Cryptocurrency tips and strategies for investors, traders, and beginners. Learn how to buy, sell, and trade Bitcoin, Ethereum, altcoins, and NFTs securely. Get insights on crypto wallets, DeFi, blockchain technology, market trends, and price predictions. Whether you're a long-term holder or day trader, this blog helps you make smarter crypto moves. Discover new coins, profitable platforms, and proven tools to grow your digital portfolio. Crypto isn’t the future—it’s now.

Cryptocurrency Tips

👉 Discover the strategy that helped early adopters multiply their earnings.

Friday, May 31, 2024

Thursday, May 30, 2024

Wednesday, May 29, 2024

Tuesday, May 28, 2024

Monday, May 27, 2024

Sunday, May 26, 2024

Saturday, May 25, 2024

Friday, May 24, 2024

Thursday, May 23, 2024

Wednesday, May 22, 2024

Tuesday, May 21, 2024

Monday, May 20, 2024

Sunday, May 19, 2024

Saturday, May 18, 2024

Bitgert Coin Price Surge: Upward Momentum Predicted by Analysts

Tons of investors have transformed their financial narrative by staying alert and paying attention to market trends.

Usually, savvy investors take time to analyze the market before going all out to accumulate a token, but on other occasions, they position their ears to catch the wind of market predictions from analysts.

Recently, investors have been responding positively to the prediction of a renowned analyst in the market. This analyst dropped a huge one last week after forecasting that Bitgert, an innovative project, would witness massive upward movements in May.

Although he backed up his market insight with credible information, his bold assertions have triggered arguments from those in support and against it.

Let’s take a quick look at the topic of discussion.

Analysts Give a Bold Forecast

Last week, a renowned market analyst shared his findings with crypto enthusiasts and market participants. Over the years, the credible insights and reputation of this analyst earned him the title of a respected figure within the crypto community.

However, after predicting that Bitgert would witness massive upward movements this month, a few folks in the crypto community have raised their eyebrows. He forecasted Bitgert to rally up to 15x before June's arrival.

Bitgert Will Pull-Off a 15x Rally: Analysts Shares His Insights

As a reputable figure in the market, this analyst’s job wasn’t complete without sharing the reason why he thought Bitgert could pull off this impressive rally.

Foremost, the analyst established the fact that Bitgert is an innovative powerhouse that doesn’t relent in building solutions that host the best digital experience for users.

He resonates with Bitgert’s commitment to improving the overall digital economy. While discussing this, he cites an example referencing how Bitgert offers traders top-level security while providing them with cost-efficient and seamless transactional advantages on its blockchain.

Speaking of market advantages, he highlighted Bitgert’s appeal, emphasizing its range of unique products that offer various solutions for market participants. He further stressed that Bitgert’s distinctiveness will attract new entrants to its ecosystem, thereby boosting its market value.

Conclusion

While he concluded his thoughts on Bitgert, he recognized the innovative project's effort to collaborate with other big market players.

For the mention, he recognized Bitgert’s recent strategic partnership with Ramestta, a platform that allows users to scale their DApps, and CoinINN, a project that aids creators in auto-listing their tokens without incurring charges.

Bitgert’s profit potential of 15x, combined with the bullish conditions of the market in May, will catapult Bitgert’s market value to new peaks.

To know more about Bitgert, visit https://bitgert.com

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

* This article was originally published here

Friday, May 17, 2024

How Blockchain Is Revolutionizing Sports: Exclusive Insights from Chiliz CEO Alex Dreyfus

Welcome to the latest edition of the GoCrypto interview series with Mike Ermolaev, made possible by GoMining. Here we’re delving deep into an exclusive conversation with Alex Dreyfus, who turned his vision into reality with Chiliz and Socios.com, sparking a new era where fans hold more than just passion for their teams—they hold influence too. With his deep-rooted expertise from over 27 years as a digital entrepreneur, Alex has consistently stayed ahead of tech trends. Keeping his eyes on pushing boundaries, he explains how blockchain-fueled fan tokens are disrupting traditional sports engagement. Fans now have a say like never before—what will this mean moving forward?

The Genesis of Fan Tokens in Football

Discussing the initial reactions of football clubs to fan tokens and the efforts to enhance their adoption, Alex Dreyfus recounted the early challenges and the groundbreaking support from clubs like Juventus FC and Paris Saint-Germain.

He explains, “Pitching clubs at the beginning wasn’t easy, because when we launched the Socios.com app and the first Fan Tokens, in 2019, very few people in the sports industry knew what blockchain technology was and very few understood what we were trying to achieve. Plus, unlike other sports, football doesn’t have a strong tradition of embracing innovation and technology. That’s why we value so much the boldness of our first partners, Juventus FC and Paris Saint-Germain, who, no surprise, happen to be two of the most innovative brands in sports. The success of these first clubs soon attracted others. Before 2022 we already had more than 100 partners, including global powerhouses such as FC Barcelona, Manchester City, Inter Milan, Galatasaray, Flamengo, Fluminense, etc.”

He further highlighted the diversity in the adoption rates among these clubs, saying, "Not all clubs have embraced their Fan Token in the same way or at the same pace. Some clubs have hired experts in the space and created specific strategies to develop and leverage the tool to its full potential, while others are taking more time. This is completely normal, that’s why we strive to keep close to them, and support and advise them whatever their strategy is or the goals they want to achieve."

Turning to the current focus of Chiliz and Socios.com, Alex Dreyfus emphasized their commitment to deepening existing partnerships rather than just expanding their number. “Although we are always open to increasing our roster of partners, at this moment we’re currently focused on strengthening the partnerships we already have in place. We do this by adding more utility to the Fan Token through increasing the catalog of benefits and rewards that Fan Token holders can access. But also by expanding the utility through partnerships and integrations with third party platforms, some of which are actually being built on the Chiliz chain, home to the growing SportFi ecosystem. Our vision is for the utility of Fan Tokens to expand far beyond the Socios.com app and unlock access to a wide range of third party platforms and ecosystems,” he explains.

"The More You Act, The More You Get Rewarded": The Dynamic Uses of Fan Tokens

When asked about the specific use cases for fan tokens, such as voting on team decisions or accessing VIP perks, Alex Dreyfus detailed how they extend beyond these fundamental applications. He remarked, "Voting on team decisions through Fan Polls and accessing VIP experiences are two pillars of the Fan Token proposition, and indeed two of the most popular perks, but there is much more."

Explaining further, he shared, "On the decision side, Fan Tokens have given football fans the chance to make unprecedented calls such as choosing the design of their teams’ home and away kits, the squad number for a new signing, and the name of a new club facility or stadium stand, amongst others. These Fan Polls are very popular because in most cases it’s the first time that fans are being able to take part in these kinds of decisions."

On the experience side, Alex Dreyfus praised the team's accomplishments: "We’re proud to be able to say that we’ve also broken new ground and delivered unprecedented opportunities such as acting as the club’s official speaker for a day and announcing the lineup during a home match (we’ve done this with Argentina, CA Independiente, Millonarios FC, AC Milan, and Real Sociedad, amongst other clubs) or giving fans the chance to take part in the team’s official photo-shoot, which we did this season with AS Monaco and Atlético de Madrid."

He continued to describe how Fan Token holders can access various rewards: "Fan Token holders access these and other rewards such as VIP tickets, meet and greet sessions, and 'play on the pitch' experiences by redeeming the in-app loyalty points that they earn for free each time they engage with the multiple features of the Socios.com app, which include the Fan Polls but also match predictors, trivia quizzes, choosing match MVP, etc."

Highlighting the underlying philosophy of the fan tokens, Dreyfus stated, "A key element of the Fan Token proposition is that it recognizes fans for being active in the community - the more you act, the more you get rewarded."

Expanding the Horizon: New Developments in Fan Tokens and Partnerships

When questioned about forthcoming developments or partnerships relating to fan tokens, Alex Dreyfus elaborated on the continuous improvements and expansions in their offerings. He highlighted, "We are constantly developing our platform to improve the experience of our Fan Token holders and increase the benefits they can access. In recent months we’ve introduced the Fan Favorite, through which fans can choose their favorite player of each match; the Locker Room, where they can earn points and rewards by locking in their Fan Tokens; and we’ve also improved our very popular Token Hunt feature, which gives users the chance to hunt for Fan Tokens. All these features give access to loyalty points which can be redeemed for rewards."

Discussing further integration of fan tokens into digital ecosystems, Dreyfus shared his excitement about making fan tokens more accessible directly through club websites and apps. "We are also working closely with our partners to integrate their Fan Token in their digital ecosystem and channels, meaning fans can access all the benefits of holding Fan Tokens directly from their club’s website or app. This is something we’re very excited about since it will allow us to make the tool available to hundreds of thousands of fans. In the coming months we will be launching these integrations with a number of partners."

He also revealed details about a significant partnership with Paris Saint-Germain. "With some clubs we are exploring deeper collaborations such as the one we recently announced with Paris Saint-Germain, who has become a validator node on the Chiliz Chain. PSG, the first football club to hire a Head of Web3 (Pär Helgosson), is bringing a very innovative approach to the partnership, pledging to use 100% of its accrued revenue as a node validator to conduct regular PSG Fan Token buybacks to consistently bolster the club’s digital economy for the benefit of their Fan Token holders."

Dreyfus concluded by mentioning the broader impacts of the Chiliz Chain beyond football. "On the other hand, through the Chiliz Chain we are working with multiple startups and developers who are building exciting products, from immersive club-themed digital worlds to football manager games, fitness challenge apps, NFT marketplaces and other exciting products bound to shape the future of sports, that Fan Tokens will be integrated to."

From Football to Formula 1: Chiliz's Bold Move to Dominate Global Sports with Fan Tokens

Alex Dreyfus was asked about Chiliz's plans to broaden the adoption of Fan Tokens beyond the realm of football. In his response, he emphasized the company's extensive reach across various sports disciplines. He stated, "Football is our biggest vertical in terms of partners, because it’s the world’s most popular sport, but we also work with the UFC and the PFL (mixed martial arts), the Davis Cup (tennis), several rugby clubs, Formula 1 teams, and a handful of esports organizations."

Dreyfus further elaborated on the long-term vision for Fan Tokens, highlighting their potential universal appeal and value across the entire sports industry. He expressed strong confidence in the future integration of Fan Tokens, saying, "In the long term, we’re confident that Fan Tokens will be embraced across the global sports industry and will bring value to organizations regardless of their sport and size. In this first stage, global brands with millions of fans across the world and highly professionalized teams and structures are best suited to act as early adopters and pave the path for the rest to benefit in the future."

"Our Best Advocates Are Our 2.2 Million Users": Inside Chiliz's Strategy to Engage Diverse Audiences

During a discussion on the marketing strategies for promoting fan tokens, Alex Dreyfus shared insights into the channels Chiliz finds most effective. He highlighted their multifaceted approach tailored to a broad audience, saying, "We use a wide range of channels (owned, earned, and paid) because we are targeting a very diverse audience: sports fans (especially the fans of our 80+ Fan Token partners), but also blockchain and crypto enthusiasts."

Dreyfus went on to detail the importance of leveraging partnerships and digital influencers to educate and engage their audience. "When targeting and especially educating sports fans, which is more important for us at this moment in time than converting them, obviously our partner’s channels (social media, newsletter, etc) play a key role. But in this era, you also need to lean on opinion leaders and digital influencers, especially brands focused on digital-native audiences as we are. Some of these content creators have stronger engagement rates than the clubs themselves."

He also touched upon the complexities of engaging the crypto community and the success of their digital marketing efforts. "The crypto community is slightly more fragmented, but our digital marketing team has done a great job over the course of these years and Chiliz and Socios.com have a combined growing community of over 1m followers."

Concluding his thoughts on the topic, Dreyfus expressed pride in the authentic support from the user base of Chiliz and Socios.com. "However—and this is not disrespect to the great influencers we’ve worked with and will continue to work with both on the sports side and on the crypto side—I’m proud to say that our best advocates, the ones that communicate our proposition more passionately, are by far our more than 2.2 million users."

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

* This article was originally published here

Thursday, May 16, 2024

Wednesday, May 15, 2024

Tuesday, May 14, 2024

Monday, May 13, 2024

Navigating the Approaching Altcoin Season: Expert Picks for Early Investment

The surge of interest in lesser-known cryptocurrencies is picking up as the bull market of 2024 takes shape. This article offers insights from experts into which cryptocurrencies are positioned to potentially rise in value. The provided analysis aims to guide readers in identifying opportunities before they become common knowledge. With the market's current momentum, these selections could be crucial for those looking to invest.

CYBRO Presale: Meet the First-Ever Earn Marketplace on Blast

CYBRO introduces a unified marketplace for consistent crypto earnings, utilizing the Blast blockchain's innovation. Launching in Q2 2024, the platform invites early investors to its presale for favorable entry terms.

From now on, CYBRO offers its native tokens at attractive prices, just $0.02 apiece, an astounding 66% discount. Token holders will gain preferential access to marketplace services and various bonuses for an enhanced earning experience.

CYBRO will enable crypto growth through diverse vault investments within the Blast ecosystem and beyond, offering strategies from conservative to high-yield. It prioritizes maximizing returns with a user-friendly interface and efficient crypto transactions, with future enhancements including AIBroker for chatbot-assisted investments and One-Click Investment for optimizing yields via DeFi and CeFi integration.

CYBRO tokens will enable staking rewards, an exclusive Airdrop, marketplace cashback, reduced trading and lending fees, and the in-house insurance program.

This robust functionality positions CYBRO for potential value growth just after the TGE in Q3 2024, significantly benefiting presale investors.

>>> CYBRO Presale Is NOW Live <<<

Starknet (STRK) Sees Volatile Price Movement

Starknet's coin price has been moving up and down recently, staying between $1.11 and $1.40. Just in the last week, the price went up by about 9%. However, if you look at the past month, the coin's value has dropped by roughly 32%. But the jump over the last six months has been huge, at over 547%. Right now, the price is a bit higher than the average over the past ten days at $1.30 and over the past 100 days at $1.23. Starknet is trading below its first major price hurdle at $1.54 and above its closest support at $0.96. The coin's ups and downs seem more like a mix of jumps and backtracks rather than a clear single direction.

Celestia Token (TIA) Sees Variable Market Movements

The Celestia coin, TIA, is showing mixed signs in the market. Its current price is between $9.23 and $11.56. Over one week, the price of TIA went down by 7.80%, and over one month, it dropped by 18.45%. However, looking at a longer time frame, over the last six months, TIA's price has jumped by 304.63%. The coin is below the 10-day average of $10.10 and just below the 100-day average of $9.67, which suggests a possible shift in momentum. The RSI indicator is at 41.84, and this is not showing clear overbought or oversold conditions. Movements are leaning toward corrective rather than impulsive as the price adjusts after recent changes. The nearest resistance and support levels are at $13.07 and $8.41, respectively, indicating some room for price fluctuation within these bounds.

Conclusion

In the rapidly evolving crypto market, altcoins like STRK and TIA may offer less short-term potential compared to other opportunities. The key focus for investors is on CYBRO, a unique platform that taps into the yield potential of the Blast blockchain. The launch of CYBRO's marketplace is scheduled for the second quarter of 2024, and its token presale provides a chance for early investors to get involved under advantageous terms. This pivotal development represents a significant investment opportunity in the midst of the bull run.

Site: https://cybro.io

Twitter: https://twitter.com/Cybro_io

Discord: https://discord.gg/xFMGDQPhrB

Telegram: https://t.me/cybro_io

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

* This article was originally published here

Sunday, May 12, 2024

Top 4 ICO Projects For 2024 Bull Run: ETFSwap (ETFS) Tops The List With Highly Anticipated Launch

Investing in cryptocurrencies can be a risky business, however, with the right crypto project, anyone can make high returns. Initial Coin Offerings (ICOs) are capital-raising events that involve cryptocurrencies. Typically, it uses crowdfunding, presales, and private fundraising rounds to generate developmental capital.

These ICOs are a great place for investors to start their investment journey, pouring funds into low-value cryptocurrencies which have a great chance of surging massively with the right conditions. Given the amount of failed ICOs in the cryptocurrency industry, it’s always important to invest in the right crypto ICOs with strong use cases and utility.

The value of a cryptocurrency can rise dramatically and at the same time, it can fall drastically. For investors who aim to secure income by investing in leading ICOs, here are the top four promising ICOs for the upcoming 2024 bull run.

We have ranked ETFSwap (ETFS) at the top of the list, as this crypto project has proven to be a leading platform in the cryptocurrency space, offering investment products that are both safe and potentially profitable. Since ETFSwap (ETFS) is set to launch soon, with only nine days left in its presale, investors still have a chance to quickly get access to this groundbreaking project by investing in its native token, ETFS.

ETFSwap (ETFS): Bridging The Gap Between Cryptocurrency And The ETF Market

ETFSwap (ETFS) is a new decentralized trading platform which brings together tokenization and ETFs in one platform. This innovative crypto project is designed to provide users with the means and resources to buy and trade institutional ETFs through the groundbreaking technology of tokenization.

On ETFSwap (ETFS), users will be able to have access to the burgeoning ETF market which most cryptocurrency exchanges do not offer today. Similar to leading investment assets firms like BlackRock and Fidelity, ETFSwap (ETFS) offers the trade and investment of Spot Bitcoin ETFs.

It combines Decentralized Finance (DeFi) with traditional finance to ensure users can enjoy all the benefits of both rapidly expanding sectors. ETFSwap (ETFS) stands out considerably from other ICO projects because of its highly intuitive platform, which has real-world use cases and potential utilities.

Unlike meme coins which are dramatically influenced by market volatility, ETFSwap’s (ETFS) fundamentals are based on the $9.6 trillion ETF industry. Additionally, the platform has sold over 30 million ETFS tokens, with more selling out each day. This massive demand underscores ETFSwap’s growing prominence in the digital asset space, as well as its widespread recognition among leading crypto whales in different global regions.

Slothana (SLOTH): Bringing Engagement To The Crypto Space

The Slothana (SLOTH) is a unique cryptocurrency based on the image of a lazy sloth. The meme coin has gained a considerable following on social media, propelled by strong marketing strategies spotlighting sloth memes that epitomize the lazy lifestyle.

Despite not having any utility or use case as well as being highly volatile, Slothana (SLOTH) has amassed a significant amount of funds through its presale round. The meme coin was able to record a milestone of more than $15 million.

As the number of intrigued fans of the meme coin grows, it could positively impact the sloth-themed meme coin, particularly since it is a community-driven cryptocurrency. This means that, unlike crypto projects like ETFSwap (ETFS) and cryptocurrencies like Bitcoin (BTC), Slothana has no tangible value and can easily be affected by market conditions.

WiernerAI (WAI): Merging Artificial Intelligence With Blockchain Technology

Werner AI is a doggy-themed cryptocurrency backed by both Artificial Intelligence (AI) and blockchain technology. As one of the few cryptocurrency projects combining these core elements, WeirnerAI aims to dominate both the digital asset and technology sectors.

While this cryptocurrency introduces a unique concept, it has not gained much traction or popularity within the space. Regardless, the meme coin has raised over $350,000 in presale investments, with 30% of the token’s massive 69 million supply designated for the presale.

The cryptocurrency’s value is mostly fueled by its memetic culture which attracts investors humored by its dog-themed mascot. Although the meme coin lacks real-world use cases, WeinerAI offers staking rewards to users, offering a 1,800% APY.

Hypeloot (HPLT): Introducing Decentralized Payments To Gaming

Taking a more fun-themed approach, Hypeloot (HPLT) is a cryptocurrency designed specifically for the gaming and esports ecosystems. This token brings decentralized transactions into the gaming industry, providing faster and more inclusive transactions.

Players can use this cryptocurrency for in-game purchases, player rewards and collectable purchases. Additionally, Hypeloot (HPLT) aims to establish itself as the first upcoming crypto casino to offer a fiat payment gateway.

Despite being established in 2022, Hypeloot (HPLT) has been unable to gain widespread recognition and adoption. The cryptocurrency has only amassed about 100,000 active users and processed over 50 million bets.

For crypto enthusiasts who enjoy casino games and all the excitement of gambling, Hypeloot (HPLT) offers both slots and live casino options. The platform has also introduced NFT collections and special reward features for presale contributors.

Invest In Only The Best Crypto ICO Projects For Maximum Returns

We believe that ETFSwap (ETFS) is the best crypto ICO project for investors to dive into before the 2024 bull run fully kicks in. Interested investors can gain access to this platform by purchasing its token during its ongoing presale.

The price of a single token is available for $0.00854 in the first presale stage. Given how low these prices are, large-scale investors are accumulating ETFSwap tokens at a fast pace, hoping to gain maximum profits when the token rises to $0.01831 during the second presale stage and following the launch of its innovative platform.

For more information about the ETFS Presale:

Disclaimer: This is a sponsored press release and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

* This article was originally published here

Saturday, May 11, 2024

How to Make Money with NFTs in 2024

The world of digital art and collectibles has been revolutionized by the introduction of non-fungible tokens (NFTs). There are hundreds of promising NFTs startups on the crypto market these days. If you are an artist, collector, or investor, the NFT landscape provides you with numerous opportunities to generate income. If you’ve been wondering how to make money with NFTs, you’ve come to the right place.

In this blog post, we will take a look at 6 different ways of investing in NFTs. From creating and selling your own digital art to investing in virtual land, these tips are designed to help you navigate the NFT market and potentially generate significant returns.

How to Make Money with NFTs? The Best Ways To Profit from Non-Fungible Tokens

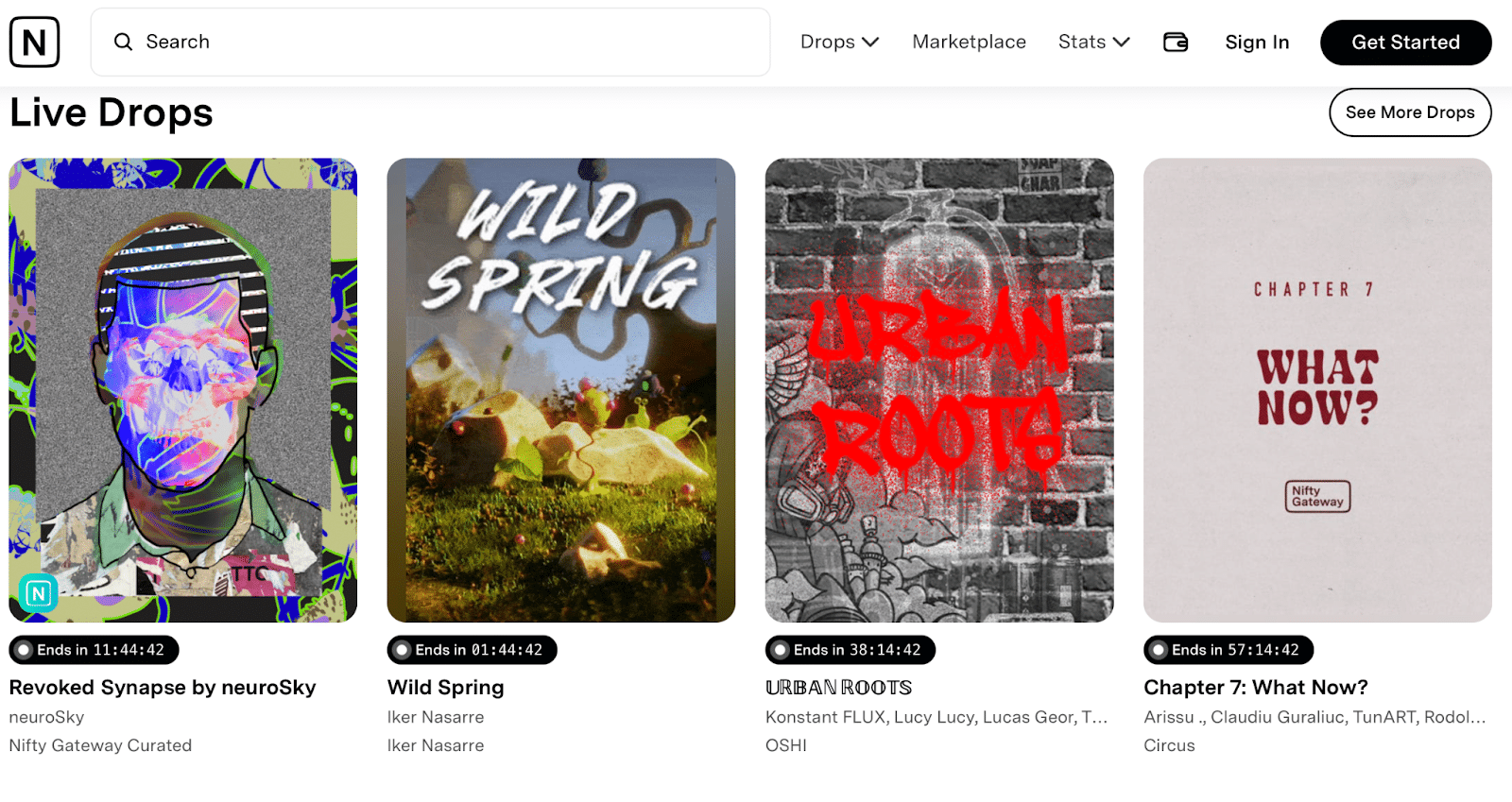

- Trade NFTs on Secondary Markets. Platforms like OpenSea and Nifty Gateway allow buying and selling previously owned NFTs. Users should research market trends and aim to buy low and sell high.

- Earn Passive Income through NFT Staking. Staking NFTs on platforms like Unifty or NFT20 can earn rewards, typically in the form of cryptocurrency.

- Create and Sell Your Own NFT Art. Artists can tokenize their digital art (images, videos, music, 3D models) and sell them on NFT marketplaces like OpenSea and Rarible.

- Invest in NFT Collections. This involves buying NFTs from collections like CryptoPunks or Bored Ape Yacht Club with the intent to sell them at a higher price later.

- Play NFT games. Trade your time for money by grinding in-game NFTs that you can later sell for profit.

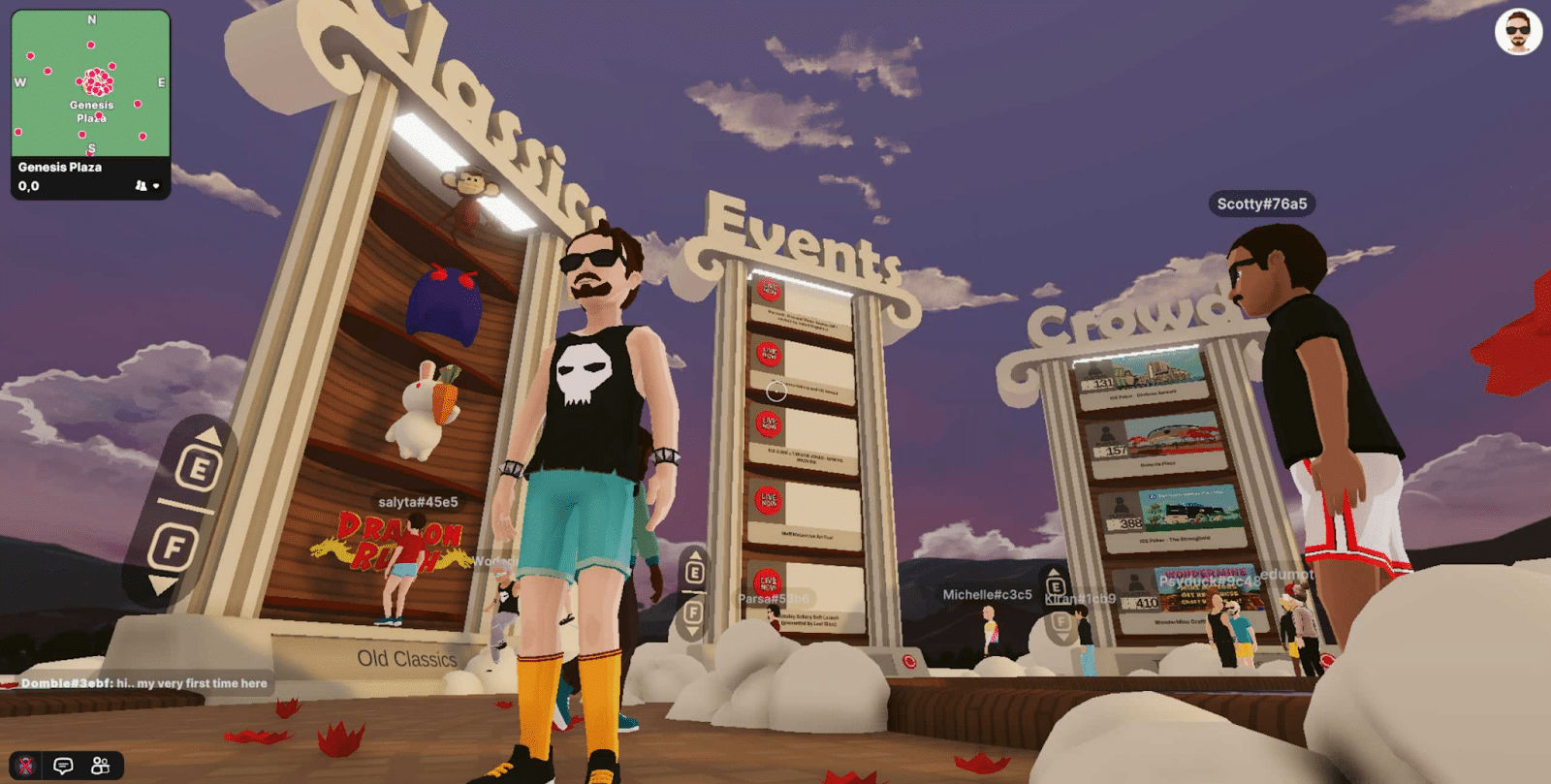

- Investing in Virtual Land and Metaverse Assets. Buying and developing virtual land in metaverse platforms like Decentraland or the Sandbox can be profitable.

What Is an NFT?

An NFT, or non-fungible token, is a unique crypto token that is used to certify ownership and authenticity. Imagine you have a special, one-of-a-kind trading card, but instead of holding it in your hand, it exists online as a virtual asset.

Each NFT is distinct and has its own unique identifier, much like a serial number, making it different from all other NFTs. They’re often used to represent digital artwork, game items, music, videos, and other digital and physical assets — even, in some rare cases, real estate. The “non-fungible” part means that these tokens can’t be exchanged on a one-to-one basis like regular money; each NFT has its own value based on factors like rarity, demand, and the artist’s fame.

The power behind NFTs lies in the blockchain technology. The blockchain keeps track of who owns what, providing proof of ownership for each NFT. Think of it like a certificate of authenticity for a painting, but for digital items. The native token of a blockchain that is capable of supporting non-fungible tokens, like Ether for the Ethereum network, is often used to buy and sell these NFTs.

Now, let’s take a look at how NFTs can make you money and become an additional source of income.

1. Create and Sell Your Own NFT Art

The most direct way to make money with NFTs is by creating and selling them. As an artist or content creator, you can tokenize your work, turning it into a unique, tradeable asset on the blockchain.

Creating NFTs for profit is easy — here’s how you can get started:

- Choose your art medium. NFTs encompass a wide range of digital media, including images, videos, music, 3D models, and even virtual reality experiences. Pick the one you like the most and do it best.

- Create your asset. Spend time refining your digital creation, making it unique and visually appealing — something that collectors or investors would value.

- Select an NFT marketplace. There are numerous NFT marketplaces where you can mint and list your art, such as OpenSea, Rarible, and Foundation. Research each platform’s fees, user base, and supported blockchains before making your decision.

- Mint your NFT. Once you’ve chosen a marketplace, follow their guidelines for minting NFTs, upload your digital artwork, and create a token to represent it on the blockchain.

- List your NFT for sale. Set a price for your NFT and list it on the marketplace, either for a fixed price or as an auction.

- License your NFT. Artists can earn ongoing revenue through licensing agreements or royalties each time their NFT is resold. This can provide a continuous income stream beyond the initial sale.

Tip: To generate interest and increase the value of your NFTs, consider collaborating with other established artists, leveraging social media marketing, or even creating limited edition collections.

2. Invest in NFT Collections

If you don’t want to create NFTs, you can go with another way to make money with NFTs: investing in digital collectibles and art. This involves purchasing non-fungible tokens that are part of a series or set, with the goal of selling them later for a higher price. Some well-known NFT collections include CryptoPunks, Bored Ape Yacht Club, and World of Women.

To get started with investing in NFT collections, follow these steps:

- Research popular and upcoming collections. Keep an eye on NFT marketplaces, social media platforms, and industry news to identify trending and potentially valuable releases.

- Analyze rarity and value factors. Assess the rarity of NFTs within a collection based on factors such as edition size, artist reputation, and unique traits. Higher rarity generally correlates with higher value.

- Set a budget. Determine how much you’re willing to invest in NFT collections and stick to your budget. Remember that investing in NFTs can be risky, and there’s no guarantee of returns.

- Purchase NFTs. Once you’ve identified a collection that aligns with your interests and investment goals, buy the NFTs on a trusted marketplace.

- Monitor the market. Keep track of the value of your NFTs, paying attention to trends and news related to the collection. When the time is right, consider selling your NFTs for profit.

Tip: Diversify your NFT investments across various collections and artists to reduce risk and potentially increase returns.

3. Selling NFTs You Get from Playing NFT Games

Playing NFT games can be more than just a fun pastime; it can also be a lucrative opportunity to earn valuable NFTs and turn a profit. These games often reward players with unique digital items, which can range from in-game assets like special characters or equipment to exclusive artwork.

Here’s how you can make money with NFTs you get from playing games:

- Identify valuable NFTs within the game: As you play, keep an eye out for rare or sought-after items. These could be anything from limited edition characters to unique in-game artifacts. The rarer the item, the more potential it has to be valuable in the marketplace.

- Evaluate and flip undervalued NFTs: Sometimes, you may come across NFTs that are undervalued in the game’s marketplace. Buying these NFTs and selling them at a higher price, a practice known as ‘flipping,’ can be a smart way to earn a profit. Keep in mind that flipping NFTs requires a good understanding of the game’s economy and what other players are willing to pay.

- Transfer your NFTs to a compatible marketplace: Once you’ve acquired NFTs in a game, the next step is to transfer them to an NFT marketplace. Ensure that the marketplace you choose supports the blockchain on which your NFTs are built. Popular platforms for selling NFTs include OpenSea, Rarible, and Foundation.

- List your NFTs for sale: After transferring your NFTs, list them on the marketplace. You can set a fixed price or opt for an auction format, depending on what you think will attract the most buyers. Be sure to highlight the uniqueness and potential value of your NFTs to gain attention.

- Monitor the market for trends: The NFT market can be volatile, with the value of digital assets fluctuating rapidly. Keep an eye on market trends to understand when it’s the best time to sell your NFTs. Timing your sale right can significantly impact how much profit you make.

Tip: Engage with the game community to stay informed about which NFTs are in demand. Building a network and reputation can also help you spot opportunities to buy undervalued NFTs and sell them for a profit.

4. Trade NFTs on Secondary Markets

Trading NFTs on secondary markets can be a lucrative way to make money with NFTs. Secondary markets are platforms where users can buy and sell previously owned NFTs, often at fluctuating prices based on demand and rarity. Examples of secondary market platforms include OpenSea and Nifty Gateway.

To begin trading NFTs on secondary markets, follow these steps:

- Sign up on a secondary market platform. Create an account on a trusted NFT secondary market platform and connect your cryptocurrency wallet.

- Research the market. Study trends, prices, and popular NFTs on your chosen platform to identify potential trading opportunities.

- Buy low, sell high. Look for NFTs that are undervalued or have growth potential and purchase them with the intention of selling at a higher price later on.

- Monitor your portfolio. Keep an eye on your NFT investments and track their performance over time. Stay up to date with market trends and news to make informed decisions about when to sell.

Tip: Develop a trading strategy based on factors such as price patterns, market sentiment, and NFT rarity to increase your chances of success.

5. Earn Passive Income through NFT Staking

Earning passive income through staking NFTs is another way to make money with NFTs. Staking involves locking up your NFTs in a smart contract to earn rewards, typically in the form of the platform’s native cryptocurrency.

Here’s how you can get started with NFT staking:

- Find a suitable staking platform. Research various NFT staking platforms, considering factors such as supported NFTs, staking rewards, and platform reputation. Examples of NFT staking platforms include Unifty, NFT20, and Muse.

- Stake your NFTs. Follow the platform’s guidelines to stake your NFTs, locking them up in a smart contract for a specified period.

- Earn rewards. Collect staking rewards in the form of the platform’s native cryptocurrency or other incentives.

- Unstake and sell. Once your staking period has ended, you can unstake your NFTs and either hold onto them or sell them on the market.

Tip: Be aware of the potential risks associated with staking, such as smart contract vulnerabilities and the possible depreciation of staked NFTs. Always research a platform thoroughly before committing to staking your NFTs.

6. Investing in Virtual Land and Metaverse Assets

The booming metaverse has created new opportunities for making money with NFTs by investing in virtual land and assets. Virtual land is a digital space within a metaverse platform that can be bought, sold, and developed. Examples of metaverse platforms include Decentraland, the Sandbox, and Somnium Space.

To start investing in virtual land and metaverse assets, follow these steps:

- Choose a metaverse platform. Research various metaverse platforms to find one that aligns with your interests and investment goals. Consider factors such as user base, development potential, and marketplace activity.

- Purchase virtual land. Buy virtual land on the platform’s marketplace using the platform’s native cryptocurrency or other supported tokens.

- Develop your land. Increase the value of your virtual land by developing it with virtual buildings, experiences, or other assets. This can attract users and generate revenue through in-world transactions or advertising.

- Rent or sell your land. You can choose to rent out your virtual land to other users for recurring income or sell it for profit when its value has increased.

Tip: Diversify your investments across multiple metaverse platforms and virtual land parcels to reduce risk and potentially increase returns.

Other Ways To Make Money From NFTs

In addition to the options I’ve talked about above, there are some other, lesser known ways to make money with NFTs.

- NFT Rentals. Similar to renting out physical assets, digital assets, especially in gaming and virtual reality environments, can be rented to other users. This is particularly useful for expensive or utility-based NFTs, such as those that provide access to specific parts of a game or virtual event access.

- Fractional Ownership. This involves breaking down an expensive NFT into smaller, more affordable pieces, allowing multiple investors to own a portion of an NFT.

- NFT Fundraising and Crowdfunding. Use NFTs for fundraising by creating tokens that represent a stake in a project or venture. This can attract investors who are looking for unique opportunities in new and upcoming projects.

- Creating NFT-based Experiences. Offer unique digital experiences or services tied to NFT ownership. For example, virtual meet-and-greets, exclusive online events, or access to specialized content can be tied to owning a specific NFT, adding value to the token.

- NFT Collateralization. You can use NFTs as collateral to secure loans or other forms of finance. This can be particularly useful in liquidity management for NFT owners who need funds but do not wish to sell their assets.

Why Invest in NFTs?

Unlike cryptocurrencies such as Bitcoin or Ethereum, NFTs are not interchangeable and hold their value based on their uniqueness and rarity. Combined with their recent popularity and hype, these features make them an attractive asset for crypto and non-crypto investors alike. Let’s take a look at some of the benefits and risks of trying to make money with NFTs.

Benefits of Investing in NFTs

There are several reasons why investing in NFTs can appeal to both seasoned investors and newcomers to the digital asset space:

- Digital Ownership. NFTs provide a way to prove ownership of digital assets, enabling buying, selling, and trading of unique digital content on a global scale.

- Potential for High Returns. Some NFTs have seen incredible returns on investment, with rare and sought-after pieces being sold for significant profits.

- Diversification. NFTs can offer a unique and exciting way to diversify your investment portfolio, particularly if you have already invested in other cryptocurrencies or digital assets.

- Supporting Artists and Creators. By investing in NFTs, you are directly supporting artists and creators, providing them with a new revenue stream and recognition for their work.

- Access to Exclusive Content. Owning an NFT can grant you access to exclusive content, experiences, or even virtual spaces within online communities and metaverse platforms.

Risks of Investing in NFTs

While there are numerous benefits to investing in NFTs, it is crucial to be aware of the potential risks involved:

- Market Volatility. The NFT market can be highly volatile, with prices fluctuating rapidly. This can lead to substantial gains but also significant losses.

- Lack of Liquidity. Some collections see very few NFT sales, particularly if there is a low demand for the specific asset or if the overall market is experiencing a downturn.

- Copyright and Intellectual Property Issues. There can be potential legal issues surrounding the copyright and intellectual property rights of NFTs, particularly if the creator did not have the right to tokenize the asset in the first place.

- Fraud and Scams. As with any emerging market, the NFT space has seen its share of fraud and scams. For example, there are some bad actors that are selling themselves their own NFTs to inflate the prices of their digital assets. It is essential to exercise caution and thoroughly research any NFT investments or platforms before getting involved.

- Environmental Concerns. Some NFT platforms use blockchain networks with high energy consumption, leading to concerns about the environmental impact of NFT transactions.

Conclusion

Making money with NFTs can be a rewarding and exciting venture. By following the tips outlined in this guide, you’ll be well-equipped to create, invest in, and trade NFTs for potential profit. As with any investment, remember to do thorough research, assess risks, and never invest more than you can afford to lose. With the right approach, you can capitalize on the numerous opportunities that the NFT landscape has to offer.

Making Money From NFTs: Frequently Asked Questions

What does NFT stand for?

NFT stands for “Non-Fungible Token.” Non-fungible means that it is unique and can’t be replaced with something else. For example, one Bitcoin is fungible — trade one for another Bitcoin, and you’ll have exactly the same thing. However, a one-of-a-kind trading asset like an NFT is non-fungible. If you traded it for a different asset, you’d have something completely different.

How do NFT marketplaces make money?

NFT marketplaces generate revenue through various fees, such as listing fees, transaction fees, and sometimes royalties on secondary sales. These fees are typically charged as a percentage of the sale price or as a flat rate per transaction.

What NFTs pay you to hold them?

Some NFT projects offer incentives to hold their tokens by providing rewards or passive income. These rewards can come in the form of cryptocurrencies, additional NFTs, or platform-specific tokens. One example of an NFT project that rewards holders is EulerBeats, which pays royalties to original NFT owners when copies of their NFTs are sold.

How to get into NFT trading?

To get started with NFT trading, follow these steps:

- Set up a crypto wallet, such as MetaMask or Trust Wallet, to store and manage your cryptocurrency and NFTs.

- Top up your wallet with cryptocurrency, typically Ethereum (ETH), as it is the most widely used currency for NFT transactions.

- Choose an NFT marketplace, such as OpenSea, Rarible, or Foundation, and create an account.

- Connect your crypto wallet to the NFT marketplace.

- Research and identify the NFT collection and exact assets that you would like to buy or trade, and make transactions using your digital wallet.

If you’re just starting out and still researching how to make money with NFTs, it might be better to start with something cheaper. There are many affordable NFTs out there that you can purchase before getting into more expensive trading.

How to make and sell NFTs?

To create and sell your own NFT, you will first need to create your digital content, such as artwork, music, or a 3D model — or even simply make a viral tweet. Then, choose an NFT platform, like OpenSea, Rarible, or Mintable, that allows you to create and sell NFTs.

You will need to connect your digital wallet to the NFT platform and follow their guidelines for creating and minting your NFT. Set a price for your NFT, either as a fixed price or as an auction, and list it for sale on the platform.

Promote your NFT to potential buyers through social media, collaborations, or other marketing channels.

Is NFT real money?

While NFTs are not considered real money, they have the potential to be valuable digital assets. They use blockchain technology to verify uniqueness, ownership, and authenticity. NFTs can be anything from a piece of artwork to a tweet (for example, Twitter CEO Jack Dorsey sold his first post on the platform as an NFT), and they are often sold on online marketplaces using cryptocurrency.

So, NFTs are not real money, but they can still be a worthwhile investment. Unlike fiat money, which can be printed at will by governments, and cryptocurrency, which can be infinitely copied, NFTs are one of a kind by design and cannot be replicated. The rarity of these items can increase their worth for both collectors and investors.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

The post How to Make Money with NFTs in 2024 appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

Friday, May 10, 2024

Thursday, May 9, 2024

Wednesday, May 8, 2024

Tuesday, May 7, 2024

Sunday, May 5, 2024

Saturday, May 4, 2024

Friday, May 3, 2024

Thursday, May 2, 2024

LBank Surpasses $15 Billion in Tokenized Stocks Trading Volume, Dominating Tokenized Equities

Singapore, Singapore, February 6th, 2026, Chainwire LBank , a leading global cryptocurrency exchange, today announced that its tokenized...

-

* This article was originally published here

-

* This article was originally published here

-

Bitwise Asset Management, the largest crypto index fund manager in America, announced today that the Bitwise Bitcoin ETF (BITB), the firm’s...