Friday, June 30, 2023

Thursday, June 29, 2023

Wednesday, June 28, 2023

Tuesday, June 27, 2023

Monday, June 26, 2023

Sunday, June 25, 2023

Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet

The team of Pods recently announced the mainnet launch of its 3rd strategy on Pods Yield: FUD Vault, which now complements ETHphoria and stETHvv.

FUD Vault provides a way for users to benefit from market downturns by offering a mechanism to hedge against significant price drops in ETH while preserving the deposited principal.

Who is this product for?

The FUD Vault is designed for individuals who have uncertainties about the future performance of ETH and want to find a way to potentially profit even when the market is experiencing a downward trend.

By depositing funds into the FUD Vault, users can take advantage of a specific strategy that aims to mitigate the risks associated with a falling market.

Therefore, if you feel uncertain or skeptical about the future performance of ETH and desire a strategy that allows for potential profit-making during market declines, the FUD Vault could be a suitable option.

Product Values

The FUD Vault offers several key values to its users:

- Simplified Strategy: By consolidating a single strategy into one token, the FUD Vault enhances both DeFi composability and user convenience. Users can easily manage their deposits by transferring them between addresses, utilizing them as collateral on other protocols, and effortlessly verifying their holdings within a specific strategy. The aim is to streamline the user experience and provide a seamless interface for interacting with the vault.

- Access to Intricate Strategies: With just a single click, users gain access to intricate strategies within the FUD Vault. These strategies are designed to optimize returns and navigate the complexities of the market. By offering these strategies in a user-friendly manner, the vault allows users to benefit from sophisticated investment approaches without needing in-depth knowledge or expertise.

- Flexible Withdrawal: Users can withdraw their funds from the FUD Vault at any point after the deposit has been processed. This feature ensures that users maintain control over their assets and can access their funds whenever they need them.

- Transparent Historical Returns: The FUD Vault provides users with a clear display of actual historical returns. This transparency allows users to assess the performance of the vault and make informed decisions about their investments. By presenting accurate and up-to-date information, the vault aims to build trust and confidence among its users.

How FUD Vault Operates

When you deposit USDC the vault immediately invests in Aave. Then, it utilizes the entire lending yield generated by Aave for purchasing ETH put options. These put options have a delta ranging from 0,03-0,12 and a maturity period of one week.

In simple terms, the put options act as a form of insurance against a significant drop in the price of ETH. If the price of ETH decreases by more than 10% within the one-week timeframe, the put options are exercised and the resulting profits are distributed to the depositors of the FUD Vault.

Summary

The FUD Vault offers a user-friendly experience, providing convenient deposit management, access to intricate strategies, flexible withdrawal options, and transparent historical return information.

These values ensure that users can easily navigate the vault, make informed decisions, and enjoy the benefits of the platform’s offerings.

About Pods:

Pods make structured products for crypto assets that are easy to use and seamless. Co-founded by Rafaella Baraldo, Robson Silva, and Guilherme Guimarães, the team has developed some of the most innovative and secure tools in DeFi. The success of the products, security audits, and brand efforts, have set a new standard for building DeFi methods in this rapidly expanding sector. Security audits conducted by OpenZeppelin further demonstrate the commitment to safety and reliability. Pods continue to focus on infrastructure and serving professional clients and investors looking to diversify their portfolios.

Contracts

The vault has undergone four audits by leading audit firms, including OpenZeppelin and ABDK. Audit reports are available at https://github.com/pods-finance/yield-contracts/tree/main/audits

The open-source contracts can be reviewed at https://github.com/pods-finance/yield-contracts

Join the Pods community on Twitter

The post Crypto traders can mitigate risk with PODS’ FUD Vault – now live on mainnet appeared first on CryptoNinjas.

* This article was originally published here

Saturday, June 24, 2023

Friday, June 23, 2023

Thursday, June 22, 2023

Tuesday, June 20, 2023

Monday, June 19, 2023

Sunday, June 18, 2023

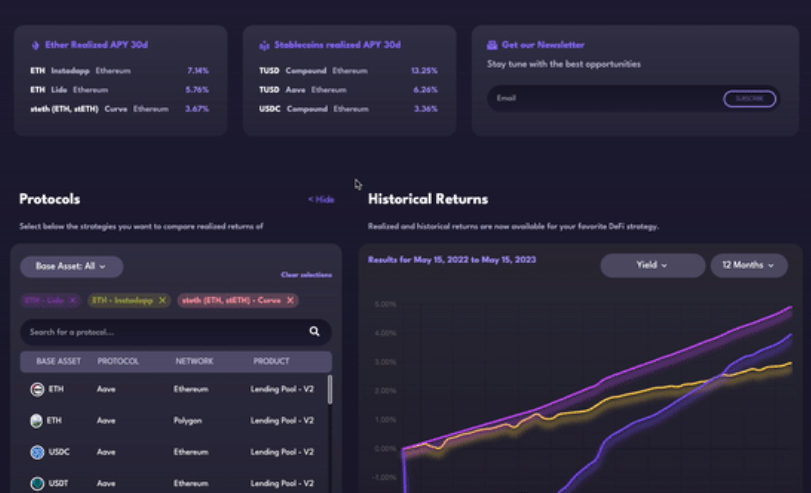

What is DeFi Returns? A new way of DeFi Investing

DeFi Returns brings comprehensive up-to-date information on DeFi strategies and protocols, to easily compare and analyze their performance. Getting the most reliable data source for historical yield on DeFi, to help users make informed decisions when investing in the ecosystem. All data displayed is sourced from the protocol’s smart contracts directly.

- The new DeFi Returns v2 is faster and smoother. It’s designed to make the process of checking and comparing DeFi returns as efficient and enjoyable as possible, emphasizing efforts in the user experience. New features also include:

- Advanced Analytics for Strategies with Rewards: to view the accumulated yield with or without rewards, providing deeper insights into your DeFi investments and making it easier for users to make informed decisions.

- For multi-token strategies, such as providing liquidity to pools, users can now compare how the strategy performed compared to just buying and holding the asset.

- Ranking of Top Performers in the Past 30 Days: Find the top 3 strategies for ETH and USDC quickly.

- Newsletter: Sign up! access opportunities with free analyses on the market, actionable and insightful information about Defi strategies such as Curve, Uniswap GMX, and more.

The company’s blog states: “The launch of the new and improved DeFiReturns.com is a testament to our commitment to providing the most reliable data to assist you when investing and exploring DeFi strategies. We are excited about this new chapter and look forward to supporting you in your DeFi investment journey. As we embark on this exciting new chapter, we invite you to access the relaunched DeFiReturns app, explore its new features, and join us in understanding what real returns are in DeFi”

DeFi Returns is free to access, and there is a paid API with smaller granularity. Try it out! DeFiReturns

About Pods:

Pods makes structured products for crypto assets that are easy to use and seamless. Co-founded by Rafaella Baraldo, Robson Silva, and Guilherme Guimarães, the team has developed some of the most innovative and secure tools in DeFi.

The success of the products, security audits, and brand efforts, have set a new standard for building DeFi methods in this rapidly expanding sector.

Recent security audits conducted by OpenZeppelin further demonstrate the commitment to safety and reliability. Pods continues to focus on infrastructure and serving professional clients and investors looking to diversify their portfolios.

Connect with Pods:

The post What is DeFi Returns? A new way of DeFi Investing appeared first on CryptoNinjas.

* This article was originally published here

Saturday, June 17, 2023

Friday, June 16, 2023

Thursday, June 15, 2023

Wednesday, June 14, 2023

Tuesday, June 13, 2023

RockX broadens suite with launch of new ether (ETH) native staking solution

RockX, an Asia-based institutional-grade staking services provider, announced today the broadening of its staking product suite with the addition of a new ether (ETH) native staking solution. This latest offering strengthens RockX’s position as a comprehensive provider of diverse staking needs, maneuvering quickly to the evolving crypto market landscape.

Navigating the Ethereum ecosystem presents institutions with unique challenges, including liquidity issues, cybersecurity vulnerabilities, counterparty failures, and a complex technological mastery hurdle, which have become more pronounced in the wake of the Shapella upgrade. RockX is committed to overcoming these hurdles by providing robust and secure solutions that simplify the staking process and instill confidence in its users.

The ETH native staking solution stands as a testament to this commitment, differentiating itself through optimal yield for validators via its pool solution on execution layer rewards, competitively low fees without charges on protocol rewards, and a swift, two-step staking process. The strategic introduction of these ETH staking solutions by RockX leverages the vast market potential as institutions increasingly venture into the Ethereum ecosystem.

Aligned with its long-term strategy to simplify institutional blockchain adoption, RockX is planning the full launch of a Staking API that supports blockchains later this year. This will offer institutions a scalable, secure, and efficient pathway for integrating their existing platforms with RockX, thereby facilitating speedier market entry.

Already, RockX has registered an inflow of over 7,000 ETH staking post the Shapella upgrade and anticipates an additional 50,000 ETH in the coming weeks. RockX’s staking solutions have garnered the trust of leading crypto exchanges and wallets/custodians, including Amber Group, Bitgo, and Matrixport.

“Our partnership with RockX reflects our joint dedication to enhancing investor confidence and establishing a secure and efficient crypto ecosystem. We are enthusiastic about the potential of RockX’s institutional staking solution, which we believe will address liquidity needs of institutional clients while driving innovation in the blockchain industry.”

– Annabelle Huang, Managing Partner of Amber Group

Following the recent launch of its Liquid Staking product, Bedrock, and a White Label product designed for companies seeking to establish crypto businesses, the addition of an ETH native staking service showcases RockX’s devotion to helping institutions overcome hurdles to Ethereum adoption.

“Our diversified staking solutions, headlined by the new ETH native staking tool, equip institutions with reliable and user-friendly resources in the blockchain domain. As the staking landscape continues to grow, we are thrilled to be at the forefront of this exciting evolution in institutional staking solutions.”

– Chen Zhuling, CEO of RockX

The post RockX broadens suite with launch of new ether (ETH) native staking solution appeared first on CryptoNinjas.

* This article was originally published here

Monday, June 12, 2023

Sunday, June 11, 2023

Saturday, June 10, 2023

Friday, June 9, 2023

Thursday, June 8, 2023

Wednesday, June 7, 2023

Tuesday, June 6, 2023

Monday, June 5, 2023

Sunday, June 4, 2023

Saturday, June 3, 2023

The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets

Hex Trust, a regulated institutional-grade crypto-asset custodian, today announced it has partnered with The Sandbox, a leading decentralized gaming virtual world to enable fully-licensed and highly-secure custody of assets such as LAND in The Sandbox’s metaverse.

The partnership sees Hex Trust fully integrate LAND into its custody platform, Hex Safe, which supports cryptocurrencies, security tokens, and NFTs. The Sandbox has added Hex Trust as a certified partner to its directory list for custody services.

“We are always on the lookout to provide new ways to secure our community’s digital assets and bring peace of mind to The Sandbox’s community. After working with Hex Trust for the past few months, we are very excited to formally establish a partnership to further integrate their services into the metaverse.”

– Sebastien Borget, COO & Co-Founder of The Sandbox

This integration enables institutional investors, brands, and corporations to store LAND assets with Hex Trust, instead of having to store these valuable virtual land assets in online hot wallets exposed to security and hacking risks.

Besides providing custody services for LAND, Hex Trust provides services to buy and sell LAND, as well as financing solutions, including leasing LAND assets and virtual mortgages. Hex Trust entered The Sandbox’s metaverse in 2022 and purchased an Estate in the ‘Web3 Zone’.

“Hex Trust and The Sandbox have been working closely together over the last few months following the launch of our NFT custody services back in early 2020. It’s great to solidify our relationship with a certified partnership, continuing to provide the best-in-class custody services for assets in the metaverse to meet increasing institutional demand. As web3 continues to grow, more brands and investors will need highly-secure solutions provided by custodians to store their assets with peace of mind in a fully-compliant manner.”

– Alessio Quaglini, CEO & Co-Founder of Hex Trust

SAND is The Sandbox utility token, SAND is used to buy LAND, ASSETS, or to invest in staking pools.

The post The Sandbox teams with Hex Trust for licensed, secure custody of its virtual assets appeared first on CryptoNinjas.

* This article was originally published here

Friday, June 2, 2023

These Cryptos Have MASSIVE Potential?! ETH Layer 3 Explained!

* This article was originally published here

-

Gate.io, a bitcoin and crypto exchange company, today announced a cooperation with the decentralized financial data provider, Pyth Network, ...

-

The US Securities and Exchange Commission is suing Elon Musk to compel him to testify as part of the investigation into his takeover of Tw...

-

With ByBit beginning to cease operations in the U.K., British users are looking for alternative crypto trading platforms, especially those...