Friday, September 30, 2022

Thursday, September 29, 2022

Wednesday, September 28, 2022

Tuesday, September 27, 2022

Monday, September 26, 2022

Sunday, September 25, 2022

Saturday, September 24, 2022

Friday, September 23, 2022

Thursday, September 22, 2022

Wednesday, September 21, 2022

Tuesday, September 20, 2022

Monday, September 19, 2022

Saturday, September 17, 2022

Friday, September 16, 2022

Thursday, September 15, 2022

Wednesday, September 14, 2022

Tuesday, September 13, 2022

Monday, September 12, 2022

Sunday, September 11, 2022

Saturday, September 10, 2022

Crypto exchange Kraken’s second reserves audit adds 5 new assets: USDT, USDC, XRP, ADA, and DOT

Kraken, the popular crypto exchange, has announced the results of its second 2022 Proof of Reserves audit, which has now been expanded beyond *BTC, and ETH* to include USDT, USDC, XRP, ADA*, and DOT.

*Indicates Proof of Reserves audit covered assets held both on Kraken’s spot exchange and Kraken’s staking platform.

The addition of five more cryptocurrencies expands the verification of Kraken client balance coverage to 63% of the total assets held on Kraken. The firm says it plans to continue including additional assets in future Proof of Reserves audits.

A Proof of Reserve audit is an accounting procedure that cryptographically verifies cryptocurrency holdings and account balances. The results of the most recent audit were again verified by the top-25 global accounting firm, Armanino LLP.

This latest audit determined Kraken securely held all of the above assets belonging to clients on its exchange, as well as held in its on-chain and off-chain staking services.

“…don’t just take our word for it. We have always focused on security and our latest Proof of Reserves audit enables clients who held these assets on the exchange to independently verify their Kraken balances are indeed backed by real assets secured by our global exchange.”

– The Kraken Team

As quoted, Kraken now provides the tools needed for clients to independently affirm the results of audits. To learn more about this process and Proof of Reserves in general, see the details on Kraken’s website.

The post Crypto exchange Kraken’s second reserves audit adds 5 new assets: USDT, USDC, XRP, ADA, and DOT appeared first on CryptoNinjas.

* This article was originally published here

Friday, September 9, 2022

Blocknative releases new tool to enable high-speed propagation of ETH transactions

Blocknative, a web3 infrastructure company, today launched the Transaction Distribution Network (TDN). This tool allows blockchain users to respond to pre-chain risks and opportunities faster than ever, ensuring each transaction has the best chance of getting into the next block.

The result is better, more predictable outcomes when submitting or replacing transactions.

TDN works by simultaneously injecting a transaction into multiple Ethereum nodes located worldwide. This accelerates Ethereum’s peer-to-peer propagation, reducing the time it takes for the transaction to reach every node in the network, including miners and validators post-merge.

To achieve this, TDN uses a low-latency, self-optimizing peer-to-peer overlay that automatically finds and exploits the fastest network routes.

This allows the Transaction Distribution Network to respond to changes in network conditions in real-time, for example routing around congestion caused by a bidding war. When combined with Blocknative’s optimized networking stack, Transaction Distribution Network provides propagation speeds close to the theoretical limit, even under adverse conditions, giving a notable advantage for inclusion in the next block.

With TDN, Blocknative users now have access to complete, real-time transaction control.

Users can respond faster than ever to every risk and opportunity in the mempool. TDN users receive real-time alerts as their transactions race across Blocknative’s global network, providing insight beyond the acknowledgment of single-point injection provided by standard RPCs.

“Transaction Distribution Network gives users a competitive edge by rapidly propagating their transactions to Ethereum nodes so that they have a higher probability of inclusion. Transactions are simultaneously injected into multiple global nodes through our private, geographically optimized network, so there is no need to wait for peer-to-peer propagation.”

– Chris Meisl, CTO of Blocknative

Those users without access to the pre-blockchain layer can be vulnerable to its innate uncertainty. Including volatile gas fees, inaccurate transaction previews, and adversarial actors. These can all result in less-than-favorable settlement outcomes, including failed transactions or increased MEV exposure.

Blocknative’s TDN adds the ability to write to the pre-chain layer with confidence. Users can now respond to the pre-chain risks and opportunities they already monitor with Blocknative.

To learn more about Blocknative’s Transaction Distribution Network (TDN) tool click here.

The post Blocknative releases new tool to enable high-speed propagation of ETH transactions appeared first on CryptoNinjas.

* This article was originally published here

Thursday, September 8, 2022

SynFutures plans to integrate with Router Protocol to improve multi-chain access

SynFutures, a decentralized derivatives exchange, announced today a new partnership with Router, a cross-chain protocol that enables fund transfer, asset swaps, and cross-chain applications.

The projects will work together to expand their respective ecosystems and explore integration, taking a crucial step in SynFutures’ mission to become a multi-chain trading platform.

Cross-chain, or blockchain interoperability, refers to the ability to perform transactions, send assets, and other activities across two or multiple networks. Cross-chain plays a crucial role in improving the overall user experience for DeFi projects, such as SynFutures, where users and liquidity providers (LPs) must operate and complete transactions on one chain at a time.

Through integration with Router, SynFutures could solve this pain point for users and LPs.

“SynFutures was designed to be multi-chain, and we’ve been making strides to deploy on both EVM and non-EVM compatible chains. Through our partnership with Router, we can explore new opportunities that will speed up this process and make our platform truly chain-agnostic, opening our platform up to new audiences across the entire blockchain ecosystem.”

– Rachel Lin, Co-Founder & CEO at SynFutures

In addition to asset transfers, Router Protocol allows the flow of arbitrary messages across chains securely and seamlessly, thereby extending the composability of DeFi across various blockchains.

“Router Protocol is excited to help SynFutures go multi-chain and leverage cross-chain primitives. In the era of fragmentation of users and liquidity — we are committed to help DApps expand to multiple chains,.”

– Ramanai Ramachandran, CEO of Router Protocol

Today’s announcement comes following SynFutures’ plans to deploy Optimism, a growing L2 network. Seeking to expand its multi-chain strategy, SynFutures is also preparing to release its V2 closed Alpha, which will introduce new features and updates to the trading platform.

The post SynFutures plans to integrate with Router Protocol to improve multi-chain access appeared first on CryptoNinjas.

* This article was originally published here

Wednesday, September 7, 2022

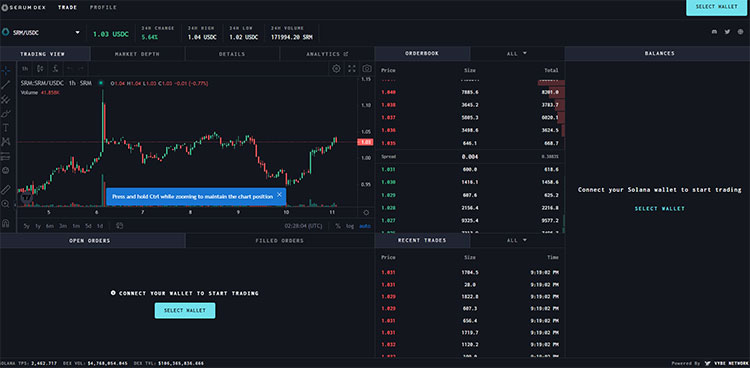

New Serum powered DEX for Solana from Vybe Network launches

Today it was announced from the Serum community the launch of Vybe DEX, a data-driven trading interface powered by Serum’s central limit order book & matching engine, built by Vybe Network.

Vybe Network is a data infrastructure solution that enables the Solana community to query, index, and share on-chain data to build web3 dApps and analytics.

For now, the DEX trading platform is available on a desktop web interface, where users can buy, sell and trade various digital assets using Serum’s liquidity and matching engine.

Now Live: Vybe DEX

Vybe DEX enables users to directly interact with Project Serum, in a fully decentralized manner. Users can place a trade on Vybe DEX in an easy-to-use interface, just as they would on centralized exchanges.

The interface’s functionalities include placing limit and market orders for all Serum markets, viewing open orders and transaction history, live and historical chart data, statistics on order book liquidity, SPL tokens as well as market depth charts.

Users can also access their profile page to view and manage their assets, open orders, unsettled balances, and open order accounts.

Vybe Network

Vybe Network is at the forefront of building on-chain analytics products for Solana.

One of Vybe’s notable contributions to the Serum ecosystem is Serum Analytics (projectserum.vybenetwork.com), a dashboard with real-time data related to Serum including trading volume, total value locked, and top trading pairs.

The post New Serum powered DEX for Solana from Vybe Network launches appeared first on CryptoNinjas.

* This article was originally published here

Tuesday, September 6, 2022

Brazil payment app PicPay launches new crypto exchange service with Paxos technology

PicPay, a Brazil-based payment app, has announced will now allow its users to buy, sell and hold cryptocurrencies, in its first foray into the crypto market. Today, PicPay launches its cryptocurrency exchange service, which initially supports trading of Bitcoin and Ethereum, as well as USDP.

The exchange is operated in partnership with Paxos, a blockchain infrastructure company regulated by the New York Department of Financial Services. Paxos will manage trading and custody of assets for PicPay. Paxos is also the issuer of USDP, a regulated US dollar stablecoin.

Gradually, the exchange will be made available on the PicPay app, which has more than 30M active users. Trading will start from R$ 1 with PicPay also providing users with data and info on the crypto market within the exchange platform.

“PicPay is one of the most disruptive players in payments in Brazil and our goal is to lead the growth of the crypto market, by eliminating the complexity that is still associated with it and expanding information on the technology, so that everyone can take advantage of this asset class, technology.”

– Bruno Gregory, Head of PicPay’s Crypto and Web3 business unit

Next Phases

Later this year, users will be able to pay using cryptocurrencies in the PicPay app and will be able to complete crypto transfers. In addition to the crypto exchange, PicPay will soon launch its own stablecoin. It is to be backed by the Brazilian real, with one-to-one parity and will allow the PicPay stablecoin to be available as a payment method, anywhere that accepts crypto.

“We’re excited to partner with PicPay to offer millions of Brazilians access to crypto markets and the Paxos regulated digital dollar USDP. PicPay is renowned for its innovative payments solutions, ensuring this partnership will make it easier for Brazilians to use digital assets safely in their daily lives.”

– Mike Coscetta, Paxos Head of Revenue

The post Brazil payment app PicPay launches new crypto exchange service with Paxos technology appeared first on CryptoNinjas.

* This article was originally published here

Monday, September 5, 2022

BitPay teams with Dosh to enable cashback rewards on crypto debit card

BitPay, the bitcoin and crypto payment processing platform, announced today that users of its BitPay Card will now be rewarded with automatic cashback rewards when swiping the card at thousands of retailers.

Thanks to a new partnership with Dosh, when spending with the BitPay Card, users will see crypto cashback rewards add up directly in the BitPay app,

“We’ve partnered with Dosh to bring you cashback offers from brands you love. When you make a transaction with your BitPay Card, Dosh checks to see if it is eligible for a cashback reward. If the transaction is eligible for cash back, Dosh will send us a message to credit your checking account after the transaction has been completed and posted.”

– The BitPay Team

The post BitPay teams with Dosh to enable cashback rewards on crypto debit card appeared first on CryptoNinjas.

* This article was originally published here

Sunday, September 4, 2022

“Move-and-earn” app STEPN to utilize LINE Blockchain for the Japanese market

LINE, the Japanese corporation specializing in mobile technologies, announced today that LINE Xenesis and Find Satoshi recently concluded an MOU aiming to utilize LINE Blockchain in the localization of STEPN for the Japanese market.

STEPN is a “move-and-earn” blockchain game that lets players earn crypto assets equivalent to the number of steps they’ve taken. Since its beta release back in December 2021, its popularity as a fitness app has grown among people worried about their lack of exercise. As of July 15th, 2022, the app boasts 4.5 million global registered users, including 3 million MAU.

In April 2018, LINE established the LINE Blockchain Lab and has since pursued the development of dApps with blockchain along with research into P2P-network distributed systems and encryption technology. LINE Blockchain (LINE’s proprietary blockchain) was created and used to issue native crypto asset LINK.

The entire group is now developing and operating various blockchain-related businesses, including the crypto asset trading services LINE BITMAX (in Japan) and BITFRONT (globally) as well as a comprehensive NFT marketplace called LINE NFT.

“We’re very pleased to be able to cooperate with STEPN, which is very popular in Japan as well as a representative example of web3 in the world. As LINE’s proprietary blockchain, LINE Blockchain serves as the technological foundation for LINE’s various services. With this collaboration across international borders, we hope to create new synergy and continue to offer new blockchain value from a position that is closest to our users.”

– Lim Inkyu, LINE Xenesis’ Representative Director & CEO

Moving forward, both companies will collaborate on the technological and business aspects of localizing STEPN for the Japanese market while seeking to create a service that lets Japanese users simply and enjoyably experience web3 as part of their healthy lifestyles.

“We at STEPN are excited about this opportunity to partner with LINE Blockchain. We believe this collaboration with LINE blockchain will help us better engage with the users of LINE in a web3 way, and in return help LINE promote a healthy lifestyle and carbon offsetting / environmental friendly initiatives to its users all over the world. We appreciate the progress of LINE blockchain as an avant garde in the enterprise blockchain space. Japan, one of the largest consumer markets of LINE, is also one of the most important markets of STEPN. We plan to continue to have more engagements in this market and hope to offer more exciting opportunities to our Japanese users.”

– Yawn Rong, STEPN Co-Founder

The post “Move-and-earn” app STEPN to utilize LINE Blockchain for the Japanese market appeared first on CryptoNinjas.

* This article was originally published here

Saturday, September 3, 2022

Crypto risk & intel platform Merkle Science extends its Series A to over $24M

Merkle Science, a predictive crypto risk and intelligence platform has announced an extension of more than $19 million to its Series A funding round, bringing the total raised to over $24 million.

New investments will help accelerate the company’s growth and will be used for expansion across the U.S. and Europe, as well as for R&D in emerging segments such as analytics and forensics across NFTs, DeFi, and cryptocurrency bridge protocols.

Merkle Science’s solution suite screens over 3 million digital assets per month and covers cryptocurrencies representing 96% of the current $1.13 trillion crypto market cap. It uses machine learning to drive transaction monitoring and risk mitigation for AML compliance, offers a crypto forensics tool that tracks stolen funds and enables investigations, enhanced due diligence and entity reporting, and crypto compliance and investigations training.

BECO Capital, Susquehanna affiliate (Darrow Holdings), and K3 Ventures co-led the extension, with participation from new investors including Republic Crypto, Summer Capital, 500 StartUps APAC, and US, Aspen Digital, HashKey Capital, and Coinhako. They were joined by existing investors Kraken Ventures, Digital Currency Group (DCG), Kenetic, Uncorrelated Ventures, Fenbushi Capital, Lucy Gazmararian of Token Bay Capital, and Libertus Capital.

Several market vectors have converged to drive exponential global demand for the company’s solutions. This includes the rapid adoption of blockchain technology across the financial services industry, including on the part of many large institutions; the escalating impact and cost of hacks and exploits, such as the Nomad and the Ronin Bridge exploits; and increased regulatory scrutiny, such as NYDFS’s Virtual Currency Guidance, FINCEN’s Advisory on Illicit Activity Involving Convertible Virtual Currency and the sanctioning of Tornado cash and Blender.io by the US treasury.

These developments, together with the government’s enforcement-first approach and enormous penalties recently issued to companies such as Robinhood and BlockFi, have made clear the need for stronger and more widespread compliance, risk management, and forensics solutions in the space.

Merkle Science meets this need by providing next-generation crypto threat detection, risk mitigation, investigations, and compliance solutions to financial institutions, crypto businesses, DeFi participants, NFT platforms, and government agencies.

“We’ve seen over 300% growth over the past year, despite the onset of a severe bear market in crypto and throughout the broader global economy. Web3 companies, financial institutions, and regulators are continuing to invest heavily in crypto compliance and forensics. Recent high-profile events in the space, including the failure of large companies and massive hacks, are a clear indicator of the need for much more robust risk management, forensics, and compliance for digital assets.”

– Merkle Science CEO & Co-Founder Mriganka Pattnaik

To support its goals, Merkle Science recently added to its leadership team, which features talent from Paypal, Luno, Bank of America, the FBI, and the DOJ, with new Chief Revenue Officer Fernando Castellanos – a New York-based sales leader and former Forter VP experienced in scaling organizations.

The post Crypto risk & intel platform Merkle Science extends its Series A to over $24M appeared first on CryptoNinjas.

* This article was originally published here

Friday, September 2, 2022

Tetrix and Pitaka crypto wallet launch ‘Tetrix Link’ to digitize contact exchange

Today it was announced by Filipino-led blockchain Tetrix Network and Pitaka crypto wallet, the launch of Tetrix Link, an NFC card that enables users to select and store information, such as their personal contact details and relevant social media accounts, and share these data when they tap or hover over their card to an NFC-enabled mobile device.

Offering an easy-to-navigate UI backed with blockchain, Tetrix Link can function as any ID or key card. Eventually, it will also store mission-critical data and other physical documents like vaccine certificates and data inside NFTs for specific use cases.

To use Terix Link, users must download the latest version of the Pitaka mobile app. Next, sign up at https://link.tetrix.xyz and fill out the personal details and contact information needed in the dashboard.

Once the card is purchased, users receive an authentication code to connect the dashboard to the Tetrix Link card. Finally, share that data by tapping the card onto an NFC-enabled device, and do not remove it until the information pops up on the screen.

“With Tetrix Link, you can share your data to your peers more easily and would eliminate the need for multiple business cards since the data of multiple assets are stored inside the network. You can control which information to share, and lastly, you would only require a link or QR code to share.”

– Felix Asuncion, Co-Founder & Chief Revenue Officer of Tetrix Network

Aiming to recreate the way we use our physical wallets, Tetrix Link allows users to secure other forms of self-custodial data. All the data that is needed to present is housed in a handy little card, and potential connections only need to tap the card onto their NFC-enabled phones.

The card has a QR code in case one’s phone doesn’t support NFC. Plus, if no internet connection at the moment of transfer, the receiver can bookmark the link and access it later. In later versions, Tetrix Link will enable users to access data offline as well.

Also in the works is a second version, wherein users can add their resumé and an intro about themselves, plus book their schedule or create a calendar when they tap the card onto an NFC-enabled phone.

Future updates on the card seek to enable users to transfer and receive cryptocurrencies via the Pitaka wallet, receive perks as with loyalty or rewards cards, and pay for merchants and transportation.

For more information about Tetrix Link click here.

The post Tetrix and Pitaka crypto wallet launch ‘Tetrix Link’ to digitize contact exchange appeared first on CryptoNinjas.

* This article was originally published here

Thursday, September 1, 2022

THORWallet expands DeFi swap functionality with Rango Exchange integration

THORWallet, a non-custodial wallet that allows users to swap native crypto-assets across chains and earn passive income on them, today announced a new partnership with multi-chain DEX, Rango Exchange.

For the first time, THORWallet DEX users can now execute cross-chain swaps on assets beyond those available in THORChain pools, starting with cross-chain swaps compatible with the Ethereum Virtual Machine (EVM), plus more than 40 chains.

“The team at Rango Exchange are renowned specialists in DEX aggregation. Joining forces allows us to collaborate on our shared vision of building a fair and open financial system for the future. Bringing together a multitude of cross-chain swap services into a single wallet application grants immediate access to the entire DeFi universe, including swap pairs not supported by THORChain.”

– Marcel Harmann, Founder & CEO of THORWallet DEX

As the gateway to THORChain, THORWallet DEX enables users to access native and cross-chain liquidity plus the full DeFi landscape from a single entry point.

“Collaborating with the team at THORWallet is as exciting as it is significant. Until now, accessing multichain DeFi through multiple applications has been an intimidating experience for the average user. Consolidating our service’s features into a single wallet solution allows anyone with a smart device to easily take advantage of all the top chains and DEXs, swapping BTC with ETH or any liquid EVM assets.”

– Martin, CMO at Rango Exchange

For Rango Exchange, this integration follows a string of successful partnerships including 1inch, Paraswap, and more.

The post THORWallet expands DeFi swap functionality with Rango Exchange integration appeared first on CryptoNinjas.

* This article was originally published here

These Cryptos Have MASSIVE Potential?! ETH Layer 3 Explained!

* This article was originally published here

-

Gate.io, a bitcoin and crypto exchange company, today announced a cooperation with the decentralized financial data provider, Pyth Network, ...

-

The US Securities and Exchange Commission is suing Elon Musk to compel him to testify as part of the investigation into his takeover of Tw...

-

With ByBit beginning to cease operations in the U.K., British users are looking for alternative crypto trading platforms, especially those...