regulatory framework for all its sectors–from Bitcoin, to stablecoins and NFTs.

the person reportedly said:

“This is designed to look holistically at digital assets and develop a set of policies that give coherency to what the government is trying to do in this space,”

Rumors about the executive order being in preparation for February release were spurred at the end of last week.

Last Friday, Bloomberg reported White House is gearing up to “place itself at the center of US crypto policy”–citing anonymous sources familiar with the matter. The report revealed that senior administration officials are in the late stage of drafting the executive order.

The document reportedly “details economic, regulatory and national security challenges posed by cryptocurrencies”–calling for reports from government agencies by the second half of the year.

A comprehensive analysis

Various studies performed by federal agencies–including everyone “from the State Department to the Commerce Department” would help tailor a comprehensive regulatory strategy.

Tasked to investigate all aspects of the industry, the agencies’ reports are expected to assess possible systemic impacts of crypto, analyze its illicit use cases, but also weigh and protect the country’s competitive role in the space.

The US government’s increased focus on crypto regulation comes paired with exploring the possibility of CBDC issuance, as the Federal Reserve recently issued a preliminary report on the matter–opening a public feedback period through May.

However, the US is not alone in the matter, with countries like India and Russia also currently mulling ways to regulate the crypto sector and adopt tax laws.

The post White House to pursue crypto regulation as a matter of national security appeared first on CryptoSlate.

* This article was originally published here

Friday, January 28, 2022

Nigerians attack Binance, trends #BinanceStopScamming

The largest crypto exchange by trading volume, Binance, is under fire from its users in Nigeria over the “unreasonable” closure of their accounts amidst other inappropriate activities carried out by the platform.

Nigerians lash out at Binance

According to a trending Twitter Nigeria hashtag, #BinanceStopScamming, which has generated over 20k tweets within the last 24 hours, several users have alleged that Binance closed their accounts or froze their crypto holdings without offering any explanation for their actions.

Binance is one of the most used exchanges in the country due to its peer-to-peer (P2P) feature, allowing crypto traders to bypass the government’s hardline stance towards the industry.

One user, Ama Judy, wrote that the exchange had seized her crypto holdings for ten months. She stated that her attempts at reaching out to the firm’s customer service unit had not gotten any positive response.

It’s been 10 months now that Binance held my hard earned crypto, I have reached out to customer care severally, till now I have not been given any tangible reason for this act @binance @BinanceAfrica @cz_binance @BinanceHelpDesk #BinanceStopScamming #BinanceStealingCrypto

— Ama Judy (@AmaJudy_) January 25, 2022

When she was contacted for further information, she revealed that the exchange first blocked her ability to withdraw her crypto assets in March 2021 because of “risk control.” Fast forward to January this year, the exchange disabled her account because she violated their terms and conditions.

In her words:

“I found out they had disabled my account and the reason given was I violated their terms and conditions by having more than one account; this is a big lie because I do not have another Binance account apart from one, which is the one I am having an issue with.”

Other users also complained about the quality of responses the customer service of the exchange gave them.

Are you still using binance? Many people coin have been locked for years, months and days now without any reason and to make the matter worst some of the account have been closed STOP USING BINANCE FOR UR OWN Interests.. #binancestopscamming

— Bu_kng (@FX_bitcoin4) January 26, 2022

Binance terms and conditions under spotlight

A look at a number of the responses given by the customer service agent of the exchange would reveal that they were quoting a part of Binance terms and conditions, which gave them the right to freeze users’ accounts without their consent or notice.

The said terms and conditions in screenshots seen read in part, “Binance and Binance Chain community reserves the right to refuse service of the Site, or to bar transactions from or to, or terminate any relationship with, any user for any reason (or for no reason) at any time.”

Binance Terms and Conditions. The first sentence contains a clause, and that's insane. #BinanceStopScamming pic.twitter.com/StReqKDEwg

— ®Plug (@pureviberplug) January 26, 2022

This clause has generated criticism on Twitter as some users have labeled it “crazy.”

Binance’s official site shows that the exchange says it could suspend users’ accounts if it suspects that any account is in violation of its terms, privacy policy, and any applicable laws and regulations.

Binance reacts

In response to the wave of allegations, the company released a statement calling for calm, and that it was working on the issues.

Binance also asked users who believe their accounts have been wrongly suspended to fill out a form where they could properly investigate the matter.

(1/4) If you're a Nigerian #Binance user and you believe your account is wrongly suspended, please fill in this form and we will investigate.

Open this thread for an explanation of what's happening

pic.twitter.com/1M1D3ojdOu

— Binance Africa (@BinanceAfrica) January 26, 2022

Additionally, the exchange said it “proactively restrict accounts to protect users’ funds. Other times, we have to restrict accounts at the request of law enforcement. But never will we restrict accounts without good reason.”

To further address the issues, it has set up an AMA session slated for 11 AM today.

The post Nigerians attack Binance, trends #BinanceStopScamming appeared first on CryptoSlate.

* This article was originally published here

Thursday, January 27, 2022

Constellation Network launches pre-order for retail traffic crypto mining hardware product

Constellation Network, a Web3 blockchain ecosystem that bridges crypto economies with traditional businesses, announced the pre-sale of its first hardware product, the Dôr Traffic Miner. This device demonstrates that anybody can earn crypto easily through offline activities. Owners simply apply the Dôr Traffic Miner to any doorway to calculate foot traffic. They’ll earn crypto rewards while it does so. That’s it.

Ben Jorgensen, Co-Founder & CEO at Constellation Network explained that it’s exactly this kind of simplicity that sets the Dôr Traffic Miner apart:

“Traditional mining is energy-intensive and complicated, requiring costly hardware investments and advanced technical know-how. Constellation wants to make mining something anyone can do. Our Traffic Miner will make learning crypto easy, fun, and affordable for anyone curious about token economics. Just peel-and-stick it wherever you want, it’s that easy to get started.”

Before users have the device in hand, they reserve one through an NFT purchase from an exclusive batch set to release later in the month. When they connect their NFT to the Constellation Mining Platform, they can still start earning crypto rewards right away. Each NFT represents a ticket to exchange for the Dôr Traffic Miner when it becomes available later in 2022.

Dor + Constellation

Retail analytics startup Dôr, acquired by Constellation in October 2021, developed the battery-operated Traffic Miner hardware and software technology to include proprietary thermal-sensing hardware and machine learning algorithms. It anonymously counts foot traffic without detecting or recording any personally identifying information while mining and rewarding Constellation’s token ($DAG) and distributing it to the hardware owners.

As Michael Brand, Co-Founder of Dôr & Chief Product Officer at Constellation Network describes, it’s exciting to see others benefit from Dôr’s successful deployment of over 3,000-foot traffic sensors:

“Individuals and third-party operators can purchase our Traffic Miners, install them, and share in the economic rewards generated by the data they collect.”

To get notified when the NFTs become available for purchase so you can join the Dôr Traffic Miner pre-order list, provide your email here.

The post Constellation Network launches pre-order for retail traffic crypto mining hardware product appeared first on CryptoNinjas.

* This article was originally published here

Wednesday, January 26, 2022

Tuesday, January 25, 2022

White House To Release New Crypto Policy Through Executive Order

The Biden administration is currently working on an executive order which might be issued next month, to establish an initial government-wide approach towards digital assets.

Biden’s Executive Order For CryptoThe news is yet to be confirmed by any official government sources. However, Bloomberg has reported that the executive order is currently being drafted by senior White House officials and will be presented in front of President Biden in the next few weeks. Several meetings are underway to discuss the order, which will reportedly tackle economic, regulatory, and national security challenges posed by cryptocurrencies. Furthermore, several federal agencies, like the State Department and the Commerce Department, will also be roped in to assess the risks and opportunities presented by these digital assets.

Federal Agencies Overtaken By Biden AdministrationCurrently, only Bitcoin and Ethereum are considered commodities in the US and are overseen by the Commodity Futures Trading Commission (CFTC). Other cryptocurrencies, however, do not have a proper framework in place, leading to the SEC accusing them of being unregistered securities. The Ripple lawsuit is a prime example. Multiple US federal agencies are working on different approaches to regulating cryptocurrencies. If the executive order is released, it will put the Biden administration at the center of crypto legislation in the country.

Fed’s CBDC Whitepaper And Its ImplicationsThe Bloomberg report also highlights that the executive order will also include directives on the issuance of a Digital Dollar or a central bank digital currency (CBDC). The conversation around the Digital Dollar has been recently reawakened by the whitepaper on the same topic released by the US Federal Chair, i.e., the country’s central bank. The paper has addressed matters of functionality and challenges that surround a CBDC in a move to get different agencies to start talking about the Digital Dollar.

The paper and some Democrats have come to the agreement that such a digital currency could help the unbanked populations by providing a safe, digital payment option for households and businesses. Since the Federal Reserve is already discussing the Digital Dollar, it is unlikely that the White House executive order will maintain a rigid directive on the same. The Fed has already maintained that the whitepaper was issued as solely a study into the pros and cons of a CBDC. It has no intention of proceeding with the plans for a Digital Dollar without explicit consent from the White House and Congress.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

* This article was originally published here

Monday, January 24, 2022

Sunday, January 23, 2022

Saturday, January 22, 2022

Permissioned DeFi protocol Aave Arc goes live on Fireblocks

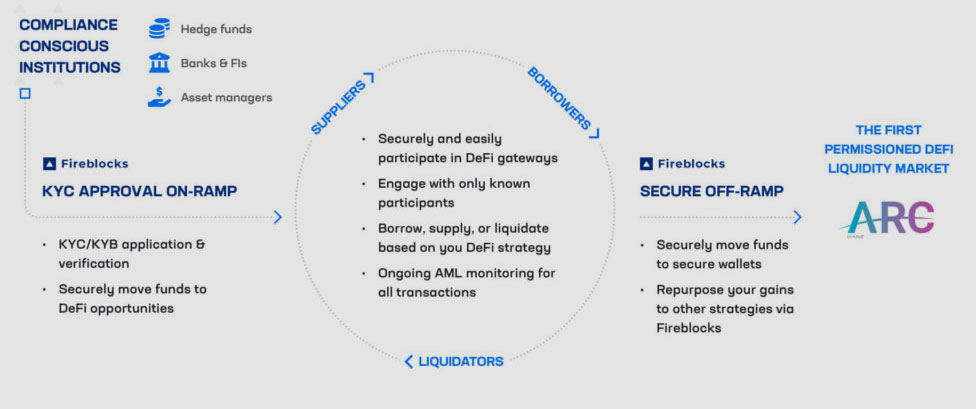

Firebox, a software platform for custody, managing treasury operations, accessing DeFi, minting & burning tokens, and managing digital asset operations, announced that Aave Arc, a new permissioned DeFi liquidity pool for institutions, is now live with Fireblocks as the very first active white-lister for the protocol.

Aave Arc is a DeFi liquidity market designed to be compliant with AML regulations, with all participating institutions required to undergo Know Your Customer (KYC) verification. Providing a separate deployment of the Aave V2 liquidity pool for institutional players, the protocol enables whitelisted institutions to securely participate in DeFi as liquidity suppliers and borrowers.

Now, Fireblocks users who volunteer to become whitelisted by undergoing a KYC process can access Aave while benefiting from Fireblocks’ industry-leading security. In general, permissioned protocols like Aave Arc can offer the decentralization benefits of DeFi, while allowing only permissioning (white-listing) to be more centralized for KYC/AML purposes.

“DeFi represents a powerful wave of financial innovation including transparency, liquidity, and programmability–and it’s been inaccessible to traditional financial institutions for far too long. The launch of Aave Arc allows these institutions to participate in DeFi in a compliant way for the very first time.”

– Stani Kulechov. Founder & CEO of Aave

Supporting permissioned DeFi on Aave Arc as a white-lister

As Aave Arc’s first active white-lister, Fireblocks has developed a framework for whitelisting institutions that references globally accepted KYC/CDD/EDD principles, in accordance with FATF guidelines.

With this framework, Fireblocks is able to verify the identity and beneficial ownership of legal entity customers, as well as monitor the Aave Arc pool and its participants on an ongoing basis.

At launch, Fireblocks has approved 30 licensed financial institutions to participate on Aave Arc as suppliers, borrowers, and liquidators. Among the institutions are Anubi Digital, Bluefire Capital (acquired by Galaxy Digital), Canvas Digital, Celsius, CoinShares, GSR, Hidden Road, Ribbit Capital, and Wintermute.

Fireblocks’ approach has been approved by Aave protocol governance and all future white-lister institutions, if approved by Aave protocol governance, will have to meet or exceed these standards.

How to access Aave Arc with Fireblocks

With Fireblocks, getting onboarded onto Aave Arc is an easy process:

- Apply for access on this page – Undergo KYC with Fireblocks to become a whitelisted supplier, borrower, and/or liquidator on Aave Arc. You must be a Fireblocks user to join as a supplier or borrower.

- Access Aave Arc through Fireblocks’ DeFi gateways – Aave Arc is another market on Aave which users can access through their web3 app as soon as they are whitelisted.

FAQ

1. What is a “white-lister”?

White-listers are regulated custodians and financial institutions that are approved to KYC and whitelist their customers to participate in the KYC’d DeFi protocol’s marketplace.

2. Are any other institutions approved to participate in Aave Arc’s liquidity market besides Fireblocks users?

Fireblocks is the first regulated entity that is a white-lister approved to KYC customers for Aave Arc. Other regulated entities will be added in the future that will also be able to whitelist customers.

3. Does Aave also whitelist institutions into the market?

Aave only recommends institutions to trusted regulated entities (such as Fireblocks), which are the only ones who can KYC and whitelist the recommended institutions.

4. Is the functionality any different for Aave Arc compared to standard Aave?

The experience and app UI are generally the same. The main difference is interacting with whitelisted suppliers and borrowers, and there is a smaller subset of tokens (WBTC, ETH, USDC, and AAVE).

5. What are the roles approved institutions can have on Aave Arc?

- Suppliers – Earn interest for providing liquidity to the marketplace.

- Borrowers – Put up collateral in order to borrow from the liquidity market.

- Liquidators – If a borrower isn’t meeting their terms, liquidators enforce “good behavior” by buying a portion of the debt at a pre-decided discount. They find out via API or smart contract who is not meeting their loan terms.

The post Permissioned DeFi protocol Aave Arc goes live on Fireblocks appeared first on CryptoNinjas.

* This article was originally published here

Friday, January 21, 2022

Thursday, January 20, 2022

Google Reportedly Exploring Options To Enable Crypto On Digital Cards

Google Inc. (NASDAQ: GOOG), a multinational technology corporation known for its suite of internet services, is reportedly taking strategic inroads to the crypto space, through its recent partnerships formed with Coinbase and BitPay that would enable new functionalities for Google Pay, its consumer payments division.

According to an initial report by Bloomberg, the tech firm has recently formed partnerships with Coinbase, a leading crypto exchange, and BitPay, a bitcoin payment service provider, both of which are headquartered in the U.S. The initial report explores Google’s relationship with the two crypto firms, and goes on to link this with Google’s recent hiring of Arnold Goldberg to run Google Pay’s payments and emerging market efforts. Goldberg has previously worked at PayPal Holdings Inc. as VP for Merchant Product and Technology.The move comes right after Google has deprecated its project for banking services, instead moving to broaden its position in the financial services space, which includes crypto. Bill Ready, who lead’s Google’s commerce division, said that this was aligned with the firm’s broader strategy to expand Google Pay’s custody capabilities for crypto assets on its digital cards. Ready also previously worked at PayPal as its COO.With this integration, users would soon be able to hold Bitcoin and other cryptocurrencies by spending amounts in fiat through Google Pay. Notably, Google's cloud services division, Google Cloud, has concurrent partnerships with CryptoWire and Dapper Labs. Google's former CEO, Eric Schmidt, also serves as strategic advisor to Chainlink Labs, a blockchain infrastructure firm providing open-source oracle solutions.

“Crypto is something we pay a lot of attention to. As user demand and merchant demand evolves, we’ll evolve with it.” shares Ready.

Google has not clarified, however, whether these integrations would extend to Google itself accepting Bitcoin for transactions without the fiat on-ramp. Ready has acknowledged this necessity, however, and says that the division he leads is looking to expand partnership opportunities with other crypto firms that would provide more crypto-specific functionalities to Google Pay.Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

* This article was originally published here

Wednesday, January 19, 2022

Tuesday, January 18, 2022

TON Founder Pavel Durov Endorses Project As It Targets Mass Adoption

The highly ambitious TON blockchain is planning big things in 2022 following an endorsement of its efforts by its founder, the CEO of Telegram, Pavel Durov.

Durov, who created TON almost five years ago, said in a recent post on Telegram that the project is “alive and evolving”. He added that it’s still “years ahead of anything else” in the blockchain space in terms of its speed and scalability.

That Durov is still advocating for the project is a big surprise because it was barely two years ago that he unceremoniously dumped TON in the wake of a legal challenge by the U.S. Securities and Exchange Commission. Telegram launched the initiative way back in 2017 and had a lot of success in the early days, raising more than $1.6 billion in an ICO for the platform’s original cryptocurrency token “GRAM” and winning dozens of plaudits from the community for its ambition.

Unfortunately for Durov, progress came screeching to a halt in 2019 with the revelation that the SEC was stepping in to halt its token sale after classifying GRAM as an “unregistered security”. A lengthy court battle ensued with the SEC, unsurprisingly, emerging as the victor. Telegram ultimately agreed to return $1.2 billion raised in the ICO to investors, and followed up by dropping the project altogether.

That may have spelled the end for TON, but Durov sowed the seeds of its current incarnation by open-sourcing all of the work it had done in creating the blockchain. Its plans were quickly picked up by a team of developers led by the Russian Anatoly Makosov, which has quietly been plotting a renaissance ever since.

Believers in the project will be pleased to know that under Makosov’s leadership, TON has discarded none of its original vision. If anything, the new team’s zeal for the project is even stronger than that of Durov’s, and it has published an extremely ambitious roadmap calling for all of its major components to be live by the end of the year.

TON’s blockchain has been up and running since last year and its next milestones call for the establishment of its DNS service, enabling human-readable smart contracts and account names, by the end of the first quarter. Other Q1 targets include the launch of TON’s first DeFi apps, its proxy server and a new developer program at the same time.

Once those are all set up, only two tasks remain: First, its decentralized file-storage system and then, the TON Workchains that will link it to every other blockchain in the world. The team has already made solid progress on that latter goal, launching a TON-ETH bridge last year that makes it possible for Toncoins to be sent back and forth between it and the Ethereum blockchain.

Such a busy roadmap is necessary because TON is hoping that its blockchain will ultimately become the foundation of the new and emerging web3 - a decentralized version of the public internet in which people have full control over their data and complete anonymity. If it is going to achieve that, it will need to unify every other blockchain into a single, decentralized network and also enable super-fast transactions and low costs.

The TON project has set itself some formidable goals yet it cannot be accused of lacking confidence in its ability to achieve them - recently boasting on Telegram that 2022 will be the year it finally achieves “mass adoption”, which is something that, up until now, has eluded every blockchain project so far.

While most of the crypto community is likely to dismiss those claims as pure bravado, few will deny that 2022 is set to be a critical year for one of the most ambitious blockchain projects ever conceived.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

* This article was originally published here

Monday, January 17, 2022

Sunday, January 16, 2022

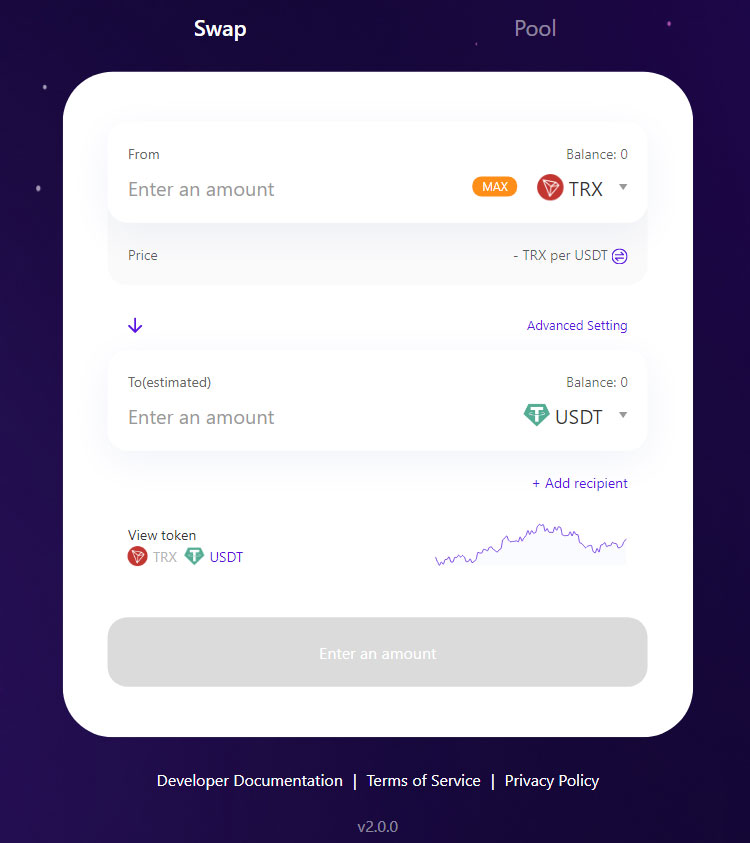

TRON TRC20 exchange SunSwap rolls out V2 upgrade

SunSwap, a decentralized application on TRON for exchanges between TRC20 tokens, recently announced it has officially rolled out an upgrade with the brand-new SunSwap V2.

There have been a series of improvements implemented based on the swap and liquidity mechanism, with V2 featuring the following modifications:

- Users do not need TRX as an intermediary to swap TRC20 tokens;

- Now users can directly add liquidity to trading pairs of any two TRC20 tokens;

- V2 includes a new swap routing protocol that can automatically recommend the optimal swap path;

- A new liquidity migration feature has been added, allowing users to migrate liquidity from SunSwap V1 and V1.5 to SunSwap V2 in a quick way;

- The user interfaces and interactions for swap, liquidity pools, the explorer, and other modules have also been improved.

“Committed to building long-term value, SunSwap has made significant progress in improving its functionalities, user experience, and security. We are confident that as V2 goes live, it will surely deliver a better user experience.”

– The SunSwap Team

Around two months ago, the SunSwap team acquired JustSwap and officially renamed it SunSwap, along with launching the exchange on the domain sunswap.com. With SunSwap, all trading fees collected on the exchange go directly to liquidity providers rather than the protocol itself.

The post TRON TRC20 exchange SunSwap rolls out V2 upgrade appeared first on CryptoNinjas.

* This article was originally published here

Saturday, January 15, 2022

Friday, January 14, 2022

Tether freezes three Ethereum addresses holding $150 million in USDT

World’s largest stablecoin issuer Tether has added three more Ethereum addresses to its blacklist that held nearly $150 million worth of USDT.

Being a centralized company, Tether has the authority to freeze accounts comprising dubious funds related to crime and money laundering.

Tether freezes three Ethereum addresses.

The three accounts frozen by Tether will not be able to move funds or conduct any transfers. Given increasing crypto crime, Tether had earlier issued statements that the company is always vigilant towards supervising any malicious crypto movement and regulating funds that might be associated with crime and money laundering.

As per sources, Tether also stated that it regularly helps international law enforcement to track questionable funds and help them freeze such suspicious accounts.

According to data from Bloxy Block Explorer, Tether had earlier froze 563 addresses containing dubious funds in November, followed by freezing additional 312 addresses in December 2021.

Tether actively began blocking blockchain addresses in 2017, when a theft comprising $30 million USDT was reported by a firm. As per sources, Tether’s unique “recovery mechanism” allows it to freeze USDT and later reissue them in certain cases.

A recent Chainanalysis report stated how crime in the sector of crypto has increased consistently since 2020. Nearly $14 billion worth of funds were held by illicit addresses in 2021 exhibiting a stark rise in malicious activities conducted through crypto.

Tether is yet to disclose reasons why the three addresses were blacklisted. The rising speculation suggests that the move may prove to be a precautionary measure to prevent rising scams and fraudulent activities concerning USDT. Earlier, Tether had blocked an address holding $1 million worth of USDT. The company’s spokesperson later referred to the move as a way to “help recover funds stolen by hackers or are compromised.”

Formerly launched as RealCoin, USDT is a second layer cryptocurrency token built on top of the Bitcoin blockchain through the use of the Omni platform. USDT, issued by Hong Kong-based company Tether, is the world’s largest stablecoin issuer with a market cap of nearly $78.3 billion.

The post Tether freezes three Ethereum addresses holding $150 million in USDT appeared first on CryptoSlate.

* This article was originally published here

Thursday, January 13, 2022

Cardano (ADA) Price Forecast for 2022-2040

Cardano (ADA) is the native token of a proof-of-stake blockchain that goes by the same name. Cardano network was founded in 2015 by Ethereum co-founder Charles Hoskinson. Cardano Foundation states that its ultimate goal is to give innovators and visionaries a platform that will help them make the world a better place. To accomplish this, Cardano’s team is building an interoperable and scalable multi-asset ledger with a platform for verifiable smart contracts. If you want to learn more about this innovative cryptocurrency and how Cardano operates, read this article or head on over to the official Cardano website.

ADA is currently ranked 6th by market capitalization, so it is undoubtedly a cryptocurrency many people are interested in and has great growth potential. Let’s look at Cardano ADA price prediction for the coming years.

Please keep in mind that as with any other cryptocurrency, it is near impossible to make a 100% accurate Cardano price forecast. We mention what minimum price and maximum price ADA can potentially reach in one year or the next five years, but those are just our estimations.

Cardano Price Prediction After Smart Contracts

First, let’s analyze Cardano’s recent price history. The coin followed the general crypto market bullish trend in early 2021, going from $0.13 to an (at the time) maximum price of $1.3 in just two months. Since then, the coin has never gone below a minimum price of $1 – and it even rose 15% in mid-May following an announcement of a smart contract rollout called Alonzo. Afterward, however, ADA went through the same correction the whole market did, dropping back to its February-March levels. After July 21, the Cardano price increased and half a month later reached its current ATH of $3.10.

Cardano Price Prediction December and at the End of 2021

Once again, it is near impossible to make a 100% accurate prediction when it comes to the crypto world. That said, we think that ADA price stands to rise by the end of 2021. We think that the current correction may be over by then, and it is possible that the Cardano team may announce a new feature. If that happens, then Cardano cryptocurrency price will very likely rise.

Cardano Price Prediction by 2022

Cardano’s maximum price in 2022 will depend on a wide variety of factors, like the general situation on both the crypto market and in the global economy, or the state of other cryptocurrencies that can be seen as ADA’s main competitors, like QTUM or WAVES.

Some experts predict that ADA will be around the $2.5 mark for most of 2022 – which is rather optimistic considering the coin is currently hovering around $1.9.

Cardano Price Prediction in the End of 2022

Several experts expect ADA price to reach up to $4 by the end of 2022. While we think this is rather optimistic, we can’t deny that it is possible.

CoinDesk says that it’s even possible for ADA to smash its previous ATH and reach $5.17 – especially if ecological concerns become an even more prominent topic in the crypto world. However, they also point out that usability concerns may drive some investors away from the coin, and cause its price to not move past the $3.99 mark in 2022.

The most optimistic experts from Coinquora even believe that if ADA bulls further throughout 2022, then Cardano future price could reach $12 -$15 by the end of the year.

Cardano Price Prediction by 2025

CoinSwitch predicts that the price of ADA will reach $3. Wallet Investor, on the other hand, is more optimistic, forecasting ADA’s price to reach at least $9.8 in 2025.

On the other end of the spectrum, there is Trading Beasts, which expects ADA to not gain much in the next 4 years and predicts that it will have an average price of $5 by 2025.

Cardano Price Prediction 2030

The more long-term the investment, the harder it is to predict its outcome. However, Cardano has a lot of things going for it. It has good adaptability to change, a solid roadmap, a dedicated and talented team behind it, and it is eco-friendly. All these factors mean it’s here to stay. While it is impossible to predict the exact Cardano cryptocurrency price will have in 2040 and beyond, we think it is a good long-term investment.

Cardano Price Prediction 2040

It’s hard to make a Cardano price forecast for the long run. We think that it is likely that ADA’s price will continue to rise and may even reach the $15 mark in 2030 – that is, of course, if cryptocurrencies don’t become obsolete by then and get replaced by some new technology. Overall, ADA has a chance to renew its historical maximum price and get a new all-time high.

Cardano Price Prediction by Experts

Experts over at Investor Cube are predicting that ADA is up for a big break in their Cardano forecast. They say that the key support and resistance levels to watch at the moment are $1.002 and $1.68. Digital Coin Price also has an optimistic outlook, forecasting that ADA can reach a maximum price of up to $3.97.

ADA can reach a price of up to $3.97

Digital Coin Price

As you can see, there are as many predictions and opinions as there are experts. Still, the majority seem to have an optimistic outlook in both the short and long term. At the end of the day, you should follow the main advice we always give beginner investors – DYOR, do your own research – and decide for yourself what Cardano price forecast you believe in and if ADA is a project you want to invest in. You should make your own investment decisions.

Why is Cardano so Cheap?

Cardano’s price is rather low, but its supply is high, which allows it to have the market cap that it has. The maximum number of ADA coins that will be issued is 45B.

Market capitalization is a true sign of value, so it matters more than the price of a single coin – and Cardano’s market cap is high. You simply have to own more ADA to have $1000 worth of it in your wallet – but the value of it will stay the same, no matter whether you got it by buying 10 ADA or 100.

Will Cardano Reach $20 and $100?

Technically, everything is possible, and there’s definitely at least one Cardano price prediction out there that says $100 will be the coin’s minimum price in the next five years, not it’s the unattainable maximum price.

In reality, however, it is highly unlikely that ADA price will ever rise that high. If Cardano’s price reached $20 with everything else unchanged, it could’ve taken over Bitcoin by market capitalization. And not even the most optimistic Cardano price forecast will ever predict something like this. In order for ADA to reach such high numbers, either the whole market will need to experience an astronomical rise the likes of which we’ve never seen before, or the coin itself will have to get a one-way ticket to the moon by being officially recognised as a currency by an economically powerful country like the US or China.

Does Cardano Have a Future?

Cardano’s team plans on implementing all the best features of other cryptocurrencies. That tells us two things: first, this blockchain is unlikely to become outdated and thus fade into obscurity, second, both its team and the chain itself have good adaptability to change, which is a very good quality to have in such a rapidly changing and evolving industry as crypto. All this allows us to be optimistic in our ADA Cardano price prediction and shows the coin can offer long-term earning potential.

Is Cardano a Good Investment?

Cardano may not be as hyped as some other cryptocurrencies like DOGE or BTC, but this coin is still one of the most aggressive cryptocurrencies which has a solid team behind it and has stayed on top despite many challenges that the industry has faced in recent years. It has seen steady growth over the past few years and, as we have seen above, stands to rise even higher. Based on this, it is a good investment.

Final Thoughts

We hope you enjoyed our Cardano forecast, and that our ADA price prediction will give you some food for thought. Although this coin’s price is unlikely to ever reach the maximum price of Bitcoin or Ethereum, it can be an excellent long-term investment.

Follow us on Social Media and subscribe to our mailing list to get the latest Cardano news, updates on this ADA price prediction, technical analysis of cryptocurrencies, and more.

Frequently Asked Questions

Can Cardano make you a millionaire?

If you bought $400k worth of ADA when it was at $1, and then sold it for its maximum price of $3.10 at the beginning of September, you would’ve had more than a million USD right now. Obviously, $400k is quite a hefty investment. However, if you bought ADA coin in 2019 for the price of $0.04, you would’ve only needed $16k to become a millionaire now.

What is Cardano worth in 2025?

There’s no sure way to make an accurate Cardano forecast for 2025, however, we can make a general ADA price prediction. Crypto has been receiving more and more hype recently, and even if it fades, the current boom in popularity has certainly introduced many faithful HODLers and investors to cryptocurrency markets. We always say that for mass adoption to happen, people need to be educated about crypto – and the recent hype is very likely to have introduced quite a lot of people to crypto and blockchain.

If positive trends continue, and ADA’s team sticks to its plans and ideas, then Cardano price has a chance to reach at the very least $5 by 2025.

Is Cardano better than Bitcoin?

There’s no “better” when it comes to cryptocurrencies. They’re all different and serve different purposes. That said, Cardano team has ambitious plans for new feature implementation and is highly technologically advanced – but so is Bitcoin, of course. One solid advantage ADA has over BTC right now is that it is more eco-friendly. However, in the end, only you can decide which crypto is the best for you.

Can Cardano replace Bitcoin?

If Cardano price becomes equal to $20 and Bitcoin’s price remains the same, then it can potentially replace BTC as the number one cryptocurrency by market cap. But it is highly unlikely that Cardano, or any other crypto for that matter, will ever replace Bitcoin in terms of cultural and technological impact, popularity, and arguably even significance.

Can Cardano reach $10?

Some experts believe that the price of Cardano coins may reach $10 in the near future.

What is Cardano worth in 2022?

According to our Cardano price predictions, the value of the ADA coin will fluctuate around $3-3.5 in 2022.

Disclaimer: This article should not be considered as offering trading recommendations. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. While price analysis is a useful tool, it should not be considered predictive for the future performance of any investment vehicle.

Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment. Website personnel and the author of this article may have holdings in the above-mentioned cryptocurrencies.

The post Cardano (ADA) Price Forecast for 2022-2040 appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

Wednesday, January 12, 2022

EToro offers metaverse exposure to investors

The leading social trading platform eToro has announced the launch of a new smart portfolio that will give investors long-term exposure to key projects in the metaverse.

Metaverse is very much the major buzz-word in the cryptocurrency sector currently. Much extra hype surrounded the metaverse when Mark Zuckerberg, CEO of Facebook, announced that his company would rebrand to ‘Meta’, and would build out its own metaverse.

Microsoft is also in on the action, and has created its own metaverse platform called ‘Mesh’. Other major tech giants have also entered into the metaverse industry in their own ways. Unity Software, Nvidia, and Ubisoft are those that spring to mind.

According to Dani Brinker, Head of Investment Portfolios at eToro, who was quoted in a recent FinExtra sponsored press article:

“When evaluating the investment opportunity of emerging industries, diversification is key as not everyone involved will be a winner. For people who don’t have the time to research the ongoing developments of the industry, the market may seem overwhelming. By packaging up a selection of assets in a portfolio, we’re doing the heavy lifting and enabling our customers to gain exposure to the metaverse and spread the risk across a variety of assets.”

The eToro smart portfolios already exist for other themes across the markets. They enable investors to receive a passive income from long-term investments with no management fees.

EToro is concentrating a great deal of its resources on developing the assets that will support investor interest in the metaverse. It recently announced that it would list The Sandbox (SAND) as a crypto asset on the platform, and plans a collaboration on land purchases in the future.

Tomer Niv, the eToro Director of Global Crypto Solutions said:

“eToro is a crypto pioneer with an established track record of embracing new technologies for the benefit of retail investors. We are incredibly excited by the opportunities offered by the metaverse and will be revealing further details including some key partnerships very soon.”

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

* This article was originally published here

Tuesday, January 11, 2022

Swarm Markets inks deal with Germany’s Volksbank to digitize bonds on Polygon

Swarm Markets, an open platform for the creation and management of blockchain assets, announced today it will be developing its first digital security in partnership with Volksbank Mittweida, a German-based bank. The first registered bond (Namensschuldverschreibung) will be issued in an aggregate of €1 million on the Polygon chain and sold by Volksbank directly to its retail customers.

Swarm Markets prevailed in a field of competitors responding to an RFP to digitize bonds for one of the world’s most respected cooperative banks, meeting technical and regulatory requirements as well as accommodating Volksbank’s business needs. In this case, aligning with sustainability goals by utilizing Polygon to reduce the asset’s energy burden compared to Ethereum’s proof-of-work (PoW) blockchain.

Bonds will be issued using the SRC20 security token protocol (Swarm Powered Fundraise uses SRC20 to perform regulatory compliant fundraises for security tokens) and administered via the MySwarm App, both originally developed by the Swarm Network DAO, using smart contracts newly adapted by Swarm Markets for the Polygon chain.

The bonds represent an important first use-case demonstrating how Swarm Markets’ license status — operating under the authority of Germany’s Federal Financial Supervisory Authority (BaFin) — provides unique capabilities to eliminate obstacles to DeFi for institutions.

Swarm Markets is leveraging these licenses to create tools that empower traditional financial institutions to operate in digital asset markets and solve real-world problems. Almost all bonds in the traditional finance industry are registered bonds: where the bondholder’s information is kept on record; such as corporate bonds, treasury bonds, or municipal bonds.

This partnership is an opportunity for Volksbank’s investment banking apparatus and its customers to familiarize themselves with financial instruments living on the blockchain. It uses a straightforward asset class and allows users to further explore other functionality that comes embedded with digital assets.

“Both sides view the bond digitization partnership as a jumping-off point from which future opportunities to build new (DeFi) products around new assets will emerge. In just over 6 months since Swarm Markets’ first public announcement, we’ve built out a formidable tech infrastructure for digital assets supported by a world’s-first regulatory framework, which has now borne its first digital asset anchored in a trust structure with a global banking titan. We’re proud to make good on our promises in such a short time and we look forward to seeing where innovations and partnerships like this one take us in the future.”

– The Swarm Team

The post Swarm Markets inks deal with Germany’s Volksbank to digitize bonds on Polygon appeared first on CryptoNinjas.

* This article was originally published here

Monday, January 10, 2022

Sunday, January 9, 2022

Vitalik Buterin proposes new changes to Ethereum gas fees

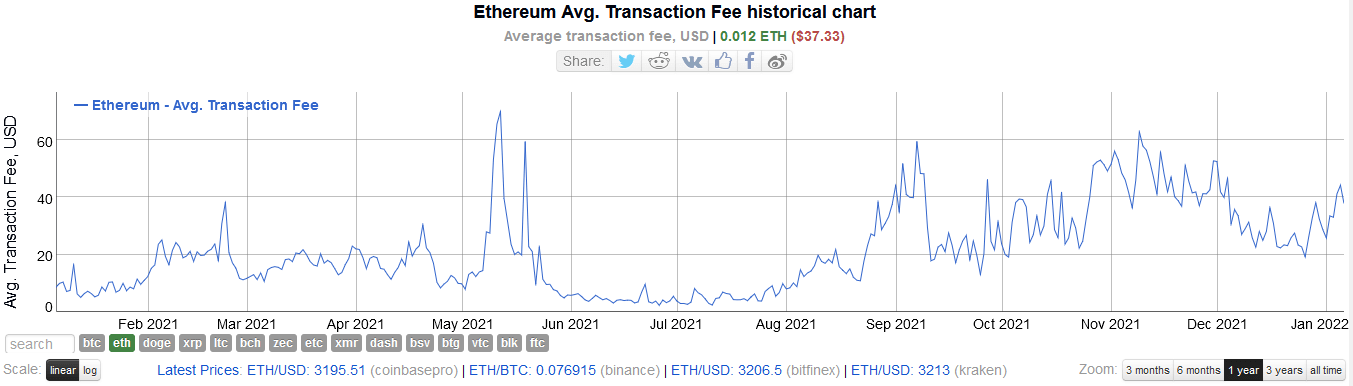

Ethereum co-founder Vitalik Buterin proposed a new “multidimensional” approach to gas fees this week. By charging different gas prices depending on the resource used, he thinks users will benefit from optimal gas costs.

High Ethereum gas fees have been a persistent problem since DeFi took off in the summer of 2020. And it’s not uncommon to hear of people paying hundreds of dollars to use the network.

As expected, the uproar over this situation forced devs to act, and they did with the rollout of EIP 1559, which went live on August 5, 2021.

EIP 1559 brought in several changes, but primarily it shelved the auction bidding system in favor of a moving base fee system. In other words, gas fees would not be driven by users bidding higher to have their transactions processed first.

Analysis of average gas fees in dollars shows June 2021 to August 2021 as a period of (relatively) low gas costs, hovering around $6/$7. But post-EIP 1559, gas fees have shot up, peaking at $62.84 on November 9, 2021. As of today, the average fee comes in at $37.33.

With that in mind, some would argue EIP 1559 was a failure because the most significant factor in determining gas fees is network capacity (or lack of in this case), not the method used to ascribe an individual user’s transaction cost.

As such, will a “multidimensional” approach to the problem be any different?

Was Ethereum Improvement Proposal (EIP) 1559 a failure?

Based on the raw numbers above, EIP 1559 did not lower gas fees, making it unsuccessful in that respect.

However, proponents of EIP 1559 say it was never meant to lower gas fees, only to make fees more transparent and predictable.

The thinking here is that users would know upfront how much it would cost to put through a transaction. That way, they could decide whether or not to go ahead.

At present, ConsenSys’ vision of a “world computer” in the Ethereum network does not tally with the general user experience.

Some would argue that Ethereum is a victim of its own success and will eventually nail the gas fee problem as a work in progress.

What is Buterin’s new “multidimensional” approach?

In another attempt to solve the problem, Buterin noted that different Ethereum Virtual Machine (EVM) resources have different gas usage demands.

Expanding further, he differentiates “burst capacity,” how much capacity we could handle for one or a few blocks, and “sustained capacity,” how much capacity we would be comfortable having for a long time.

“The scheme we have today, where all resources are combined together into a single multidimensional resource (“gas”), does a poor job at handling these differences.”

The revised “multidimensional EIP 1559” would use a mathematical formula to adjust the ratio of burst and sustained capacities. From that, Buterin puts forward two options:

The first is to calculate the gas fees for resources by dividing the base fee for each unit of resource by the total base fee. This would derive a base fee that is fixed per block.

Alternatively, the base fee is set for using resources but incorporates burst limits on each resource. There would are also “priority fees” paid to the block producer.

The post Vitalik Buterin proposes new changes to Ethereum gas fees appeared first on CryptoSlate.

* This article was originally published here

Saturday, January 8, 2022

Dogecoin Price Prediction: DOGE Price Forecast For 2022 – 2030

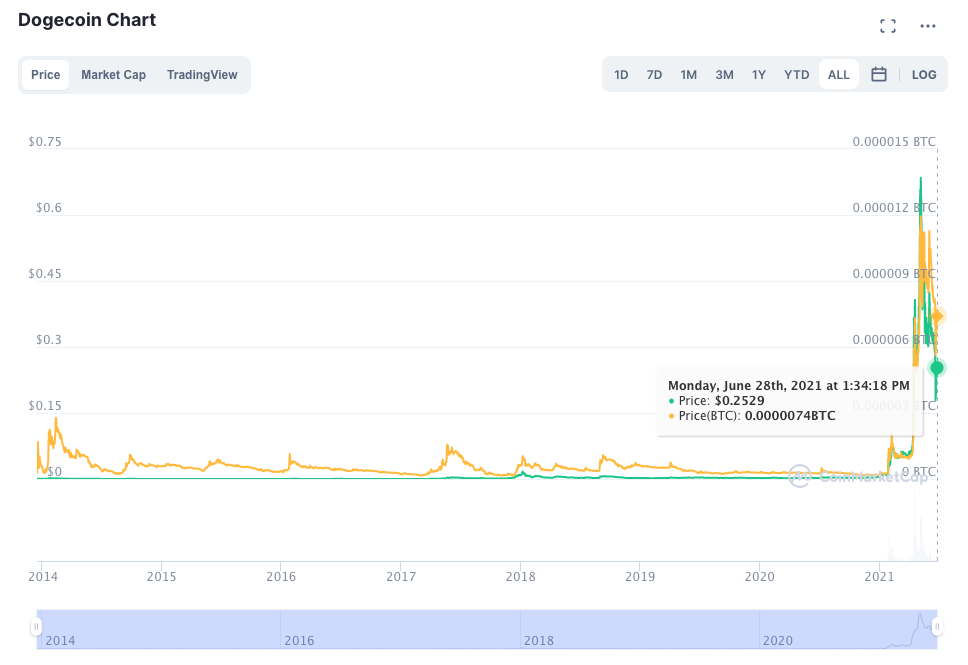

Here at Changelly, we treat Dogecoin (DOGE) cryptocurrency with respect, as DOGE is the perfect example of what can be achieved if a cryptocurrency has strong community support. Born as an Internet meme, Dogecoin demonstrates how a simple joke may increase in value and reach a $32 billion market capitalization. We’ve collected facts about the Dogecoin success story and provided DOGE price prediction.

Dogecoin Origin & Purpose

Dogecoin was designed using the codebase of Litecoin and its development was aimed at providing an alternative to Bitcoin. It should’ve been a more approachable and friendly cryptocurrency.

Its most distinct feature, however, is its mascot. The developers of Dogecoin chose a “fun” approach towards its development.

Dogecoin was just a little changed when developed as a fork of Litecoin. New blocks in the DOGE blockchain are created faster than in Litecoin – 1 minute against 2.5 minutes in LTC. Dogecoin’s mining difficulty is adjusted every block found and the reward is fixed. The most distinct change happened in the brand and it became a driving force behind its popularity.

The fun image of the crypto helped this meme token to get attention in various social media. The coin turned famous even outside the community of blockchain technology fans.

Charity & Tipping

For around three years the meme coin was famous but not actively traded and there were no rapid price movements either. Several charity programs and a friendly DOGE community helped the coin to get the trust of the community.

The coin grew its user base with the help of the Reddit community and other social platforms. It moved the Dogecoin market cap in rates not even the most bullish analysts could’ve predicted.

DOGE price dropped significantly, and its market cap has also left its high point. Still, it is one of the top-15 coins on the market and overall ROI is around 11,000%. It is also pretty popular digital coin since Elon Musk is encouraging users to buy it and send it to the moon.

Dogecoin is the tenth by sales and exchange cryptocurrency on Changelly, but despite this, users regularly exchange it thanks to the long existence and development of the coin.

Dogecoin (DOGE) Live Price

Dogecoin (DOGE) Price Analysis

2018 was a tough and bearish year for DOGE. Similarly to the other market, Dogecoin price lowered by the loss of the public’s attention.

Dogecoin price was in a downtrend for all of 2018, despite the several times the Dogecoin price was going up for a short period of time. Today, the long-term Dogecoin forecast is not very bright.

During the price falls of March, July, and September, Dogecoin was falling along with the market. The DOGE price drop isn’t that bad as it is for Bitcoin and the price spikes after the downtrend show that DOGE was recovering faster than BTC.

Dogecoin is obviously very dependent on the overall interest in the blockchain industry and behaves like most of the other coins, discussed the Cryptocurrency Price Predictions articles published on our website. For example, Zcash and BitcoinCash – both coins mirrored the Bitcoin price graph.

Due to the fact that DOGE depends on the cryptocurrency market movements, predicting its price becomes difficult, especially for the long term.

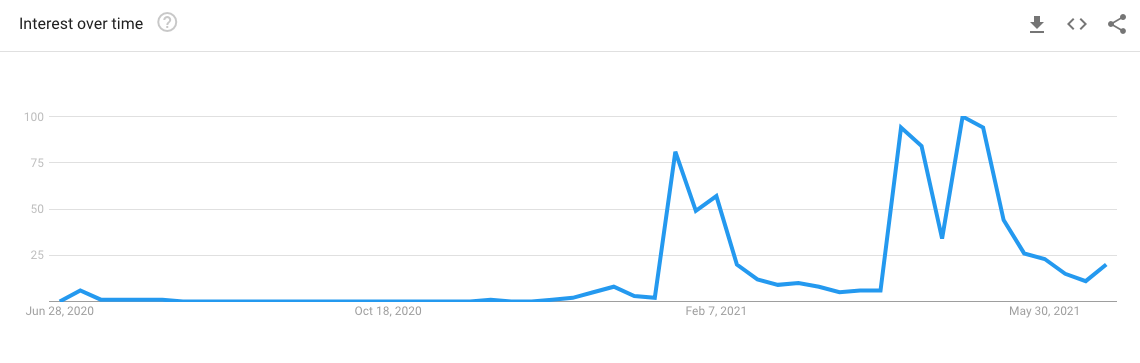

Dogecoin Trend Analysis

Dogecoin popularity was outstandingly stable over the course of the previous year. You can see on the following graph that the coin even managed to get a search term “Dogecoin” spike in popularity.

The coin was very interesting for Google users in January 2018. A couple of less significant peaks happened in July and December. At the start of 2019, the popularity was around the same level as it was in the same period of 2018, which is a major accomplishment in terms of the industry crisis, happening today.

Finally, our most-requested product is here! Rent your next #AirBnB with crypto!!!https://t.co/JAEUOmnGea#Bitcoin #Ethereum #Dash #Litecoin #Dogecoin pic.twitter.com/AOHmXUkCok

— Bitrefill (@bitrefill) March 27, 2019

The price of Dogecoin is not very responsive to media attention. For example, the news about Airbnb caused a price rise against USD by ~3% over 3 days after the announcement.

According to Google Trends, DOGE has its committed audience and most popular in Venezuela.

Similarly to Dash, DOGE turned out to be one of the go-to cryptos in countries where the financial system is struggling. Other countries with a large amount of the “Dogecoin” searches include Bangladesh, Pakistan, the Philippines, and Nigeria.

It is a good sign that the coin is used as an alternative to the official fiat currencies of these countries for monetary exchange between regular people.

Recently, Dogecoin’s price went up by 100%. Such a success was waiting for the coin after the publication of the viral video in TikTok, where the user of The Wolf Of Bitcoins showed his mining farm.

@thewolfofbitcoins Sorry, not sorry

♬ Lalala – Y2K & bbno$##bitcoin ##explainbitcoin ##bitcoinmining ##minecraft ##gaming

A warning has appeared in Dogecoin’s official Twitter account, aimed at potential cryptocurrency buyers. In it, developers urge not to succumb to FOMO and make investment decisions on their own.

Be mindful of the intentions people have when they direct you to buy things. None of them are in the spot to be financially advising.

— Dogecoin (@dogecoin) July 8, 2020

Make choices right for you, do not ride other peoples FOMO or manipulation.

Stay safe. Be smart.#dogecoin

Dogecoin Technical Analysis

Well, there is not actually any technical analysis expertise of Dogecoin cryptocurrency. However, here is the aggregate rating for DOGE from several traders & analysts on TradingView.

Dogecoin Price Prediction for 2021 – 2025

Despite all the pumps associated with the DOGE cryptocurrency, the coin rate is very volatile. We can expect both the boost and the fall in the rate.

Wallet Investor DOGE Price Prediction for 2021 and 2025

There will be a positive trend in the future of the asset. DOGE might be a good idea for investing. In 2021, the coin will be stable and cost around $0.24. In 2025, the average Dogecoin price can reach $1.22.

DigitalCoinPrice Forecast for 2021 – 2025

According to DigitalCoinPrice source, DOGE is a profitable investment based on the forecast. By the end of 2021, the coin price will reach $0.34. In 2025, the DOGE prices can be around $0.675.

Elon Musk Opinion on Dogecoin Future

Dogecoin has support from Elon Musk. All of you have already seen the hype that boosted Dogecoin price. When Elon Musk tweets about Dogecoin, the price always goes up. Well, soon to the Moon! Much Space!

Dogecoin rulz pic.twitter.com/flWWUgAgLU

— Elon Musk (@elonmusk) April 2, 2019

Dogecoin (DOGE) Price Prediction for 2030

According to the technical analysis of Dogecoin (DOGE) price graphs, the price of one Dogecoin in 2030 may reach $1. The prediction depends on the whole market situation and mostly on Elon Musk’s opinion.

Dogecoin F.A.Q.

Does Elon Musk own Dogecoin?

Of course he does. He even bought some for his child.

Bought some Dogecoin for lil X, so he can be a toddler hodler

— Elon Musk (@elonmusk) February 10, 2021

How and Where to Buy Dogecoin (DOGE)?

It is easy to buy or swap DOGE coins on many exchanges. When purchasing crypto it is important to seize the moment of the best rates as the cryptocurrency market continuously fluctuates. You can always check the Dogecoin cross-rate to other cryptocurrencies on our website.

How Much Are Dogecoins Worth?

Dogecoin’s current market value is about $30,445,829,131 — as of November 2021.

Will Dogecoin Ever Reach $10?

Reddit users suppose Doge to become the currency of the internet. So it can definitely go higher than $10.

Is Dogecoin Dead?

According to Reddit, this meme-inspired cryptocurrency stays solid on its paws. Some stores accept DOGE coins nowadays. So it’s the best evidence that Dogecoin is alive.

Is Dogecoin a good investment?

Well, Dogecoin started as a joke. However, nowadays, the meme coin is still one of the most popular among the crypto community. Despite the fact that the price is not at its highest point, the long-term earning potential of this coin looks moderately optimistic.

Who Created Dogecoin?

Dogecoin was created by Billy Markus and Jackson Palmer.

Is Dogecoin Mining Profitable?

Mining Dogecoin is not profitable using the Dogecoin mining hardware hashrate.

What Are Dogecoins Used For?

One of the most popular cases to use Dogecoin is tipping users on the internet who create or share content. Dogecoin (DOGE) can be associated with like or upvote with real value that can be used all across the internet.

How Much Are Dogecoins Worth?

Here is a Doge Live Price.

How and Where Buy DOGE at the Best Rate

Changelly allows you to swap and buy DOGE cryptocurrency with fiat using your credit/debit card, bank transfer, or even Apple Pay. Choose the best rate and get some DOGE to your wallet.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post Dogecoin Price Prediction: DOGE Price Forecast For 2022 – 2030 appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

LBank Surpasses $15 Billion in Tokenized Stocks Trading Volume, Dominating Tokenized Equities

Singapore, Singapore, February 6th, 2026, Chainwire LBank , a leading global cryptocurrency exchange, today announced that its tokenized...

-

* This article was originally published here

-

* This article was originally published here

-

Bitwise Asset Management, the largest crypto index fund manager in America, announced today that the Bitwise Bitcoin ETF (BITB), the firm’s...