Tuesday, August 31, 2021

Monday, August 30, 2021

Sunday, August 29, 2021

AMLBot Check List Makes Easier To Examine and Manage AML Risks

Bitcoin was created as a peer-to-peer monetary system that returns control of assets to its owners. But along with control, cryptocurrency holders faced a higher level of responsibility both for […]

Bitcoin was created as a peer-to-peer monetary system that returns control of assets to its owners. But along with control, cryptocurrency holders faced a higher level of responsibility both for […]

The post AMLBot Check List Makes Easier To Examine and Manage AML Risks appeared first on Cryptorials.

* This article was originally published here

Saturday, August 28, 2021

Friday, August 27, 2021

Zilliqa unveils newest ZILHive Accelerator 2021-2022 blockchain projects

Zilliqa, the Singapore-based enterprise-grade blockchain platform, has announced its 2021-2022 cohort of ZILHive Accelerator projects. The ZILHive Accelerator is a six-month program focused on launching blockchain-enabled projects from concept to commercialization.

The accelerator program is part of ZILHive’s end-to-end ecosystem designed to foster innovative blockchain applications throughout various stages of maturity. Startups in the accelerator will be able to apply for additional funding under ZILHive Grants, aimed at supporting specific pre-launch needs such as regulatory compliance or technical integration with third-party apps.

Han Wen Chua, Vice President of Ecosystem Growth at Zilliqa, commented: “The tremendous progress the startups have made in turning their ideas into real-world use cases for blockchain is a validation of our efforts at growing Singapore’s role in the global fintech ecosystem.”

Incubation Projects

Six of the eight startups accepted into the Accelerator this year were advanced from an earlier Incubator program which began in March.

The inaugural 14-week ZILHive Incubator matched technical and non-technical participants into teams that could design and build unique solutions on the Zilliqa blockchain protocol.

The eight startups accepted into the Accelerator include:

- Access, a startup that looks to combat ticketing fraud and prevent ticket scalping by issuing tickets as non-fungible tokens;

- Cerchia, a startup building blockchain-based tools to help catastrophe bond issuers, re-insurers, and investors better predict and price the risks of natural hazards through crowdsourcing;

- Green Beanz, a project that aims to incentivize consumer-facing companies and NGOs to improve the transparency and accuracy of their corporate social responsibility and sustainable development goals reporting;

- HeyAlfie, a smart dashboard for users to manage, invest and borrow digital assets through a single interface, by connecting multiple types of wallets (custodial, non-custodial, and even exchange accounts);

- Invopay, an invoice financing platform designed to help small-to-medium enterprises (SMEs) better manage their cash flow with low-interest loans secured on the blockchain;

- MustPool, a gamified no-loss prize protocol, where the deposited principle remains safe and the prizes come from the interest earnings, leveraging different staking and lending dApps on Zilliqa;

- Tyron SSI Protocol, a self-sovereign identity protocol that enables users to manage access to their data securely, while allowing them to provide verified credentials selectively without relying on middlemen or centralized databases;

- Ultimate Franchise Fantasy Sports, a fantasy sports platform offering digital asset ownership to sports fans through the use of NFTs to represent athletes in the various sports leagues.

Startups accepted into the Accelerator feature founders from diverse backgrounds – from enterprising college students to seasoned industry professionals.

“The diversity of the participants graduating from the incubator and into the accelerator program highlight the importance of having a comprehensive suite of programs, each tailored to the different stages of an innovator’s journey,” noted Chua.

Access founder Mihir Mohan said, “From the design sprints with the ZILHive team to the valuable advice I’ve gained from experienced professionals during the Incubator program, ZILHive’s programs have helped me turn my ideas into a viable product.” Mohan first joined ZILHive through its student practicum and later started Access during the incubator program.

Projects such as Cerchia, on the other hand, were founded by seasoned industry professionals.

Led by a founding team of quants and risk managers from the likes of financial institutions such as UBS and GIC, Cerchia’s chief technical officer Fabian Buchmann said, “The ZILHive Incubator was a great opportunity to enlarge our network and increase the team’s expertise significantly with their complementary skill sets. The development of a minimum viable product during the incubator has prepared us to launch the product on the Zilliqa protocol during the upcoming accelerator program.”

ZILHive has also appealed to traditional businesses looking to generate new revenue models by implementing emerging technologies into their existing tech stack. Judobi is looking to launch Invopay, its new invoice financing platform, via the ZILHive Accelerator.

Julien Doherty-Bigara, CEO of Judobi, said: “The ZILHive Incubator has opened up a new chapter in my entrepreneurial journey by partnering my team with great co-founders to solve a real problem using blockchain. The incubator itself helped us to conceptualize and validate our idea and we’re now looking forward to powering the growth of Invopay with the ZILHive Accelerator program.”

The ZILHive Accelerator program will culminate in a worldwide Demo Day in December 2021, where outstanding projects stand the chance to receive up to USD $150,000 in growth capital from ZILHive Ventures, Zilliqa’s internal venture fund.

The post Zilliqa unveils newest ZILHive Accelerator 2021-2022 blockchain projects appeared first on CryptoNinjas.

* This article was originally published here

Thursday, August 26, 2021

Cardano (ADA), Solana (SOL) are increasingly seeing institutional bets. Here’s why.

Warmed-up investor sentiment favors Cardano (ADA) and Solana (SOL) the most, revealed the recent CoinShares report.

The digital asset investment firm recently published a report for the week ending August 20, which recorded first inflows totaling $21 million, following a six-week run of outflows.

Solana recorded the highest weekly inflows

“Positive price action in recent weeks has now pushed total assets under management (AuM) to $57,3 billion, the highest since mid-May,” read the report, while indicating that “flows across product providers remained mixed, with some continuing to post outflows for the week while others in both North America and Europe posted inflows.”

While Bitcoin (BTC) witnessed its seventh straight week of outflows totaling $2.8 million, Ethereum (ETH) experienced minor inflows totaling $3.2 million last week as other altcoins, including Solana, Cardano, Litecoin (LTC) and Polkadot (DOT) also recorded millions pouring in.

Solana saw the biggest inflow last week, totaling $7.1 million, followed by another Ethereum competitor, Cardano, which attracted $6.4 million.

At the same time, Litecoin and Polkadot saw $1,8 million and $1,1 million of inflows respectively. Solana rallied last week and finally hit its all-time high of $81.44 on August 21.

The single-chain, delegated-Proof-of-Stake protocol, which became known as “high-performance” blockchain, has been experiencing growing awareness and popularity recently.

Cardano saw the highest monthly inflows

According to the report, Charles Hoskinson’s Cardano saw the largest inflows of any crypto on a month-to-date (MTD) basis.

Cardano’s recent performance comes on the back of announcements of the network’s major upgrade rollout that will usher the smart contract functionality and enable the deployment of numerous dapps.

With recording $8.6 million of inflows in a 30 day period ending August 20, Cardano outplayed Solana and Ethereum, which saw $7.1 million and $5.1 million of inflows respectively.

Cardano rallied 129.9% during the past 30 days and neared the $3 mark as it hit its all-time high at $2.96 on August 23.

The post Cardano (ADA), Solana (SOL) are increasingly seeing institutional bets. Here’s why. appeared first on CryptoSlate.

* This article was originally published here

Wednesday, August 25, 2021

The Sandbox (SAND) Listed on Changelly

SAND, the utility token of the Sandbox platform, has just been listed on Changelly. Starting today, users will be able to exchange it for the 200+ cryptocurrencies already available on our platform as well as purchase it on our fiat-to-crypto marketplace Changelly Buy.

The Sandbox is a blockchain-based virtual world that lets users create, build, buy, and sell digital assets in a gamified way. The company’s main goal is to create a platform that could allow users to be both gamers and creators simultaneously via a “play-to-earn” model.

The Sandbox virtual world is built on top of the Ethereum blockchain and is secured by the proof-of-stake (PoS) algorithm. Players create digital assets in the form of NFTs (non-fungible tokens) that can be uploaded to the marketplace and later integrated into games using the Game Maker.

The platform allows users to make money in 4 main ways:

- Creating and selling NFTs on the Marketplace

- Buying and renting out LAND – a digital piece of real estate in The Sandbox metaverse

- Monetizing games they created using the Game Maker

- Staking their SAND

SAND is the utility token of The Sandbox, and it facilitates all transactions on the platform. As a standard ERC-20 token, it allows its holders to stake it for profit. SAND is also used for network governance.

Gamification is the best way to introduce people to new products and industries. The Sandbox simplifies and gamifies the typically complex process of making NFTs, eliminating the usually rather high entry barrier to the creation of one’s own digital assets. We look forward to seeing what benefits this listing will bring to both our companies and our users.

Changelly team

About The Sandbox

The Sandbox is a decentralised, community-driven gaming ecosystem where creators can share and monetise voxel assets and gaming experiences on the Ethereum blockchain. Using The Sandbox’s free software, such as VoxEdit and the Game Maker, players can create ASSETs and games for themselves and to share with others. These can be monetised to earn the creator passive income.

Current products on The Sandbox platform include:

- VoxEdit: software to create voxel ASSETS, which can then become Non-Fungible Tokens (NFTs) and be imported to the Marketplace.

- Marketplace: a decentralized marketplace for trading in-game ASSETS created in VoxEdit.

- Game Maker: a visual scripting toolbox that allows anyone to build 3D games for free.

Learn more about The Sandbox:

Website: www.sandbox.game

Twitter: twitter.com/TheSandboxGame

About Changelly

Changelly provides an ecosystem of products and services that enables customers to have a one-stop-shop experience when engaging with crypto. Operating since 2015, Changelly acts as an intermediary between crypto exchanges and users, offering access to 200+ cryptocurrencies that can be effortlessly swapped within 10 minutes on desktop and on-the-go via Changelly mobile app.

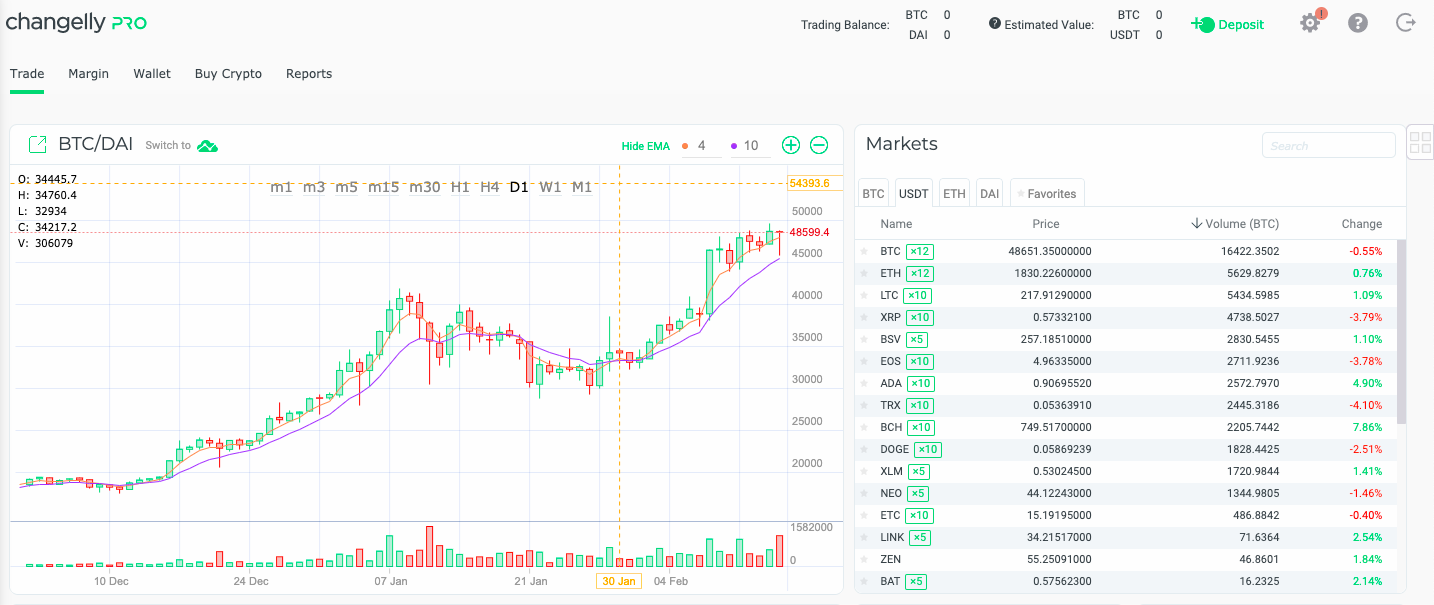

In 2020, Changelly branched out to accommodate the needs of traders. PRO has been built as a platform focused on the customer’s needs, effectively enabling retail buying and selling digital tokens and coins. Piggy-backing on the great support system found within Changelly, Changelly PRO will provide the community with high limits, effective pricing, fast execution, and 24/7 live support.

Learn more about Changelly:

Website: changelly.com

Changelly PRO website: pro.changelly.com

Twitter: https://twitter.com/Changelly_team/

The post The Sandbox (SAND) Listed on Changelly appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

What Will Be the Next Cryptocurrency to Explode in 2021?

The crypto market is extremely volatile, and cryptocurrencies that make it big can become shitcoins not a week later. However, some of those crypto coins and tokens manage to stay on top. Regardless of where they end up after their trip to the moon, cheap cryptocurrencies that have a chance to explode are what many crypto investors are looking for.

Whether you want to find the next cryptocurrency to explode in 2021 or just want to diversify your portfolio with some extremely high risk, high reward digital assets, the cryptocurrencies on this list will be perfect for you!

Best Cryptocurrency to Invest in 2021 for Long Term

Penny cryptocurrencies are ones that have a price of under $1. They are extremely cheap, and sometimes cost less than a literal penny. However, despite their low price, some of them have incredible growth potential, which attracts many investors.

Always do your research before investing in any digital asset and check whether it’s been listed on reputable crypto exchanges.

Some penny cryptocurrencies can already be considered the next big thing – after all, it’s not the price that determines the true value of a crypto coin or token, but market capitalization and many penny cryptocurrencies have a rather high market cap.

However, most cheap cryptos have room to grow in terms of market cap and are still waiting for their chance to explode. But don’t invest in just any penny cryptocurrency – some of them may turn out to be nothing more than shitcoins. Always do your research before investing in any digital asset and check whether it’s been listed on reputable crypto exchanges.

Below we have listed some of the cheap digital currencies that we think are likely to be the next cryptocurrency to explode. Have a look!

1. SAFEMOON (SafeMoon)

Name: SafeMoon

Ticker: SAFEMOON

Website: safemoon.net

CoinMarketCap ranking (as of 9/8/21): #210

SafeMoon blockchain protocol is a DeFi token that has 3 functions that take place during each trade: Reflection, LP Acquisition, and Burn. This token was launched in May 2021 and is still very young. Its price has dropped after an initially strong start, but SAFEMOON has a solid market cap.

Moreover, this digital token gained over 2 million holders in just a couple of months – a very impressive number that means there are a lot of people interested in this crypto, which is always a good sign. SAFEMOON has a chance to be the next cryptocurrency to explode.

One downside (or upside, depending on how you look at it) this coin has is the fact that it has a selling fee – every holder that sells their SAFEMOON tokens will have to pay an extra 10%.

2. OXEN (Oxen)

Name: Oxen

Ticker: OXEN

Website: oxen.io

CoinMarketCap ranking (as of 9/8/21): #499

Oxen (formerly known as LOKI) is a fairly small cryptocurrency that (at the moment of writing this article) has a daily trading volume of less than $100,000. Despite that, many crypto investors have their eyes on this token.

OXEN is a private cryptocurrency with instant transactions that are protected by a proof-of-stake consensus protocol. The project’s goal is to enable truly private communication and transactions for users from all across the world.

Oxen is a non-mainstream cryptocurrency that has everything potentially successful crypto needs: a solid technical foundation, a great idea behind it, and an ambitious and driven team managing and developing it. Although at the moment it has the lowest market cap out of all the crypto assets on this list, it has all the chances to be the next cryptocurrency to explode.

3. VET (VeChain)

Name: VeChain

Ticker: VET

Website: vechain.org

CoinMarketCap ranking (as of 9/8/21): #22

VET is one of the two in-house tokens of VeChain, a blockchain-powered supply chain platform. The VeChain project has quite ambitious goals, aiming to solve the major issues the supply chain industry suffers from with the use of an ecosystem created using distributed governance and the Internet of Things (IoT) technology.

The supply chain industry has suffered quite a lot in 2021, and blockchain technology may provide the solutions needed to revitalize it. VeChain’s experience and established reputation can help it to pull ahead of the competition. Not to mention, the efficiency, traceability, transparency, and the reduced cost VeChain can provide are all extremely valuable. If this project manages to become a major player in the supply chain industry, its native token VET can rise in price quite significantly.

Of course, this is just our prediction – but there’s no denying that VeChain is an interesting project with a high market cap that still has a lot to offer.

Get VeChain (VET) on Changelly.

4. XLM (Stellar)

Name: Stellar

Ticker: XLM

Website: stellar.org

CoinMarketCap ranking (as of 9/8/21): #20

Stellar is an open network that allows users to move and store money in a highly efficient way. Stellar has the highest market cap out of all the crypto coins and tokens on this list.

Just like Bitcoin and Ethereum, XLM, Stellar’s native token, is a very viable option for payments – its network can process anywhere from 1 to 5 thousand transactions per second. Additionally, it has extremely low fees, with each transaction costing exactly 0.00001 XLM.

Thanks to its in-built KYC functionality, Stellar is an incredibly secure digital token and cannot be used in money laundering. This means that it is more likely to be favored by regulators, which, together with the other functions XLM provides, makes this cryptocurrency a good long-term investment.

Get Stellar (XLM) on Changelly.

5. REEF (REEF Finance)

Name: REEF Finance

Ticker: REEF

Website: reef.finance

CoinMarketCap ranking (as of 9/8/21): #164

REEF Finance is a DeFi project created on Polkadot that aims to solve the issue of interoperability that plagues the crypto and the decentralized finance industry. This project is attempting to build a single platform that will combine all the various DeFi applications in one place.

REEF Finance’s yield engine and smart liquidity aggregator allow the platform to quickly and easily integrate other DeFi protocols. Having been created on Polkadot, REEF Finance shares its security model.

REEF Finance already has many partners and is establishing its place in the industry. Its digital token REEF has all the chances to be the next cryptocurrency to explode.

6. HBAR (Hedera Hashgraph)

Name: Hedera Hashgraph

Ticker: HBAR

Website: hedera.com

CoinMarketCap ranking (as of 9/8/21): #54

Hedera Hashgraph is often called a “trust layer of the Internet”. It is a public network that lets businesses and individuals build decentralized applications (DApps). It was designed to solve some issues old cryptos like the Bitcoin or Ethereum blockchain face, such as slow performance or instability. The hashgraph consensus is extremely efficient and has a throughput of over 10,000 transactions per second.

Hedera Hashgraph is not exactly a newcomer to the crypto world – it was launched back in 2019. However, it is a prime example of a crypto that has all the chances to be the next cryptocurrency to explode in 2021.

HBAR, the platform’s native cryptocurrency, has a dual role on the network. Firstly, this digital currency fuels Hedera Hashgraph’s various services like smart contracts or file storage. Secondly, it helps to secure the platform, as HBAR holders can stake their tokens to maintain the integrity of the platform.

Hedera Hashgraph has excellent utility, a solid technical foundation, a rather high market capitalization, and is governed by a council of up to 39 leading global enterprises. All these things combined make it a very promising cryptocurrency.

Get Hedera Hashgraph (HBAR) on Changelly.

7. AKRO (Akropolis)

Name: Akropolis

Ticker: AKRO

Website: akropolis.io

CoinMarketCap ranking (as of 9/8/21): #372

Akropolis is an Ethereum-based decentralized finance (DeFi) protocol that aims to provide users with an autonomous ecosystem for growing and saving wealth. It offers a wide range of products, including Delphi, a yield farming aggregator, AkropolisOS, a framework for developing for-profit decentralized autonomous organizations, and Sparta, a platform for uncollateralized lending.

AKRO is an ERC-20 token that is used for network governance across all of Akropolis products.

Experts over at Wallet Investor consider AKRO to be a good long-term investment, predicting that the price of this digital currency will double in value in just one year. Considering AKRO is a governance token of a very promising platform, it does have the potential to be the next crypto to explode.

8. MANA (Decentraland)

Name: Decentraland

Ticker: MANA

Website: decentraland.org

CoinMarketCap ranking (as of 9/8/21): #70

Decentraland is an Ethereum-powered virtual reality platform. It allows users to buy plots of land where they can build and monetize content and applications in a quick and easy way. Other users can visit those plots of land, experiencing and enjoying the content others have created. Although the platform has only been officially launched in 2020, it has already been used to create a bunch of games, 3D scenes, and other interactive experiences.

MANA is one of the two tokens used by the Decentraland platform. It is an ERC-20 token that must be burned to obtain ERC-721 LAND tokens. Additionally, MANA can be used to pay for avatars, names, and many other similar things on the Decentraland marketplace.

This penny cryptocurrency is one of the best altcoins to invest in 2021. Experts are bullish on it, and it is backed by a solid innovative project that has the potential to make it big.

Get Decentraland (MANA) on Changelly.

9. ONE (Harmony)

Name: Harmony

Ticker: ONE

Website: harmony.one

CoinMarketCap ranking (as of 9/8/21): #88

Harmony is a blockchain platform that was designed to facilitate the creation and use of DApps – decentralized applications. This project aims to revolutionize the block creation process by focusing on random state sharding that significantly reduces node validation times.

Nodes and validators on the Harmony network are assigned and re-assigned in a randomized manner, which secures the validation process and ensures node protection. According to Harmony’s website, the project is planning to introduce cross-shard contracts and a cross-chain infrastructure by the end of 2021.

Harmony is a well-connected project with ambitious plans for the future. It, and its token ONE, have good long-term prospects. ONE is definitely on our “altcoins to watch” list.

Get Harmony (ONE) on Changelly.

10. POLY (Polymath)

Name: Polymath

Ticker: POLY

Website: polymath.network

CoinMarketCap ranking (as of 9/8/21): #184

Polymath is a decentralized Ethereum project. Its main goal is to facilitate easier creation and management of security tokens. Polymath’s ST-20 standard lets users embed regulatory requirements into the tokens themselves to restrict trading to verified participants. Over 220 tokens have already been created on the Polymath platform. You can find them here.

Polymath was deployed on the Ethereum mainnet in January 2018. In its three years on the crypto market, the platform has managed to attract a lot of partners and thousands of users, establishing itself as a promising crypto project.

POLY is the platform’s utility token that is used to access the suite of smart contracts that are needed to create ST-20 tokens. It is one of the altcoins that is most likely to explode in 2021.

Get Polymath (POLY) on Changelly.

11. ZIL (Zilliqa)

Name: Zilliqa

Ticker: ZIL

Website: zilliqa.com

CoinMarketCap ranking (as of 9/8/21): #79

Zilliqa is a public permissionless blockchain that was designed to offer extremely high throughput and can complete thousands of transactions per second. Using sharding as a second-layer scaling solution, this project aims to solve the age-old issue the crypto industry suffers from – scalability.

Zilliqa can be used to create DApps, and it has also introduced staking and yield farming back in 2020. The platform’s native utility token, ZIL, is used to execute smart contracts and process transactions on the network.

Zilliqa has very ambitious plans. It aims to become the network of choice for large-scale enterprise use in gaming, advertising, and many other industries. Its team has listed Visa and Mastercard as Zilliqa’s potential competition. It has all the chances to be the next cryptocurrency to explode.

Get Zilliqa (ZIL) on Changelly.

Where to Invest in Rising Cryptocurrencies

There are quite a few crypto exchanges that allow you to get these and other rising cryptocurrencies. Platforms like Binance or Coinbase always make sure to list the latest trending crypto coins and tokens ASAP so that users can get them before they shoot for the moon.

If you’re looking for an intuitive, beginner-friendly cryptocurrency exchange where you could get all the latest trending cryptocurrencies, try out Changelly!

- Our instant crypto exchange platform lets you get 200+ coins and tokens at great fixed and floating rates in a quick and easy way

- Changelly Buy, our fiat-to-crypto marketplace, allows you to buy dozens of crypto assets with 60+ fiat currencies

- Changelly PRO, our full-featured trading platform, can help you to ease yourself into the world of crypto trading

We always make sure to list all the best new cryptocurrencies on all of our platforms! Follow us on Twitter (PRO) to stay up to date on all the listing news. If you prefer to get crypto on the go, we also have an easy-to-use yet powerful mobile app. (Android, iOS)

FAQ

What is the next best cryptocurrency?

There’s no such thing as the “best crypto”. The notion is highly subjective, and a lot depends on what that cryptocurrency will be used for. There’s little point in comparing Bitcoin with various DeFi tokens, for example.

It’s near impossible to predict which cryptocurrency is going to make it big next. For now, Bitcoin and Ethereum remain the best cryptos for long-term investment – however, again, they may not be the best if they don’t fit your investment goals.

To find out what your personal next best cryptocurrency is, understand what your investment goals are and clearly establish a trading strategy. Then, research the crypto market, watch the crypto space, and find the cryptocurrency that you think will both make it big and suit you as an investor.

What crypto will explode in 2021?

The cryptocurrency market is too unpredictable for us to be able to answer this question with 100% certainty. It is pretty much impossible to say what will be the next cryptocurrency to explode in 2021. However, Ethereum seems to be in a really good spot right now, and its price has a good chance to rise later this year.

One good way of knowing what the next cryptocurrency to explode will be is to keep watch on a good crypto exchange or news aggregator. The teams working on such platforms usually watch the crypto space very closely and are always on the lookout for the next Bitcoin.

Disclaimer: Please note that the contents of this article are not financial advice. This article should not be considered as offering trading recommendations. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post What Will Be the Next Cryptocurrency to Explode in 2021? appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

Tuesday, August 24, 2021

Sunday, August 22, 2021

Canadian crypto exchange NDAX integrates algo trading and market maker engine Hummingbot

Canadian crypto exchange NDAX, today announced a new partnership with Hummingbot, the open-source software to build and run customizable trading strategies. By partnering with Hummingbot, NDAX clients can now easily set up, connect to, and automate trading on the NDAX platform.

Through its connectors with some of the world’s largest centralized and decentralized crypto exchanges, Hummingbot provides an easy-to-use command-line interface that lets users configure, customize and run automated bots and strategies. Other benefits of Hummingbot include customizable templates and built-in trading algorithms, including avellaneda market-making, plus arbitrage strategies.

Hummingbot + First NDAX Trading Competition

“With our Hummingbot integration, we will also be launching the first of many crypto trading competitions. Through Hummingbot and NDAX’s API, our clients will be able to become high volume, high-frequency traders, and participate in trading competitions to earn monetary rewards and benefit from lower trading fee structures. This two-week contest will reward top traders by overall volume across all trading pairs on NDAX with a total prize pool of CAD $10,000. By offering the best-in-class tools that easily sync with our platform and trading pairs, NDAX is one step closer to launching its own VIP program for market makers.”

– The NDAX Team

The post Canadian crypto exchange NDAX integrates algo trading and market maker engine Hummingbot appeared first on CryptoNinjas.

* This article was originally published here

Friday, August 20, 2021

Cardano bucks downtrend with 5% gains, but millions in ADA still lost in giveaway scams

Cardano is up 5% in the last 24-hours, to $2.09 at the time of writing, making it the biggest gainer in the top ten.

At the same time, other large caps are struggling to break out of this week’s market dip, which coincided with Bitcoin’s rejection at $48,000.

Indeed, the last seven days have seen the price of Cardano gain 16%, suggesting, despite the wider market consolidation, investors remain bullish over the up-and-coming Alonzo rollout.

Cardano latest on smart contract rollout

A significant factor to Cardano’s performance this week was revealing a definitive deadline date for the Alonzo rollout.

Developers Input Output Global (CEO) announced the date of Sunday, September 12, on which the blockchain will hard fork to bring smart contracts to the network.

“It’s happening. We’re targeting 12 September 2021 for the ‘Alonzo’ upgrade, bringing smart contracts to Cardano via a hard fork combinator (HFC) event.”

The final phase, Alonzo purple, began two weeks ago and is the culmination of months of coding and testing. It involves onboarding third parties, such as exchanges and wallet providers, with the upgrades.

Hoskinson reiterates warnings on giveaway scams

As much as Cardano is building up to this momentous occasion, IOG CEO Charles Hoskinson felt it was necessary to revisit the issue of giveaway scams.

Hoskinson has, in the past, voiced his concerns on scams many times. However, given the apparent ramping-up of scammer’s efforts, the issue appears to be snowballing in recent times.

In his latest social media post, Hoskinson said giveaway scams are a wide-reaching problem affecting the entire crypto industry. It involves posting recycled video content with a pledge to return double the crypto funds received from viewers.

Not mincing his words on the issue, likely due to the frustration this situation brings, Hoskinson said:

“This prays upon people’s greed, their stupidity, and in many cases their inability to properly speak English, lack of competency there.”

He continued by saying millions of dollars, just in the Cardano ecosystem, are lost to giveaway scams each month. What’s worse is that nothing can be done to return the funds.

“There is not a single day I don’t get an email about someone saying “hey, I sent you ADA, when are you sending it back?” And there’s nothing we can do about it.”

Laying the blame squarely on YouTube and Google, Hoskinson said both entities are fully aware of the issue. But, for whatever reason, every day they continue to propagate the scams by allowing them to operate.

In trying to hammer the message home, Hoskinson repeated, we will never giveaway ADA, it is always a scam.

The post Cardano bucks downtrend with 5% gains, but millions in ADA still lost in giveaway scams appeared first on CryptoSlate.

* This article was originally published here

Thursday, August 19, 2021

Wednesday, August 18, 2021

Tuesday, August 17, 2021

FTT Is Now Available on Changelly

We are happy to announce that FTT has joined the family of the over 200 cryptocurrencies available for exchange on Changelly! Now users will be able to exchange it with other digital assets at floating rates on our platform.

FTX is a cryptocurrency exchange built by traders, for traders. FTX offers innovative products including industry-first derivatives, options, volatility products, and leveraged tokens. They strive to develop a platform robust enough for professional trading firms and intuitive enough for first-time users.

FTT is the native cryptocurrency token of the crypto derivatives trading platform FTX that launched on May 8, 2019.

The team behind FTX comprises some of the largest crypto traders over the past few years who, having found issues with most mainstream crypto futures exchanges, decided to launch their own platform. FTX believes that the reason they stand out is due to features such as clawback prevention, centralized collateral pool, and universal stablecoin settlement.

We are excited to have the FTT token join Changelly, just as we are excited about the fast paced development of FTT and are happy to become partners with them.

Changelly team

About FTT

FTT is the exchange token of FTX. There are a total of 350,000,000 FTT tokens in existence, and no more will be created. 175,000,000 of those are treasury tokens and will be unlocked over the next three years.

Website: https://ftx.com

Twitter: https://twitter.com/FTX_Official

Telegram: https://t.me/FTX_Official

About Changelly

Changelly provides an ecosystem of products and services that enables customers to have a one-stop-shop experience when engaging with crypto.

Operating since 2015, Changelly acts as an intermediary between crypto exchanges and users, offering access to 200+ cryptocurrencies that can be effortlessly swapped within 10 minutes on desktop and on the go via Changelly mobile app.

In 2020, Changelly branched out to accommodate the needs of traders. PRO has been built as a platform focused on the customer’s needs, effectively enabling retail buying and selling digital tokens and coins. Piggy-backing on the great support system found within Changelly, Changelly PRO will provide the community with high limits, effective pricing, fast execution, and 24/7 live support.

Learn more about Changelly:

Changelly Website: changelly.com

Changelly PRO website: pro.changelly.com

Twitter: twitter.com/Changelly_team

The post FTT Is Now Available on Changelly appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

Sunday, August 15, 2021

Trading Platform Cryptorobotics Becomes Official Partner Of Crypto Bank MinePlex

April 12, 2021, Moscow — The automated platform for cryptocurrency trading Cryptorobotics integrates its solutions into the crypto bank MinePlex functionality. This decision has been made as part of the […]

April 12, 2021, Moscow — The automated platform for cryptocurrency trading Cryptorobotics integrates its solutions into the crypto bank MinePlex functionality. This decision has been made as part of the […]

The post Trading Platform Cryptorobotics Becomes Official Partner Of Crypto Bank MinePlex appeared first on Cryptorials.

* This article was originally published here

Saturday, August 14, 2021

The consequences of Bitcoin (BTC) issuance at zero are sooner than you think

It’s widely known that there will only ever be 21 million Bitcoin in existence. So what happens when all the Bitcoin has been mined?

This is a hotly contested topic within the cryptocurrency community and one with no affirmative answers. But what is known for sure is that miners, who secure the network, will have less incentive to stick around.

According to Justin Drake, a researcher at the Ethereum Foundation, the ramifications of this could see significant changes to the Bitcoin protocol, and sooner than you think.

Bitcoin issuance

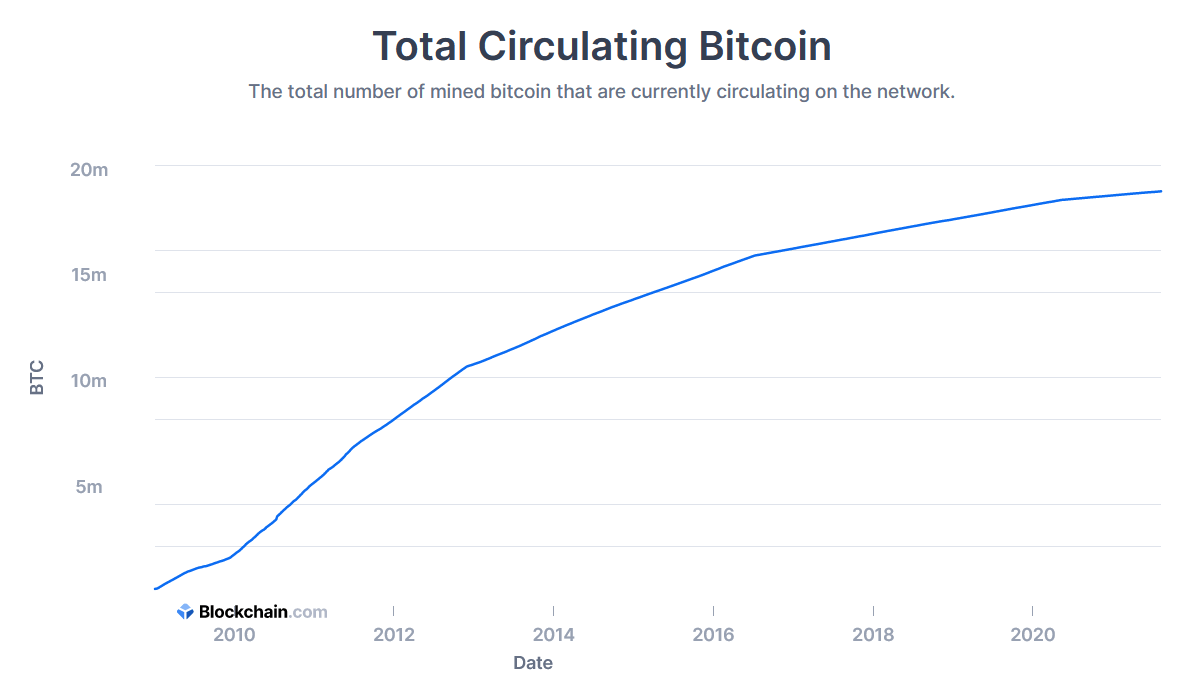

The current circulating supply of Bitcoin is around 18.8 million BTC, which accounts for close to 90% of all the tokens that will ever exist.

At the current rate, a 6.25 BTC block reward is issued every ten minutes. This equates to 900 new BTC entering circulation each day. This rate halves every four years, so it won’t be until 2140 that all 21 million tokens will have been mined and issuance is at zero.

Barring a revolution in healthcare, all of us would have passed on before then. Leading many to consider this a low-priority issue and something for the next generation to deal with.

Action is needed now

However, Drake says the effects of close to zero Bitcoin issuance are just as pertinent. What’s more concerning is that will scenario will happen within the next 20-30 years.

“So very, very quickly, you realize that Bitcoin will be a very unstable system. And it won’t happen a hundred years into the future when the issuance is zero. It will actually happen 20 to 30 years into the future.”

In eight halvings time (the year 2052), the issuance rate will be 3.5 BTC per year, which will yield just 0.0243 BTC for each block reward. Drake adds that this is likely insufficient to secure the Bitcoin blockchain.

To counter this, Drake puts forward a number of suggestions, starting with the obvious one of increasing the 21 million limit. That way, miners have more incentive to stick around and secure the blockchain.

“… they could remove the 21 million block limit. They could start increasing the block issuance again and start reviving the blockchain from a security standpoint.”

But perhaps more controversially, Drake also proposes a split of Bitcoin from the Bitcoin blockchain. Under this scenario, BTC, the asset, would be hosted on a different blockchain.

“And BTC the asset, which is super scarce like gold, can go live somewhere else on another blockchain that will host it for free. And that blockchain, for example, could be Ethereum.”

But more likely are protocol innovations that would see major changes, such as altering the reward structure. Or, as Drake puts forward, changing to a proof-of-stake consensus mechanism as Ethereum is in the process of doing.

The post The consequences of Bitcoin (BTC) issuance at zero are sooner than you think appeared first on CryptoSlate.

* This article was originally published here

Friday, August 13, 2021

Thursday, August 12, 2021

Transferring assets between Ethereum (ETH) and Polygon? This will help

Biconomy, a multichain relayer network building infrastructure to simplify the Ethereum and Web 3.0 experience, announced today the launch of its Hyphen mainnet, as per a release shared with CryptoSlate.

The protocol enables instant and low-cost token transfers across different blockchains.

Why need an Ethereum-Polygon bridge?

L2s have seen an exponential increase in demand with hundreds of dApps moving to Polygon to obtain faster transactions & cheaper gas fees. However, the user experience moving into and out of Polygon is complicated and time-consuming.

The launch of Hyphen will allow users to make USDC and USDT transfers between Ethereum and Polygon, facilitating those transfers in a few seconds, rather than the 30 minutes to multiple hours it currently takes.

“On average, to transfer funds from Layer2 to Layer1 blockchains, it can take anywhere from 40-min to 7-days for users to receive their funds,” said Sachin Tomar, CTO of Biconomy.

He added, “More specifically, it currently takes around 40-50 min to get ERC20 tokens from the Polygon Network to Ethereum via their native bridge. This results in weakened network effects, low composability, and an overall more difficult experience for the end-user. Hyphen solves that problem.”

Instant and more

Hyphen enables developers to offer instantaneous value transfers between EVM chains, various L2s, and sidechains. It also enables quick onboarding from L1 to L2s, further solving the scaling and congestion issues on Ethereum.

It is a superhighway network that connects L2 communities while expediting network effects and increasing composability and interoperability.

By maintaining and rebalancing token liquidity on both sides of the chain and instantly transferring tokens on the second chain after accepting tokens on the first chain, it is able to provide cheaper and instant transfer of funds across blockchain ecosystems.

“It is evident that the future of web3.0 will be multichain but ETH 2.0 alone cannot onboard the next billion users,” explained Sachin Tomar, CTO of Biconomy. The ball’s in the court of Polygon users now.

The post Transferring assets between Ethereum (ETH) and Polygon? This will help appeared first on CryptoSlate.

* This article was originally published here

Two leading Russian media and PR agencies united into one full cycle advertising agency

Digital marketing agency Amris.media and PR laboratory IdolMe signed a strategic partnership agreement. The teams of both agencies combined form a full cycle advertising agency that will provide clients with […]

The post Two leading Russian media and PR agencies united into one full cycle advertising agency appeared first on Cryptorials.

* This article was originally published here

Tuesday, August 10, 2021

Monday, August 9, 2021

Sunday, August 8, 2021

Saturday, August 7, 2021

Blockchain development platform Tatum now supports Polygon network

Tatum, a blockchain development platform, has announced it now supports Polygon, the network for Ethereum scaling and infrastructure development.

To build apps for Polygon or Ethereum, one needs to learn Solidity and have access to blockchain nodes. For many developers, learning a new programming language and maintaining nodes can be time-consuming, expensive, and generally difficult.

Tatum simplifies the whole process by providing access to blockchain nodes and consolidating otherwise complex blockchain operations into unified API calls that can be seamlessly integrated into an app’s backend code with zero blockchain development experience.

Tatum + Polygon

Everything needed to build blockchain apps is available on Tatum; from looking up blockchain data, sending transactions, generating wallets, creating and minting tokens, and calculating blockchain fees,

Tatum’s API allows its users to build apps on Polygon quickly and effectively, with all of the benefits and flexibility of the Polygon network.

NFTs are in high demand, though programming smart contracts using Solidity takes some experience. Thus, the Tatum team has created ready-to-deploy NFT smart contracts for Polygon that can be deployed, minted, transferred, and burned with single API calls.

“There are many modern blockchain protocols attempting to solve the current issues faced by the Ethereum network. Developers want to tap into the rich Ethereum ecosystem without suffering from its low throughput and exorbitant gas fees. Some protocols do it better than others, and Polygon is raising the bar in terms of security, scalability, and interoperability.”

– The Tatum Team

The post Blockchain development platform Tatum now supports Polygon network appeared first on CryptoNinjas.

* This article was originally published here

Friday, August 6, 2021

How to Start Trading Cryptocurrency

So, you’ve figured out how to buy crypto, exchange it, mine it, and store it in a secure cryptocurrency wallet. Now, it’s time for the next big step – trading.

Cryptocurrency trading is awfully similar and yet extremely different from traditional trading. Both can be done easily by absolute beginners, yet require a lot of practice and knowledge to master.

In many ways, cryptocurrency trading is harder than traditional trading – there’s less history to look back on, less news, fewer rules to how the assets behave, and, of course, a lot more volatility. But, in the end, all these things are what attract people to digital currency and crypto trading.

In this article, we will give a thorough how-to guide to cryptocurrency trading, starting from the very basics. Please note that nothing written in this article should be seen as investment advice. Now, let’s get started!

What is Cryptocurrency?

First, let’s establish what cryptocurrency is.

Cryptocurrency is a digital currency that serves as a means of exchange/store of value. It works thanks to the existence of a technology called blockchain – a digital decentralized distributed ledger.

Crypto assets can be divided into two groups: coins and tokens. The former are digital currencies that operate on their own blockchain, while the latter are built and launched on existing chains.

Crypto coins are usually used as a means of payment, while tokens are often used by businesses to support their internal operations or give users a better way to interact with the product/service offered by the company. Naturally, coin and token prices can get influenced by different factors, so knowing the distinction between them is important for anyone who wants to start trading crypto.

Selecting a Cryptocurrency

When you first start trading, you may want to stick to one niche – or, in our case, one cryptocurrency pair. Beginners usually do that, so they have less news to keep up with while they’re still figuring out how the market works.

Let’s get this out of the way – there’s no such thing as “the best cryptocurrency to trade”. Any answer to the “what crypto should I trade” question will inevitably be subjective. What crypto you should trade (and how you trade it) depends on your goals, experience, starting funds, risk aversion, and so on.

For example, if you see trading as a laid-back way to earn some income on the side then it’s better to stick to bigger cryptocurrencies like Bitcoin and Ethereum – their price movements are less unpredictable than those of smaller, newer coins, and you will be able to reliably trade them in the long run.

How Does Cryptocurrency Trading Work?

The crypto market operates in a different way from other financial markets, so it is important to learn more about it before diving headlong into cryptocurrency trading. Cryptocurrency traders use a lot of industry-specific jargon – brush up on it here.

Now, let’s talk about how cryptocurrency trading works. To trade cryptocurrency means to place an “order” for buying or selling a cryptocurrency with another crypto or fiat currency. There are three main types of orders: market, limit and scaled. The former means that you will request to buy an X amount of BTC for a market price that will amount to Z amount of USDT.

As the market is volatile, the price and the trade fees displayed by the exchange are often an estimation. This is where the “stop” option and other order types come into play – they help you to control what price you buy/sell your cryptocurrency at.

You can learn more about the different types of orders on the Changelly PRO website by hovering over the little “?” question mark signs. We encourage you to play around and try all the different order and setting options.

Simple market orders are executed immediately, whereas limit orders can take a while to execute – and even may expire.

Pros and Cons of Investing in Cryptocurrencies

The volatility of the crypto market is responsible for both what attracts people to crypto trading and what scares them away from it. After all, crypto is the very definition of a high-risk, high-reward asset.

On one hand, cryptocurrency trading can provide you with some quick yet immeasurable profits – on another, it can cause you to lose all your savings. It’s dangerous not only because it’s so volatile, especially compared to trading fiat currencies, but also because the regulation surrounding cryptocurrencies and the crypto market is currently muddy at best. Things can change at any day, and crypto may become outlawed or heavily regulated. Of course, these outcomes are highly unlikely to happen, but this is a risk every crypto trader has to keep in mind.

A huge benefit of crypto is that the entry barrier is not high. All one needs is an account on an exchange, a secure cryptocurrency wallet, some initial investment, and a desire and determination to learn.

Cryptocurrency Trading Steps

Now, let’s talk about the steps you need to take to start trading cryptocurrency.

Step 1: Create a Cryptocurrency Brokerage Account

The first thing you need to do to start trading cryptocurrency is to create a brokerage account on a crypto exchange.

Creating a brokerage account for cryptocurrency trading is as easy as ABC – all you need to do is register on an exchange. On some of them, like Changelly PRO, you don’t even need to pass KYC to get access to the basic trading features. However, if you want to try out more advanced features and get access to higher trading and withdrawal limits, you will need to share some personal information. Don’t fret, however – getting verified on Changelly PRO is extremely easy! Here’s how you can do it.

Although creating an account itself is easy, a more important step is finding an exchange that will be secure yet will suit your needs. Before trading on an exchange, make sure to read reviews from multiple sources, like various forums or review aggregators such as Trustpilot.

Here are some excellent cryptocurrency exchanges:

Binance

A great full-featured trading platform for crypto trading experts. This is probably the most famous cryptocurrency exchange.

Coinbase

This US-based first publicly traded cryptocurrency exchange has everything an expert crypto trader may need.

Changelly PRO

Perfect for beginners and expert cryptocurrency traders alike, Changelly PRO effortlessly combines advanced features with an easy-to-use user-friendly interface and an abundance of how-to guides.

Of course, there are many more cryptocurrency exchanges out there, and we encourage you to try trading smaller amounts on several exchanges to test them out before you commit to one. Some expert cryptocurrency traders actually prefer to trade on multiple exchanges at once, so even if you feel like you found a platform that seems perfect for you, don’t hesitate to check out other ones.

Whatever platform you choose, we recommend you always protect your account with 2FA and any other security measures offered by the exchange. Additionally, a secure crypto wallet that you can store your funds in is also essential for successful crypto trading.

Finally, make sure the cryptocurrency exchange you chose supports your preferred payment method – both for withdrawals and deposits. Additionally, make sure the platform has fair and transparent exchange fees.

Step 2: Fund Your Account

Next, you will need to deposit some starting funds into your account. As we always say, you shouldn’t invest more than you can afford to lose – this rule applies to trading, too. Carefully decide what sum you are ready to invest – if you’re a beginner, it’s better to start small. Learn how you can fund your account on Changelly PRO here.

Step 3: Learn How the Crypto Market Works

Learning how to trade, no matter whether cryptocurrencies or traditional assets like stocks, is all about getting the feel for the market.

We post all sorts of crypto-related guides on our blog – come check them out! If you’re a complete beginner, read our introduction to cryptocurrency. If you prefer auditory and visual learning to reading, then you can take advantage of the many educational crypto courses available for free on YouTube. We particularly recommend this amazing video made by 3Blue1Brown.

You may think that an in-depth knowledge of how crypto works may be unnecessary to being a successful cryptocurrency trader, but that’s not the case. The more you learn about crypto, the better you will be able to recognise which coins and tokens are destined for success, the easier it will become to identify buy/sell points that occur due to technical changes like hard forks, and so on. We highly recommend learning more about crypto in general, not just trading.

Once you amass enough general knowledge about cryptocurrency, it’s time to learn more about the market. Join crypto communities on Reddit, Discord, Twitter, or any other platform, subscribe to mailing lists, frequently check crypto prices, and so on. The goal is to not only keep with the crypto market but learn how it operates and reacts to the news even if you’re not trading the particular coin/token that is mooning or crashing at the moment.

Step 4: Pick a Cryptocurrency to Invest in

As we have already mentioned, there’s no one “best cryptocurrency” for trading. In fact, most cryptocurrency traders don’t trade just one crypto – after all, successful investment is all about diversifying your portfolio. This applies to crypto, too.

If you want to trade crypto both successfully and sustainably, as in getting profit in the long run, then it is essential to learn how to trade both small cryptocurrencies and big ones.

When you’re just starting out, go for something that isn’t as volatile, like Bitcoin or Ethereum. You can trade them together in a pair or against a stablecoin like USDT – the former is a bit more complex.

Be ready to lose money in those few days/weeks/months of trading – this is why we recommend starting with a small initial investment.

Either way, what matters the most at the start of your journey is gathering as much experience as possible, so don’t hesitate to try trading trending cryptocurrencies, ones that don’t seem to have much price movement, and so on. Be ready to lose money in those few days/weeks/months of trading – this is why we recommend starting with a small initial investment.

Step 5: Choose a Strategy

Once you’ve tested out the various features the exchange(s) you went for has to offer and decided what cryptocurrencies you will be trading in the near future, it’s time to get serious and think of an actual trading strategy.

First, establish your goals. Do you want immediate profit? Do you want long-term stable income? Or maybe you want to just learn how the market works? No matter what it is, you will need to pick a strategy that will suit your needs.

You will need to learn what things to look out for when choosing what cryptocurrency to trade, when to buy/sell, how far a price can rise, and more.

Some of the things that influence crypto prices are the cryptocurrency’s current supply, whether there are any technical updates planned for that coin/token, like hard forks, and more. Although the crypto market is not as heavily influenced by the actions of governments as fiat currencies or stocks, regulation or adoption news can cause the prices to fluctuate, so look out for those, too. You should also learn how to read the charts – the more you study them, the easier it will be for you to identify the current market sentiment (the general attitude of traders towards the market).

There is a wide variety of different trading indicators experts use as buy/sell signals. Learn more about some lesser-known metrics every crypto trader should be familiar with in this article.

Keep these things in mind when working on your crypto trading strategies and don’t forget to keep learning.

Trading Tips

The best way to become a successful crypto trader is to practice… a lot. While we encourage you to click around the exchange interface and try out all the features for yourself, here are some trading tips that can help you to get started.

You can also find other basic crypto trading tips on our blog.

Set Profit Targets and Make Use of Stop Losses

Stop-loss orders are essential to successful crypto and traditional trading. They allow you to place delayed orders that will sell/buy a cryptocurrency once it reaches a predetermined stop price.

Such orders are extremely useful on the crypto market as prices move very quickly – they can prevent you from losing money rapidly and can help to increase your profit.

Overcome FOMO

FOMO is the main villain in many traders’ journeys to success. The fear of missing out often pushes people to make rash, unthought-through decisions that often lead to some sort of loss. In trading, acting on FOMO often leads to losing one’s money.

Although the fear of missing out is a well-known enemy to rational decision-making and strategic thinking, it is especially dangerous when it comes to crypto trading. With the crypto market being so fickle and volatile, coins and tokens can moon one day and resoundingly crash the next. Often the crypto trends one sees are incredibly short-lived, sometimes not even lasting a couple of days.

Here’s an example: imagine there’s some unknown token, let’s call it ATONWT (which stands for “All The Other Names Were Taken”… seriously, it seems like there’s already a cryptocurrency for every single abbreviation out there).

ATONWT was listed on your favorite exchange quite a while ago, but you’ve always thought it to be a regular shitcoin, not worth your time. Then, you wake up one day to unbelievable news: ATONWT is aiming for the moon! The token has shot up 1234% in only two hours. Naturally, seeing these numbers, you and many others decide to jump on the bandwagon: the price of ATONWT rises a few percent, and then, as the people who initially pushed it to start selling it off, drops back to $0.0000001. You cry yourself to sleep that night.

This story is obviously exaggerated (and a bit brutal, sorry), but similar things have happened to people in the past. FOMO often drives people to buy crypto when it’s near its highest point: don’t fall for that trap. Learn how you can defeat FOMO once and for all in this article.

Utilise News

As we have already mentioned, it is very important to keep up with the latest crypto news.

Besides alerting you to possible trade entry points, they also often reflect the general mood of the market and the industry. Not to mention, many news aggregators often post price and market analysis: we don’t recommend blindly following it, but you should still keep an eye on what the experts are saying.

Technical Analysis

Technical analysis is a powerful tool many traders use to decide on their trades and establish their trading strategy. It uses past data to make conclusions about the possible future price movements for any given asset.

Doing your own technical analysis isn’t as daunting as it may seem at first glance – but if maths and stats aren’t your forte, you can always read such analysis made by other crypto experts.

Trade on Margin

Margin trading is an advanced trading feature that can help you to multiply your profit – or your losses.

There’s a good reason why margin trading on Changelly PRO and many other cryptocurrency trading platforms is locked behind KYC: you shouldn’t engage in it if you’re a complete beginner or are a casual trader. Basically, it allows you to “borrow” money from an exchange/broker, trading on leverage. It can multiply your profits tenfold with your initial investment remaining the same, but it is just as likely to multiply your losses.

You can try it out with a small sum to gain some experience, but we would recommend against engaging in crypto margin trading if you’re a beginner.

Learn more: How to start crypto margin trading?

Manage Your Risks

We’ve said this a few times already, but it’s worth repeating: the risks associated with trading cryptocurrency are quite high.

There are several ways to manage those risks. Firstly, you can diversify your portfolio – don’t make crypto trading your only source of income. Day trading should never be someone’s only form of investment. If you’re looking for more ways to invest or earn crypto, check out this article. Moreover, consider investing in other assets, possibly ones that are less liquid to balance out crypto.

Secondly, you should never fund your account with more cryptocurrency than you can lose.

Thirdly, don’t go for exceptionally risky trades. The high profit they can provide can be alluring, but often in the long run it’s better to make smaller, yet still profitable trades instead of big risky ones.

Of course, there are more ways in which you can manage risk when trading cryptocurrency, but those are the main three. As long as you keep your head cool and don’t rely too heavily on one asset, you should be fine.

Underlying Assets Create Volatile Market Conditions

One important thing all beginner crypto traders should remember is that all altcoin prices are tied to Bitcoin. The price movements may not always go in the same direction, but when something happens to Bitcoin price, then altcoins become affected, too.

Bitcoin, in turn, is influenced by fiat, the media, public opinion, and more – it is quite a volatile asset. We’ve all seen it lose almost half of its value over a few tweets. This is why the crypto market is so treacherous – a feature that scares some people off and attracts others.

Some experts advise halting all crypto trades while Bitcoin is volatile to avoid unnecessary risk. If you are a beginner, you should definitely heed to this advice – and if you’re an expert, then you likely know what to do in such situations without advice from other experts.

Don’t Buy Simply Because the Price Is Low

This is another trap many budding crypto traders fall for: buying up assets just because they used to cost a lot yet fell in the last few days/weeks. The crypto market is only cyclical when it comes to large, established cryptocurrencies like Bitcoin or Ethereum, but when smaller coins and tokens crash, they often don’t rise back up from the bottom.

Moreover, sometimes a higher/lower price doesn’t indicate the coin’s true level of success and prosperity. 1 Dogecoin may not be worth thousands of dollars, but it is still a coin that has good long-term prospects and that many people invest in.

Rather than price, pay attention to a cryptocurrency’s market capitalization, trade volume (higher volume indicates higher liquidity and genuine interest in the cryptocurrency), roadmap, team, community, and so on.

Conclusion

We’ve mentioned a lot of tips on how to trade cryptocurrency in this article but didn’t officially outline the most important one: practice.

Whether you’ve learned a new analysis technique, a new trading strategy, or discovered a new feature – try it out on an actual exchange. That’s really the best way to learn and the fastest way to become a successful crypto trader.

There are a lot of things we haven’t even touched on in this article – for example, the different ways to trade, such as day trading, binary options trading, margin trading, the futures market, CFD trading, short selling, derivatives trading… the list can go on and on. If you’re just starting out, don’t focus on these things too much – work your way up from the simplest features to the more advanced ones.

And if you feel like crypto trading isn’t your cup of tea, you can always buy, sell, and exchange crypto on our instant exchange platform Changelly.

Happy trading and good luck!

Frequently Asked Questions

How do you trade cryptocurrency as a beginner?

If you’re a complete beginner to cryptocurrency trading, we recommend starting small. Don’t deposit big amounts to your trading account.

That said, the first thing you’ll need to do is find a suitable cryptocurrency trading platform and get a secure crypto wallet. We recommend Changelly PRO – we’ve designed it to be the perfect crypto trading launchpad.

If you’re a complete beginner, don’t focus on profit yet. It is highly unlikely that you will be able to consistently make successful trades when you’re just starting out, so focus on gaining as much experience as possible while cutting your losses short.

How do you trade crypto for profit?

Just like with traditional trading, there’s a lot of money to be made by trading cryptocurrency. No matter how you trade crypto, there’s a way to make it profitable.

The first step to becoming a successful cryptocurrency trader is carefully setting your goals. Do you want to become a millionaire overnight? Do you want to have a secondary/primary source of stable, consistent income? If you answered “yes” to the first question, then let us be honest – you might as well go and buy a lottery ticket. Although quite a few people have become incredibly rich after they started trading cryptocurrency, just as many, if not more, lost everything they initially invested.

Keep a cool head on your shoulders, don’t get affected by FOMO and other such extreme emotions, diversify your portfolio, learn and practice – and you will become a successful crypto trader in no time.

Is trading cryptocurrency illegal?

Cryptocurrency trading is, in general, fully legal. Of course, a lot depends on the regulations in your country of residence – check them before you trade, purchase, or even just hold cryptocurrency.

Additionally, there may be some exchanges that operate under dodgy rules – be on the lookout for them. A huge red flag is an exchange not requesting their users to go through any sort of KYC/AML procedures even when withdrawing large sums of money. We talked a lot about the importance of those procedures in this article.

Can you get rich trading crypto?

Just like with traditional trading, it is possible to become rich when trading cryptocurrency. However, do not expect this to happen overnight – or happen at all, especially if you are just starting out. Trading is complicated, and mastering takes a lot of time and effort and requires you to invest your own time quite heavily in it.

There are plenty of examples of people who have gotten rich from trading cryptocurrency – one only needs to check Reddit and various crypto forums to find them.

When is the best time to trade cryptocurrency?

Unlike traditional exchanges, the crypto market is open 24/7 on a growing number of exchanges. The best times to trade cryptocurrency are those when global activity is at its highest – usually, that is the early morning. The timezone definition of that morning will depend on what area of the world most users on your exchange reside in.

The post How to Start Trading Cryptocurrency appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

These Cryptos Have MASSIVE Potential?! ETH Layer 3 Explained!

* This article was originally published here

-

Gate.io, a bitcoin and crypto exchange company, today announced a cooperation with the decentralized financial data provider, Pyth Network, ...

-

The US Securities and Exchange Commission is suing Elon Musk to compel him to testify as part of the investigation into his takeover of Tw...

-

With ByBit beginning to cease operations in the U.K., British users are looking for alternative crypto trading platforms, especially those...