Cryptocurrency tips and strategies for investors, traders, and beginners. Learn how to buy, sell, and trade Bitcoin, Ethereum, altcoins, and NFTs securely. Get insights on crypto wallets, DeFi, blockchain technology, market trends, and price predictions. Whether you're a long-term holder or day trader, this blog helps you make smarter crypto moves. Discover new coins, profitable platforms, and proven tools to grow your digital portfolio. Crypto isn’t the future—it’s now.

Cryptocurrency Tips

👉 Discover the strategy that helped early adopters multiply their earnings.

Tuesday, December 31, 2024

Monday, December 30, 2024

Sunday, December 29, 2024

Saturday, December 28, 2024

Friday, December 27, 2024

Thursday, December 26, 2024

Wednesday, December 25, 2024

Tuesday, December 24, 2024

Dogecoin Flaw Exploited, Hacker Crashes 69% of Active Nodes

On December 12, 2024, the Dogecoin network was exploited when an “ethical” hacker uncovered a critical flaw. This exploit brought down a staggering 69% of the network’s active nodes, sparking serious questions about the security of decentralized systems and the risks that come with publicly accessible nodes.

The Exploit and Its Execution

Andreas Kohl, co-founder of the Bitcoin sidechain Sequentia, admitted to carrying out the attack using a vulnerability he called “DogeReaper”. He ran the exploit from nothing more than an old laptop while in El Salvador.

I used a publicly disclosed (by @TobiasRuck) vulnerability to take down 69% of the Dogecoin network from an old thinkpad in rural el salvador. AMA. https://t.co/BNkGDWkWhu pic.twitter.com/qk16AwMaq5

— Andreas Kohl (@aejkohl) December 12, 2024

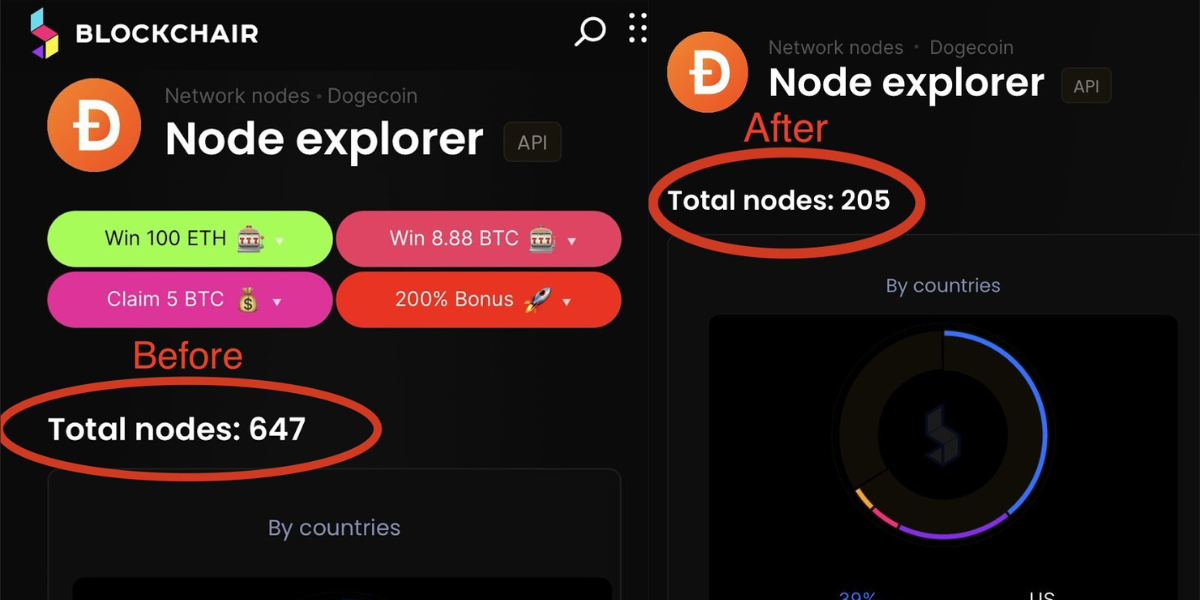

Before the attack, Dogecoin had 647 active nodes. After the exploit, the number of operational nodes dropped to just 205. Kohl’s actions have brought attention to a critical flaw in the network’s architecture.

The “DogeReaper” vulnerability, first disclosed by a social media account named “Department of DOGE Efficiency” on December 4, allows anyone to remotely crash Dogecoin nodes.

This vulnerability allows anyone to remotely crash Dogecoin nodes by triggering a segmentation fault – a software error that occurs when a program tries to access memory it shouldn’t. Because Dogecoin nodes are publicly listed, they’re easy pickings for anyone who knows how to exploit this flaw.

The “DogeReaper” is a sort of “Death Note” for Dogecoin nodes. The danger it posed was significant: a malicious hacker could have shut down the network entirely, halting transactions and block creation for days.

Also, despite its severity, the vulnerability was labeled “low-risk” by Coinbase. The researcher who discovered it, Tobias Ruck, received just $200 for his efforts. This decision has fueled debates about how the crypto world values major security findings like this one.

More News: Australia to Crack Down on Crypto ATM Providers Due to Money Laundering Risk

Community Response and Security Concerns

The attack showed just how tricky it is to keep decentralized networks safe. Sharing the flaw out in the open might have been done to push developers to act quickly, but it also gave hackers an easy chance to use it. Some people think the better move would’ve been to tell developers privately and wait to share it after a fix was ready.

Now, Dogecoin’s team is working fast to fix the problem. This isn’t just Dogecoin’s headache – it’s a warning for all blockchain projects. Even popular platforms run by their communities can have serious security problems.

As crypto keeps growing, strong security is more important than ever. Decentralized networks need to stay open but also find ways to block potential attacks.

Conclusion

Dogecoin’s developers are working on updates to close the security hole. And node operators may need to upgrade their systems. Also, the crypto community and developers should take another look at their security protocols and check how they handle vulnerabilities.

The post Dogecoin Flaw Exploited, Hacker Crashes 69% of Active Nodes appeared first on CryptoNinjas.

* This article was originally published here

Monday, December 23, 2024

Galxe Upgrades Gravity EVM (Grevm 1.0) and Announces $50 Million Ecosystem Fund

Key Takeaways:

- Revolutionary Performance Upgrade: Grevm 1.0 significantly enhances scalability and performance by leveraging Rust’s programming advantages and parallel architecture.

- Strategic Ecosystem Investment: A $50 million fund aims to boost developer engagement and attract high-quality projects to Gravity.

- Decentralized Vision and Challenges: While Gravity promises seamless multi-chain integration, overcoming intense competition and ensuring security remain critical challenges.

Introducing Galxe and Gravity: An All-in-One Web3 Tool

Galxe is the world-leading Web3 identity and rewards platform that has always struck the community with its unimaginable non-stop innovation and expansion. Focusing on the creation of user-centric experiences, Galxe goes all out to effectively reward participation in blockchain projects through missions and events, using a relevant system of rewards. Success is drawn from effectively linking the users with the projects, resulting in a dynamic ecosystem of continuous growth.

Galxe

However, this rapid growth has introduced challenges in terms of scalability and performance-related issues. In order to respond to increased demands by its users and ensure seamless operations, Galxe developed Gravity—a Layer-1 blockchain designed to solve these issues.

Launched in August 2024, Gravity is not just another blockchain; instead, it is an overall solution to the scalability and cross-chain interaction problems of Web3. Built on Arbitrum Nitro, Gravity inherits most of the advantages in speed and performance that Arbitrum has. That said, it embeds many advanced features. First of all, Gravity is EVM-compatible, which allows developers to seamlessly port existing Ethereum smart contracts to Gravity.

GREVM 1.0: A Performance and Scalability Game Changer

The most high-profile announcement Galxe has made in recent times is the upgrade of Gravity’s EVM to Grevm 1.0. This is no routine upgrade but a game-changing technological leap that promises substantial gains in performance and scalability.

Grevm 1.0 is an open-source parallel EVM, implemented based on “revm,” which is an EVM implemented in the Rust programming language. Its choice brings many advantages:

- High performance: Rust is said to have a very great speed for processing and hence is performance-optimal.

- Strong security: The strong memory management of Rust reduces errors in memory, hence offering improved security.

- Scalability: Rust supports parallel programming and, therefore, speeds up transaction processing.

Grevm 1.0 applies a parallel architecture that processes many transactions at the same time, which greatly reduces the wait times and increases the general performance of the network. According to Galxe, Grevm 1.0 has proven to be much faster than the traditional EVMs and other parallel EVMs. This simply means that Gravity can bear a huge volume of transactions within a short time for high-performance application demands.

More News: Sonic Labs Teases Upcoming Public Launch of Its Layer-1 Blockchain

$50 Million Ecosystem Fund for Sustainable Growth

Along with the Grevm 1.0 upgrade, Galxe announced a $50 million ecosystem fund. Quite a substantial investment by Galxe to show confidence in Gravity’s potential and to make sure a vibrant and sustainable ecosystem is built.

This fund will be spent on projects built on the Gravity network by both individual developers and companies. Developers will have the financial opportunity to create quality applications and services that attract users to Gravity. Venture capital involvement by firms like Dragonfly Capital, HashKey Capital, DAO5, and Lattice further helps in validating the potential of Gravity and hence attracts investors.

Moreover, another $5 million has been reserved by Galxe toward developer grants. This initiative would definitely lead to inviting many more developers into this world of Gravity and contribute towards the building of a massive and strong developer community.

Integration and Development of the Galxe Ecosystem

It was extremely important to migrate the core applications of Galxe onto Gravity. By onboarding core applications like Passport, Quest, Compass, and Identity Protocol, he successfully provided an all-in-one suite of services to the end user.

This integration allows the achievement of several advantages, such as:

- Enhanced User Experience: The users of Galxe can access, on one platform, all the services that Galxe has to offer.

- More interactions: This integration increases that between users and projects in the Gravity network.

- Wider reach: As Galxe leverages Gravity as the core platform for its work, it means its reach will be extended to a greater number of users.

The migration to Gravity also marks a critical point for Galxe in its movement from the centralized model toward one that is more decentralized, thus adding to the transparency and security of the platform for building trust with its users.

Vision and Challenges Over the Long Term

Long-term, Galxe envisions Gravity as a multi-chain network that will power thousands of projects and enable seamless, efficient cross-chain transactions for all users. And it is here that the open-source toolkit called Gravity SDK comes into play in developing this vision. This SDK will give the opportunity to develop Layer-1 and Layer-2 blockchains on Gravity by different developers, opening wide avenues for new development.

However, Galxe faces several issues:

- Stiff competition: The blockchain market is getting highly competitive. Gravity must also assure users and developers that its results are bound to be better than its rivals.

- Community Adoption: Considerable marketing and community-building efforts will be required to get the community to actually adopt and use Gravity.

- Cybersecurity: For any blockchain, security is always a big concern. Gravity should have solid cybersecurity to avoid possible attacks.

Impact on the Cryptocurrency Market

This can be illustrated by the upgrade of Gravity EVM and the establishment of Galxe’s ecosystem fund. The new version may catalyze the development of EVM-based applications, offering new prospects for developers. Attracting projects to the platform will mean a more vibrant ecosystem for Gravity and added value for the G token.

Galxe’s G token

The actual impact, however, will depend on many factors, including overall market conditions and community acceptance.

Conclusion: A Promising Future

Upgrading Gravity EVM to Grevm 1.0 and launching a $50 million ecosystem fund was a milestone that demonstrated how serious Galxe was in building a robust and sustainable blockchain ecosystem. Though the journey is not without its challenges, the future of Gravity appears very bright, with an even brighter long-term view for Galxe.

It will be exciting and worth watching how Gravity develops in the next few months. When Gravity succeeds, that will be a big success not only for Galxe but also a driver for greater growth of the blockchain industry, opening up new opportunities for developers, users, and investors alike toward a better Web3 future.

The post Galxe Upgrades Gravity EVM (Grevm 1.0) and Announces $50 Million Ecosystem Fund appeared first on CryptoNinjas.

* This article was originally published here

Sunday, December 22, 2024

Binance HODLer Airdrop launches Movement: Here’s How to Participate

Key Takeaways:

- High performance and security: Move Network is a Layer-2 on Ethereum using the Move programming language to achieve high transaction speed at 30k+ TPS and best security compared to other solutions.

- Ecosystem: More than 60 decentralized applications have already been working on testnet, and with support from such leading investment funds as Polychain Capital and Binance Labs, Movement Network is developing a very lively and promising blockchain ecosystem.

- Exciting airdrop opportunities: Join the Binance HODLer Airdrops program, which joins the distribution of the MOVE Tokens, unlocking investment opportunities in this highly promising blockchain project.

Introduction to Movement (MOVE)

Movement is an L2 built on Ethereum using the Move programming language—a language designed by Meta, earlier known as Facebook—to improve the security and performance of the layer. Unlike other L2 solutions, which try to scale transaction throughput by batching a huge number of transactions, parallelization of transaction processing is key to Movement’s strategy for handling a large number of transactions at the same time. This leads to very high transaction speeds of up to 30,000 TPS, far beyond what most existing blockchains can provide.

It’s fast and secure: in Movement, everything is oriented to be secure. For example, Move language has strict resource control features that would prevent most of the most common bugs and vulnerabilities that have appeared in smart contracts. That’s a huge contrast to many other blockchains which are still working on Solidity, the programming language which is known to be rather vulnerable.

Move language of Movement Layer-2

It supports the Move language but also allows backward compatibility with smart contracts written in Solidity, Ethereum’s language, through the Fractal interpreter. The result will be better interoperability between the Move and EVM ecosystems, increasing both accessibility and development for each.

Ecosystem and Applications

The Movement Network ecosystem will be fast-growing to an expansive platform where, all in all, over 60 dApps are already live today on testnet and boast a huge variety of uses among DeFi, gaming, NFTs, etc.—just to name a few. This points to great potential impact for Movement Network further in supporting a multitude of different types of distributed applications. Among the notables building on Movement, take a glimpse at:

- Meridian: building DeFi tools like the Automated Market Maker, Liquid Staking Tokens, and Liquid Restaking Tokens.

- Echelon: DeFi-money market featuring major and minor assets.

- Pontem Network: Digital wallet creation and DEX.

- Up Network: Creating Web3-optimized phones for Movement Network.

- Nexio: Creating high-throughput parallel Bitcoin rollups.

- And many more…

These various projects reflect the strength and flexibility of the Movement Network. Many projects chose to implement their ideas on the ground at Movement due to its technological aspects and ecosystem.

Investment and Support

The movement has seen strong support from top-tier investors including:

- Polychain Capital is a venture capital firm focused on blockchain.

- Binance Labs: The venture arm of Binance, one of the most extensive cryptocurrency exchanges globally.

These investments are not only valuable in terms of funding but also in the form of acknowledgment of potential and trust in the Movement Network.

Roadmap

Movement Network is at a stage of robust development. The following are some of the critical roadmaps for the project:

- Phase 1: The mainnet will be launched officially.

- Phase 2: The deployment of Move Stack, a suite of tools to build and deploy blockchains based on the language Move.

- Phase 3: Deployment of MoveVM—a virtual machine that will support the language Move.

- Phase 4: Multi-staking feature deployment.

Milestones reached so far: successful fundraising and testnet release.

Binance HODLer Airdrops

Binance announced the HODLer Airdrops program with MOVE tokens. This is a good opportunity to get some free MOVE tokens for those users who would register BNB in the Simple Earn Flexible or Locked products within the timeframe specified. For more detailed information, one can visit the website of Binance. Binance’s move to support MOVE through an airdrop program is a reflection of confidence in the project by the exchange.

Timeline

| Event | Date (UTC) |

| BNB registration phase | 02/12/2024 – 05/12/2024 |

| MOVE Airdrop distribution | 09/12/2024 |

| MOVE listing on Binance | 09/12/2024 |

More News: Binance Smart Chain mainnet introduces BNB staking

How to participate in Binance HODLer Airdrops

To be eligible for the Binance HODLer Airdrops, you need:

- A Binance account with verified KYC. If you don’t have a Binance account yet, register and trade HERE now!

- BNB: Subscribe BNB to the Simple Earn (Flexible or Locked) product within the period specified by Binance. The maximum BNB amount cannot exceed 4% of the total BNB participating.

- Wait: Binance will snapshot your BNB balance to calculate the rewards. MOVE tokens will be credited to your Spot wallet once the program concludes.

Conclusion

MOVE is a very promising blockchain project with advanced technology, fast ecosystem growth, and support from leading investors. The possibility of receiving airdrops through the Binance HODLer Airdrops makes it all the more enticing. Whichever project one wants to invest in, they are supposed to do deep research.

The post Binance HODLer Airdrop launches Movement: Here’s How to Participate appeared first on CryptoNinjas.

* This article was originally published here

Saturday, December 21, 2024

Bitcoin MENA 2024: A Vision towards the Future of DeFi and Blockchain Security

Key Takeaways:

- Security-Focused Blockchain Development: Core DAO’s emphasis on security-first principles in Bitcoin-based DeFi showcases the industry’s move toward trust and stability.

- Bitcoin’s Price Trajectory: Predictions of Bitcoin reaching $110,000 by 2025 highlight optimism, though the market’s volatility necessitates caution.

- Global Collaboration and Growth: Bitcoin MENA 2024 reflects the increasing global focus on blockchain technology’s potential in economic and technological advancements, particularly in the MENA region.

Bitcoin MENA 2024: A Push for Blockchain Growth in the Middle East

The Bitcoin MENA 2024 Conference, scheduled for December 9 and 10, 2024, at the ADNEC Center in Abu Dhabi, will surely capture the attention of the global blockchain community. This event is a serious footfall toward integrating Bitcoin and blockchain technology into the Middle East and North Africa. Participation from leading figures in the industry, ranging from institutional investors to cryptocurrency enthusiasts, shows that the potential for Bitcoin and blockchain technology in this area is huge.

Bitcoin MENA 2024

More News: Conferences & Events

Core DAO: Taking Bitcoin-Based DeFi to the Next Level – with Security First

In his keynote speech at the conference, Adam Bendjemil, Head of Ecosystem Development at Core DAO, gave profound insight into Bitcoin-based DeFi, known as BTCFi, and the security strategy being implemented by Core DAO. Core DAO is an L1 blockchain that fuses the security of Bitcoin with EVM compatibility for extensions in the DeFi ecosystem. Core DAO is working to help build trust in DeFi systems by combining financial solutions with Bitcoin’s security measures to drive broader blockchain adoption.

Bendjemil leaned into Core DAO’s “security-first” approach, doubling down on technologies such as Solidity and audits to reduce some of the risks associated with DeFi protocols. He added that protocol safety was key to building trust and fostering long-term adoption. He followed up with the following: “Core is boring, but boring is good,” referring to its “battle-tested” nature. This cautious approach runs in contrast to racing to market with untested new products.

Core DAO Differentiation

Unlike the line-ups of Ethereum and BNB Chain, Core DAO embeds Bitcoin into its operation. Meanwhile, the usage of EVM-compatible technology makes this blockchain even more approachable, opening wider perspectives for this blockchain to be finally put into use. In doing so, Core DAO prefers the route of reliability, using grounds already recognized secure and efficient rather than play around with untested technologies.

Bitcoin Price Prediction: Can Bitcoin Reach $110,000 by January 2025?

Raoul Pal, founder and chief executive of Global Macro Investor, gets a little more specific: Bitcoin might head to $110,000 by January 2025. It could be just a “local top” in the current cycle, as it might fall below $70,000 by February 2025 before bouncing in Q3 2025. He bases his forecast on his company’s GMI liquidity aggregate index. That said, these are but predictions, and the cryptocurrency market runs rather on the line of inherent volatility.

More News: Bitcoin Hits $100,000 – Sets an All-Time High Record

Notable Speakers at Bitcoin MENA 2024

Notable Speakers at Bitcoin MENA 2024

The Bitcoin MENA 2024 conference had an enviable team of speakers comprising the most influential names and personalities in the blockchain and cryptocurrency space. A few bigwig names include:

| Name | Position/Organization |

| H.E Dr. Mohamed Al Kuwaiti | Head of Cybersecurity, UAE Government |

| Eric Trump | Executive Vice President, Trump Organization |

| Changpeng Zhao | Founder, Binance |

| Dr. Marwan Alzarouni | CEO of AI, Dubai Department of Economy & Tourism |

…and many more.

General Insights

The Bitcoin MENA 2024 conference has underlined the growing interest in Bitcoin and blockchain technology within the MENA region. Emphasis on security and sustainable DeFi development is a good omen to show that the industry is maturing and in pursuit of stability. However, one should remember that the cryptocurrency market is highly volatile, and predictions of the prices are for reference only. Investment in cryptocurrencies should be made very carefully and diversely—the ability to risk only what one can afford to lose. This event seeks to open up new opportunities for economic and technological development within the region.

The post Bitcoin MENA 2024: A Vision towards the Future of DeFi and Blockchain Security appeared first on CryptoNinjas.

* This article was originally published here

Friday, December 20, 2024

BitOasis – UAE’s First Crypto Broker to Receive Full License from Dubai

Key Takeaways:

- CoinDCX’s acquisition of BitOasis highlights growing global attention on the MENA crypto market.

- The UAE is positioning itself as one of the major jurisdictions for crypto activities, gaining international interest.

- Strong regulation and strategic partnerships are driving trust and growth within the regional crypto ecosystem.

BitOasis’s Journey from MVP License to Full Operational License

The country’s first domestic crypto brokerage, BitOasis, reportedly achieved a feat by becoming fully licensed to operate as a Virtual Asset Service Provider via Dubai’s Virtual Assets Regulatory Authority. According to its website, VARA granted permission for onshoring BitOasis Technologies FZE in Dubai Silicon Oasis to conduct certain activities and types of products, including brokerage services.

This achievement is a result of relentless effort that has been put in by BitOasis for quite a while. In May 2023, BitOasis was granted an MVP license, enabling only small-scale operations. However, this very license was temporarily suspended. Throughout July 2023, BitOasis engaged in hard work to meet the requirements for its license reinstatement, particularly focusing on serving institutional investors and eligible retail investors. Their persistence paid off eventually with the full operational license.

A Notable Event: CoinDCX’s Acquisition of BitOasis to Enter the MENA Market

In August 2023, the investment came for BitOasis from India’s CoinDCX crypto exchange. Ola Doudin, Co-founder and CEO of BitOasis, said, “We are very excited to partner with CoinDCX, India’s leading crypto platform. This investment allows us to enhance our current products and expand into other markets. We’re excited about the opportunities this funding unlocks.”

BitOasis was acquired by CoinDCX

Later, in July 2024, BitOasis was acquired by CoinDCX. The sale marked the first international expansion for CoinDCX, trying to reach into the thriving market of MENA. Owning BitOasis gave it a strong foothold, as it already had licensing to operate in the UAE and Bahrain, placing CoinDCX in a better strategic position to grow in the MENA region.

Comparison of CoinDCX and BitOasis before Merger:

| Feature | CoinDCX | BitOasis |

| Primary Region | India | UAE, Bahrain |

| User Base | Over 15 million | Not officially disclosed |

| Trading Volume | Over $840M/quarter (past data) | $6B since 2016 (~$188M/quarter over 8 years) |

| Licensing | Operational license in India | Full VASP license in Dubai, operational license in Bahrain |

More News: India-based crypto exchange CoinDCX beefs up AML protection with Solidus Labs

Impact on the Crypto Market in UAE and MENA

The full operational license granted to BitOasis by VARA, coupled with the proposed acquisition by CoinDCX, has the following implications:

- Crypto Market Growth in the UAE: The UAE is fast shaping into a strictly regulated crypto hub with major exchanges and brokerages setting up shop in the country. Development speaks of determination by the government of UAE for a clear and safe crypto ecosystem. VARA also licensed various exchanges like Crypto.com, OKX—yet to get an approval—Backpack Exchange, Toko, and Binance, also yet to get final approval along with brokerages Aquanow, Fasset, CoinMENA, GCEX, Fuze, and Toko.

- Expansion by International Crypto Companies: Major Indian crypto exchange CoinDCX made its first move to enter the MENA market with the acquisition of BitOasis. This is a strong testament to the immense potential of the MENA region and the rising interest of global crypto companies in this area.

- Increased User Trust: The obtaining of a full operational license from a respectable regulatory body like VARA results in increased user trust towards BitOasis and increases the development of the crypto market in the UAE and at large, MENA. The deal will bring better user experiences, with myriad product offerings and varieties of tokens.

Overview of Challenges and Opportunities

While securing licenses and forging partnerships opens promising avenues, some challenges faced by BitOasis and CoinDCX in this regard include the following:

- High Competition: The cryptocurrency markets proved to be a very competitive space. The onus will be upon BitOasis and CoinDCX to be able to continuously create product, service, and user experiences that can help them compete with other market players.

- Evolution of Regulation: The regulative and legal environment related to cryptocurrencies is subject to continuing evolution and possibly unpredictable variation. Both are supposed to keep themselves updated to cope with any compliance and risk issues.

- Security and Safety: Security is the most paramount thing in the crypto industry. BitOasis and CoinDCX have to invest heavily in security technologies that protect users’ assets from cyber-attacks.

These challenges, however, are also opportunities. Blockchain and crypto technologies are opening up vast potential. With strategic collaboration coupled with regulatory support, BitOasis and CoinDCX can seize such opportunities to lead the crypto markets of the UAE and MENA.

The post BitOasis – UAE’s First Crypto Broker to Receive Full License from Dubai appeared first on CryptoNinjas.

* This article was originally published here

Thursday, December 19, 2024

NFT Market Report December 2024: A Blasting Comeback of Digital Assets

Key Takeaways:

- NFT Trading Volume Surges: The total trading volume of NFTs hit an amazing level in December 2024 as the market experienced a strong recovery.

- Ethereum Leads the Way: Ethereum continued to be at the forefront in the NFT space, as the lion’s share of the total trading volume went its way.

- Top Collections: Pudgy Penguins and CryptoPunks are two of the most popular collections that accounted for a great part of the market growth.

December 2024 is an eventful month in the NFT markets—a stronger comeback after months of stagnation. According to data from CryptoSlam, the total NFT trading volume in the first week of December surpassed $187 million, beating the best record week of November at $181 million. This has continued the positive trend started in October and marked significant recovery from the challenging month of September.

Ethereum: The Driving Force Behind the Recovery

Ethereum was the leading contributor to this strong recovery. The volume of Ethereum was well over $92 million, up 44.69% from the week before. This was highly driven by the top collections’ brilliant performance, including Pudgy Penguins and CryptoPunks.

Pudgy Penguins and CryptoPunks Shine Brightly

Pudgy Penguins reached a high trading volume of $25 million, which outperformed the previous week by 346%. Its floor price jumped from 13 ETH to 20.9 ETH, approximately $83,000 on December 8.

Pudgy Penguins NFT

Not to be left out, CryptoPunks had a total traded volume of $16.5 million to secure the second-best spot. Its floor price attained a maximum value of 44 ETH before oscillating around 40 ETH, about $160,000 as of December 8.

Participation of Other Blockchains

Apart from Ethereum, other blockchains also contributed to the NFT market’s performance in December. Bitcoin-based blockchains recorded a trading volume of $43.8 million, while other blockchains, including Solana, Immutable, Mythos Chain, Polygon, Cardano, and Flow, collectively contributed $47 million.

November: Remarkable Recovery

Even before December’s boom, November showed very promising signs with $562 million in trading volume, a 57% increase from October. This was the highest level in six months and proved that the NFT market’s heady days were slowly making their way back. CryptoPunks also saw its floor price rise significantly from around 26 ETH to almost 40 ETH by the end of November.

More News: The Rise of NFTs: How to Profit from Digital Art and Collectibles

Noteworthy Events

Besides impressive trading volume figures, a number of events took place in November and December:

- RTFKT, owned by Nike, shut down its operations completely. This is indicative of the volatility and fierce competition that characterizes the NFT market.

- Yuga Labs acquired the technical team at Tokenproof, showing deep commitment to research and development in NFT technology.

- Emergence of New Collections: The flow of projects into the NFT market persisted, fostering greater variety and competitiveness.

Blockchain Trading Volume

| Blockchain | Trading Volume (Million USD) | Note |

| Ethereum | 92+ | Growth 44.69% from the week before |

| Bitcoin | 43.8 | – |

| Solana, Immutable, Mythos Chain, Polygon, Cardano, Flow (Total) | 47 | – |

Source: CryptoSlam

Observations

The strong growth of the NFT market in December 2024 highlights the immense potential of digital assets. However, this is a volatile market that requires proper strategy on the part of investors. The fierce competition will continue to drive innovation and technology in this area.

The participation of major brands such as Nike and investment by leading companies like Yuga Labs underlines confidence in the future of NFTs. However, caution is still advised, especially for new investors in the market. A deep understanding of the market is crucial for making informed investment decisions.

The post NFT Market Report December 2024: A Blasting Comeback of Digital Assets appeared first on CryptoNinjas.

* This article was originally published here

Wednesday, December 18, 2024

Solana Price (SOL) Continues Its Upward Trend: What’s Driving It?

Key Takeaways:

- One of the biggest news events in recent history, when David Sacks, a venture capitalist and a major Solana backer, was tapped to be an advisor on AI and cryptocurrency for the Trump administration, stirred up some massive bullish momentum for SOL.

- The explosion of memecoins within the Solana ecosystem has been improving network activity and driving demand for SOL.

- Technical analysis points out that the short-term outlook for SOL is positive, though there is a possibility of an extended rally if key resistance levels are pierced.

David Sacks – The Main Driver behind Solana’s Price Surge?

The appointment of David Sacks, a popular venture capitalist and figure within the tech community, to the Trump administration as a policy advisor on AI and cryptocurrency, has given significant fuel to SOL’s price. As an outspoken Solana fan, he publicly disclosed a large ownership in the SOL token and continued to express optimism for the prospects that helped investors get their confidence back.

David Sacks – The main drive behind Solana’s price surge

Evidence of this includes frequent appearances on the All-In podcast to discuss his investments, which include SOL, and an unabashed statement of holding SOL through the FTX collapse. In fact, he even went as far as to deny speculation that he was selling any SOL post-crash.

Impact: While this development instills confidence, it could also set the stage for a possible Solana ETF approval sometime in 2025, which theoretically should drive more funds into SOL.

Wave of Memecoin Drives Solana Network Activity

This isn’t the only driven price rally that SOL is exhibiting, as memecoins are taking over the Solana ecosystem as well. Memecoin players such as Dogwifhat (WIF), Bonk (BONK), and Peanut the Squirrel (PNUT) have jumped multifold in the last 24 hours, as network action heats up. Demand has thus spiked for SOL—the gas token used to pay transaction fees.

List of Solana memecoin

Memecoin 24-hour Increase (%) Example:

- Dogwifhat (WIF): 7.5%

- Bonk (BONK): 6%

- Peanut the Squirrel (PNUT): 4.5%

Data: According to Dune Analytics, memecoin projects are developing on Solana like a boom. Many projects were launched on the platform called pump.fun, and these created enormous revenues of as high as 1.61 million SOL, approximately $300 million. In November 2024, memecoin trading volumes surged on Solana to highlight robust growth in their volumes and value.

More News: Analysts Foresee a Staggering 10,000% Surge in Solana’s Value

Technical Analysis Showing Positive Outlook

From the technical analysis perspective, the chart of SOL looks promising as its price seems to spring back from the support line of an ascending triangle, which in turn is a pattern that normally witnesses an uptrend continuation.

SOL/USD daily price chart. Source: TradingView

Prediction: Once the SOL breaks above the resistance level of around $250, then the chances are it may surely rise toward the range of $300–$310 in December 2024. Should it fail to break, a sideways movement or price correction may be witnessed further. This is just a prediction based on the technical analysis and does not guarantee outcomes.

Final Remarks

The current rise in SOL basically comes from the coincidence among strong support from influential figures, the explosive memecoin boom, and a positive perspective unveiled by tech analysis. However, essentially, the cryptocurrency market is highly capricious and very precarious. It is necessary, therefore, for all willing investors to perform vital calculations of risks and proper selection of strategies prior to real investments in SOL. Say no to FOMO and do not blindly stick with the herd.

The post Solana Price (SOL) Continues Its Upward Trend: What’s Driving It? appeared first on CryptoNinjas.

* This article was originally published here

Tuesday, December 17, 2024

Monday, December 16, 2024

Paul Atkins: The New SEC Chair and the Fate of a US Cryptocurrency Market that Remains Precarious

The appointment of Paul Atkins to the position of Chair of the U.S. Securities and Exchange Commission sent shockwaves throughout the global cryptocurrency community following his nomination by President-elect Donald Trump.

The move marks the end of the Gary Gensler era of strict regulation and ushers in a new, potentially riskier chapter for the fast-growing U.S. cryptocurrency industry.

President-elect Donald Trump announced on December 4, 2024, via the Truth Social platform, his appointment of Paul Atkins, currently Chief Executive Officer at Patomak Global Partners and a former commissioner at the SEC, as the new Commission head. The move made headlines in various media outlets and across the entire global cryptocurrency community.

Trump praised Atkins as “an outstanding leader in crafting practical regulations,” considering his broad experience and deep understanding of financial markets. A move toward pro-cryptocurrency voters, who have become quite a formidable force in U.S. politics. The appointment of Atkins—who is the whole opposite from his predecessor Gary Gensler—gave signs of a new direction which holds enormous promise but also fraught with great risks for the cryptocurrency industry.

Background and Experience of Paul Atkins

Paul Atkins has decades of experience related to financial law, graduating from Wofford College with a bachelor’s degree and Vanderbilt University Law School with a J.D. After graduating, he worked for one of the larger New York-based international commercial transaction-focused law firms, Davis Polk & Wardwell. Later in his career, he served with two of the former Chairs of the SEC, Richard C. Breeden and Arthur Levitt, during the 1990s in various functions pertaining to formulating and implementing policies relevant to securities markets.

In 2002, President George W. Bush appointed him to be one of the commissioners for the SEC, and he did this until 2008. Atkins has made his reputation known as a firm free-markets believer who would constantly oppose any too heavily weighted regulations. He had spoken frequently on issues where either no rule existed or the proposed ones impeded growth and served in numerous investigations and administrative proceedings which dealt with matters like fraud under various federal securities laws and, otherwise generally sought protection of interests of investors.

Since leaving the Commission, Atkins founded Patomak Global Partners, a risk management and strategy consulting firm serving major clients in the financial sector. His work with big financial institutions, combined with his work at the SEC, helped provide a holistic view of both market and regulatory issues.

Most notably, he has been a co-chairman, since 2017, of the Token Alliance—an initiative of the Chamber of Digital Commerce, a powerful lobbying group for the cryptocurrency sector. To be sure, that evidence shows that Atkins unmistakably understands and supports blockchain technology and the potential of cryptocurrency.

Atkins vs Gensler: Contrasting Regulatory Philosophies

Compare Paul Atkins and Gary Gensler

By contrast, the differences between Atkins and his predecessor Gary Gensler are jarring, profiling two different modes of regulation:

Gary Gensler: Favored a robust regulatory regime, classifying many cryptocurrencies as securities and imposing strict regulations on them. The policy has seen a raft of lawsuits against cryptocurrency companies, which has caused instability and costs for the industry.

Paul Atkins: A free market advocate and critic of superfluous regulation, he is of the belief that blockchain is a highly promising technology and its regulation should contribute to its development and not be an obstacle in its path. He does stress protection for investors and forbidding of illegal activities, but in softer tones, focusing more on how to create a proper, clear, and transparent regulatory framework which will enable digital currency companies to act within the law with safety.

More News: SEC seeks to halt Telegram’s GRAM token from distribution

Potential Impact on the Cryptocurrency Market

Atkins certainly has his work cut out for him: keeping political pressures in check from Congress, understanding volatility in the markets, and finding the right balance between innovation and investor protection. His legacy will be shaped by how well he can build consensus, write workable regulations, and communicate to a wide range of stakeholders and the public. Success for Atkins will be tied to his ability to usher in a legal framework that draws a balance between fostering innovation on one hand and protecting investors on the other.

Challenges for Paul Atkins and the Uncertain Future

He will face pressures from Congress, opposition from consumer advocacy groups, volatility in the marketplace, and international competition. Success in Atkins’ situation depends on leadership, thoroughness in market knowledge, and balancing promotion of innovation and protection for investors. The future is uncertain regarding cryptocurrency in the United States, but all in potential under Atkins’ leadership.

The post Paul Atkins: The New SEC Chair and the Fate of a US Cryptocurrency Market that Remains Precarious appeared first on CryptoNinjas.

* This article was originally published here

Sunday, December 15, 2024

Bitcoin Hits $100,000 – Sets an All-Time High Record

This article is intended to explain the great moment when Bitcoin first broke the $100,000 mark in history, investigating the reasons for such a wonderful price increase, forecasts, and possible risks of the near and far futures of the major cryptocurrency. We will see whether this is sustainable success or just a high before the market faces a significant correction.

BITCOIN OFFICIALLY BREAKS $100,000: A HISTORICAL MILESTONE

On December 5, 2024, Bitcoin created history when it crossed the psychological barrier of US$100,000 for the first time. The surge has marked an exceptional rise for Bitcoin since the start of 2024, at an over 140% increase. It has been a jaw-dropping moment for investors worldwide and placed Bitcoin among the top digital assets. Bitcoin reached an all-time high of $103,844.05 before slightly correcting.

FACTORS DRIVING THE DRAMATIC PRICE INCREASE OF BITCOIN

The main factors that might have caused this wild upsurge in the price of Bitcoin in 2024 include:

Institutional acceptance: The introduction of Bitcoin ETFs by larger investment firms like BlackRock, Fidelity, and Invesco has pumped much-needed capital into the Bitcoin market, pushing up the prices. Bitcoin ETF inflows have surpassed $29.3 billion this year so far, with data from Farside indicative of increased institutional confidence in Bitcoin.

Crypto-friendly policies: The election of Donald Trump as U.S. President, together with the appointment of Paul Atkins – an outspoken crypto-endorser – as Chairman of the SEC, has kept speculations of more friendly regulations well alive. Besides, discussions around making a national Bitcoin reserve and creating an exemption for crypto transaction taxings drive market sentiment massively.

Halving event: The newly mined supply of Bitcoin was further reduced since the Bitcoin halving event came rather early in the year 2024, hence placing upward pressure on prices with continued demand.

Increased retail investment: the concept of FOMO, or Fear of Missing Out, heralded a lot of retail investors into the fray, thus pushing up demand.

| Factor | Description | Impact on Bitcoin Price |

| Bitcoin ETFs | Approval and launch of Bitcoin ETFs by major firms | Sharp rise |

| Crypto-friendly policies | Friendly policies by the new administration | Sharp rise |

| Halving | Reduction of Bitcoin mining rewards | Increase |

| FOMO | Fear of missing out on the part of retail investors | Sharp rise |

More News: The Evolution of Bitcoin: A Journey Through its History

FUTURE PREDICTIONS AND RISKS

Bitcoin hits 100,000 USD (Pair: BTC/USD)

Despite the significant milestone by Bitcoin, there are a number of risks looming:

Price Correction: Bitcoin might experience a price correction after reaching the high. So far, Bitcoin has faced violent readjustments after reaching critical psychological levels. According to expert opinions, prices may fall as low as $90,000 or lower.

Policy changes: Changes in policy by the government towards cryptocurrencies can occur any moment, and this may lead to high market volatility.

Competition from other cryptocurrencies: Bitcoin is constantly under the strain of competing cryptocurrencies like Ethereum, Solana, and many others.

INSIGHTS & CONCLUSION

Bitcoin’s $100,000 milestone is an achievement, underlining the great potentiality that cryptocurrency holds. Yet, with this in mind, investors will have to be very cautious in their approach and take heed of possible risks. The market for cryptocurrencies remains volatile today, and Bitcoin’s prices can change in just a snap. In that regard, investment in Bitcoin should be made out of careful consideration of one’s risk tolerance. The general rule to follow would be diversification within an investment portfolio to lessen the risk. Second, research about the market and blockchain technology has to be done in as much detail as possible before making investment decisions.

The post Bitcoin Hits $100,000 – Sets an All-Time High Record appeared first on CryptoNinjas.

* This article was originally published here

Saturday, December 14, 2024

Friday, December 13, 2024

Ripple (XRP) Continues its Ascent, Surpassing Solana and USDT in Market Cap

This article will analyze the event that XRP surpassed Solana and USDT in market cap to become the 3rd largest cryptocurrency, just below BTC and ETH. We will consider the factors contributing to the recent increase in XRP price, from activities of Ripple Labs to XRP ETF news. Then, we will evaluate the sustainability of this trend and forecast XRP’s future.

1. XRP Surpassed Solana and USDT in Market Capitalization: a Significant Milestone in the Cryptocurrency Market

On December 1, 2024, a notable event shook the cryptocurrency market: Ripple’s market capitalization surpassed both Solana and USDT.

Source: coinmarketcap.com

According to CoinMarketCap, at the time of writing, XRP has a market cap of 122 billion USD, higher than 111.9 billion USD of Solana. This rise is surprising, given Ripple’s difficult history and regulatory challenges.

XRP Price Chart. Source: https://coinmarketcap.com/currencies/xrp/

2. Factors that Drove the Strong Increase in XRP’s Price

XRP’s price increase started in recent weeks, from November 10, and reached an all-time high of $2.19 on December 1st (ATH of 7 years). This is not just a random surge, but is based on several factors:

XRP partnerships: Ripple continually announces new important partnerships, increasing its influence and investors’ trust. For example, Ripple partnered with Archax, a crypto exchange regulated in the United Kingdom, to launch tokenized money market funds on the XRP Ledger, which are valued at $4.77 billion.

Launch new products/features: Launching many new products will impress the investor community. For instance, Ripple Labs launched RLUSD stablecoin, which will be managed and approved by the New York Financial Services Authority.

Possibility of launching XRP ETF: You have probably heard that 21Shares, WisdomTree, Canary Capital, and Bitwise have filed for the XRP ETF. These events are raising expectations of the approval of XRP within the community. If approved, XRP ETF will open more opportunities for investors to invest in XRP more. This will put pressure on the price to increase.

Unverified rumors: Some of these rumors claim that Elon Musk has invested in XRP. They also contribute to positive sentiment and push the price of XRP up, though there is no evidence to prove it.

More News: Sonic Labs Teases Upcoming Public Launch of Its Layer-1 Blockchain

3. Current Issues with XRP

Despite this price surge, XRP still faces the following challenges:

SEC Lawsuit: The SEC’s allegations that Ripple violated securities laws continue to cast a shadow over them. The outcome of this lawsuit will determine the future of XRP with a focus on the United States.

The Fluctuation of Crypto Market, up and down: The crypto market is always fluctuating unexpectedly. This may just be temporary; the surge in the price of XRP could go down with any negative events that might take place in the future.

Competitive Landscape: Crypto markets include many competitive altcoins with similar functions. Thus, in order to maintain its current position, XRP needs to continuously develop and upgrade, driven by Ripple, to attract more investors.

4. Conclusion

This increase in XRP’s price is mainly based on short-term positive factors such as the expectation of regulatory changes and rumors. Long-term success has to be based on how Ripple will be able to bring real value to users.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. Conduct your own thorough research and consult with qualified professionals before making any investment decisions.

The post Ripple (XRP) Continues its Ascent, Surpassing Solana and USDT in Market Cap appeared first on CryptoNinjas.

* This article was originally published here

Thursday, December 12, 2024

Wednesday, December 11, 2024

Sonic Labs Teases Upcoming Public Launch of Its Layer-1 Blockchain

Sonic Labs is launching its new blockchain, Sonic, in December 2024. This blockchain is a Layer-1 network designed to address key problems in decentralized technology, such as high fees, slow transaction speeds, and limited scalability.

Sonic’s advanced features aim to make blockchain technology more accessible for developers and users alike. By combining high-speed transactions, low costs, and seamless integration with Ethereum, Sonic promises to be a major improvement over many existing networks.

“S” Token Airdrop

Sonic Labs recently announced the completion of a “Snapshot” on December 2. This will determine the allocation of its “S” tokens for an upcoming airdrop. Around 200 million S tokens are set to be distributed, allowing participants to swap them with Fantom (FTM) tokens at a 1:1 ratio.

These S tokens were previously earnable by participating in Sonic’s arcade games. However, these games have now been closed as Sonic transitions to launch its public mainnet.

The Sonic blockchain will operate using a proof-of-stake (PoS) mechanism. This will allow holders of the S token to stake their tokens to participate in securing the network and potentially earn rewards.

Key Features of Sonic Blockchain

Sonic blockchain is built with the latest technology to solve common problems in blockchain systems. Its standout features include:

- High Speed: Sonic can process up to 10,000 transactions per second (TPS). This makes it much faster than many existing blockchains.

- Fast Finality: Transactions on Sonic are confirmed in less than one second, providing users with an almost instant experience.

- Low Transaction Fees: Costs on Sonic are kept low, making it affordable for both users and developers.

- Ethereum Compatibility: Through its Layer-2 bridge, Sonic can interact with Ethereum, giving it access to Ethereum’s decentralized applications and liquidity.

These features make Sonic ideal for a range of applications, from gaming and trading to payments and decentralized finance (DeFi).

Also, Sonic Labs has created a developer-friendly environment to encourage innovation. Developers who build on the Sonic blockchain can earn up to 90% of the fees generated by their applications. This revenue-sharing model is a significant improvement over traditional networks, where developers often receive little to no share of the fees.

More News: Kraken to Shut Down NFT Marketplace Amid Industry Challenges

Transition from Fantom to Sonic

Sonic Labs previously worked on the Fantom Opera blockchain, which used the $FTM token. With the launch of Sonic, the focus is shifting to a new blockchain and a new native token, $S.

Users of the Fantom Opera blockchain will be able to migrate their $FTM tokens to the Sonic network. The migration will happen at a 1:1 ratio, ensuring that users do not lose any value in the process. There will be a 90-day window for this migration, during which users can swap their tokens easily.

After the initial migration period, users will still be able to move their tokens, but only in one direction—from Fantom to Sonic. This migration process ensures a smooth transition to the new network while preserving the value of existing tokens.

Sonic Labs has secured $10 million in funding from well-known investors, including Hashed, UOB Ventures, and the Aave Foundation. This funding will be used to grow the Sonic ecosystem, improve its technology, and build partnerships.

Building a Strong Community

Sonic Labs is taking steps to create an active and engaged community. The company has announced plans for a $200 million airdrop to reward early adopters. Additionally, grants will be available to developers working on innovative projects within the Sonic ecosystem.

These initiatives aim to attract both developers and users to the platform, creating a vibrant and supportive community. With these efforts, Sonic Labs hopes to establish Sonic as a leading blockchain network.

Conclusion

The Sonic blockchain is an important development in the world of decentralized technology. By addressing common issues like slow transaction speeds and high costs, it offers a better solution for developers and users. Its high speed, low fees, and Ethereum compatibility make it a versatile platform with many potential applications.

As the launch approaches, Sonic is poised to become a key player in the blockchain space. Whether you are a developer, user, or investor, Sonic offers exciting opportunities to explore.

The post Sonic Labs Teases Upcoming Public Launch of Its Layer-1 Blockchain appeared first on CryptoNinjas.

* This article was originally published here

Tuesday, December 10, 2024

Monday, December 9, 2024

CryptoAutos Announces Launch Date for $AUTOS Token Sale: Merging Blockchain with Luxury Cars

London, United Kingdom, November 28th, 2024, Chainwire

CryptoAutos, the world’s first blockchain-powered luxury automotive marketplace, announces the launch of its native $AUTOS Token. Starting with a Fixed Price Community Launch on Fjord Foundry on December 3rd 2024, which will run for 3 days, followed by the Token Generation Event (TGE) and exchange listings in the coming weeks.

At the core of the CryptoAutos ecosystem, $AUTOS introduces blockchain-driven solutions for transactions, staking, governance, and user engagement. With a Community Launch model, the platform prioritises community-driven, decentralised token distribution over venture capital.

To mark the launch, CryptoAutos is offering a chance to win a Lamborghini Urus, showcasing its blend of blockchain innovation and luxury.

Transforming Luxury Car Ownership with $AUTOS

The $AUTOS token aims to redefine how people interact with luxury cars, offering flexibility, transparency, and security. It facilitates seamless transactions, removes traditional banking barriers, provides a native token for the upcoming RWA platform and enables participation in the Gold membership service for the marketplace.

Beyond transactions, $AUTOS empowers its community through decentralised governance, giving users a voice in shaping the platform’s future. It also incentivises loyalty with discounts, exclusive offers, and potential rewards, while providing dealers with advertising solutions within the CryptoAutos ecosystem.

Through their luxury automotive marketplace, CryptoAutos is bringing to market one of the most powerful crypto to fiat off-ramps in the industry, giving real world utility to top tokens like, $BTC, $ETH, $BNB and many more. CryptoAutos has already generated over $58m in sales revenue to date through their automotive marketplace, and just recently completed the first ever car sale in $TON.

Setting a New Benchmark for Token Launches

CryptoAutos wants to raise the bar with its Community Launch model with Fjord Foundry, meant to ensure equal access and transparency for all participants. By allocating 110 million $AUTOS tokens through a public sale and securing up to $750,000 USDT in liquidity, the platform is prioritising a sustainable, community-driven approach over traditional VC funding.

Exploring the Future of Luxury on Blockchain

“We are so excited to finally bring $AUTOS to the global stage,” said Waqas Nizam, Co-Founder & CEO. “This launch isn’t just about a token, it’s about redefining how people own and interact with luxury assets, bridging blockchain technology with real-world value.”

About CryptoAutos

CryptoAutos is the world’s first blockchain-powered luxury automotive marketplace, offering a secure and transparent platform for purchasing high-value vehicles with cryptocurrency. By integrating Web3 technologies, CryptoAutos simplifies the buying process, providing a seamless experience for car enthusiasts and investors alike. Through its innovative $AUTOS token, CryptoAutos connects blockchain technology with real-world assets, creating a new standard for luxury ownership.

To participate in the $AUTOS public sale, users can head to Fjord Foundry on the 3rd of December – https://app.fjordfoundry.com/token-sales

For more information, users can visit the links below:

- Product Website: cryptoautos.com

- Token Website: autostoken.xyz

- Whitepaper: View Whitepaper

- Pitch Deck: View Pitch Deck

- Twitter: twitter.com/cryptoautos

- Telegram:t.me/CryptoAutosHub

Contact

Co-Founder & CEO

Harley Foote

Crypto Autos

harley@cryptoautos.com

The post CryptoAutos Announces Launch Date for $AUTOS Token Sale: Merging Blockchain with Luxury Cars appeared first on CryptoNinjas.

* This article was originally published here

LBank Surpasses $15 Billion in Tokenized Stocks Trading Volume, Dominating Tokenized Equities

Singapore, Singapore, February 6th, 2026, Chainwire LBank , a leading global cryptocurrency exchange, today announced that its tokenized...

-

* This article was originally published here

-

* This article was originally published here

-

Bitwise Asset Management, the largest crypto index fund manager in America, announced today that the Bitwise Bitcoin ETF (BITB), the firm’s...