So, you’ve figured out how to buy crypto, exchange it, mine it, and store it in a secure cryptocurrency wallet. Now, it’s time for the next big step – trading.

Cryptocurrency trading is awfully similar and yet extremely different from traditional trading. Both can be done easily by absolute beginners, yet require a lot of practice and knowledge to master.

In many ways, cryptocurrency trading is harder than traditional trading – there’s less history to look back on, less news, fewer rules to how the assets behave, and, of course, a lot more volatility. But, in the end, all these things are what attract people to digital currency and crypto trading.

In this article, we will give a thorough how-to guide to cryptocurrency trading, starting from the very basics. Please note that nothing written in this article should be seen as investment advice. Now, let’s get started!

What is Cryptocurrency?

First, let’s establish what cryptocurrency is.

Cryptocurrency is a digital currency that serves as a means of exchange/store of value. It works thanks to the existence of a technology called blockchain – a digital decentralized distributed ledger.

Crypto assets can be divided into two groups: coins and tokens. The former are digital currencies that operate on their own blockchain, while the latter are built and launched on existing chains.

Crypto coins are usually used as a means of payment, while tokens are often used by businesses to support their internal operations or give users a better way to interact with the product/service offered by the company. Naturally, coin and token prices can get influenced by different factors, so knowing the distinction between them is important for anyone who wants to start trading crypto.

Selecting a Cryptocurrency

When you first start trading, you may want to stick to one niche – or, in our case, one cryptocurrency pair. Beginners usually do that, so they have less news to keep up with while they’re still figuring out how the market works.

Let’s get this out of the way – there’s no such thing as “the best cryptocurrency to trade”. Any answer to the “what crypto should I trade” question will inevitably be subjective. What crypto you should trade (and how you trade it) depends on your goals, experience, starting funds, risk aversion, and so on.

For example, if you see trading as a laid-back way to earn some income on the side then it’s better to stick to bigger cryptocurrencies like Bitcoin and Ethereum – their price movements are less unpredictable than those of smaller, newer coins, and you will be able to reliably trade them in the long run.

How Does Cryptocurrency Trading Work?

The crypto market operates in a different way from other financial markets, so it is important to learn more about it before diving headlong into cryptocurrency trading. Cryptocurrency traders use a lot of industry-specific jargon – brush up on it here.

Now, let’s talk about how cryptocurrency trading works. To trade cryptocurrency means to place an “order” for buying or selling a cryptocurrency with another crypto or fiat currency. There are three main types of orders: market, limit and scaled. The former means that you will request to buy an X amount of BTC for a market price that will amount to Z amount of USDT.

As the market is volatile, the price and the trade fees displayed by the exchange are often an estimation. This is where the “stop” option and other order types come into play – they help you to control what price you buy/sell your cryptocurrency at.

You can learn more about the different types of orders on the Changelly PRO website by hovering over the little “?” question mark signs. We encourage you to play around and try all the different order and setting options.

Simple market orders are executed immediately, whereas limit orders can take a while to execute – and even may expire.

Pros and Cons of Investing in Cryptocurrencies

The volatility of the crypto market is responsible for both what attracts people to crypto trading and what scares them away from it. After all, crypto is the very definition of a high-risk, high-reward asset.

On one hand, cryptocurrency trading can provide you with some quick yet immeasurable profits – on another, it can cause you to lose all your savings. It’s dangerous not only because it’s so volatile, especially compared to trading fiat currencies, but also because the regulation surrounding cryptocurrencies and the crypto market is currently muddy at best. Things can change at any day, and crypto may become outlawed or heavily regulated. Of course, these outcomes are highly unlikely to happen, but this is a risk every crypto trader has to keep in mind.

A huge benefit of crypto is that the entry barrier is not high. All one needs is an account on an exchange, a secure cryptocurrency wallet, some initial investment, and a desire and determination to learn.

Cryptocurrency Trading Steps

Now, let’s talk about the steps you need to take to start trading cryptocurrency.

Step 1: Create a Cryptocurrency Brokerage Account

The first thing you need to do to start trading cryptocurrency is to create a brokerage account on a crypto exchange.

Creating a brokerage account for cryptocurrency trading is as easy as ABC – all you need to do is register on an exchange. On some of them, like Changelly PRO, you don’t even need to pass KYC to get access to the basic trading features. However, if you want to try out more advanced features and get access to higher trading and withdrawal limits, you will need to share some personal information. Don’t fret, however – getting verified on Changelly PRO is extremely easy! Here’s how you can do it.

Although creating an account itself is easy, a more important step is finding an exchange that will be secure yet will suit your needs. Before trading on an exchange, make sure to read reviews from multiple sources, like various forums or review aggregators such as Trustpilot.

Here are some excellent cryptocurrency exchanges:

Binance

A great full-featured trading platform for crypto trading experts. This is probably the most famous cryptocurrency exchange.

Coinbase

This US-based first publicly traded cryptocurrency exchange has everything an expert crypto trader may need.

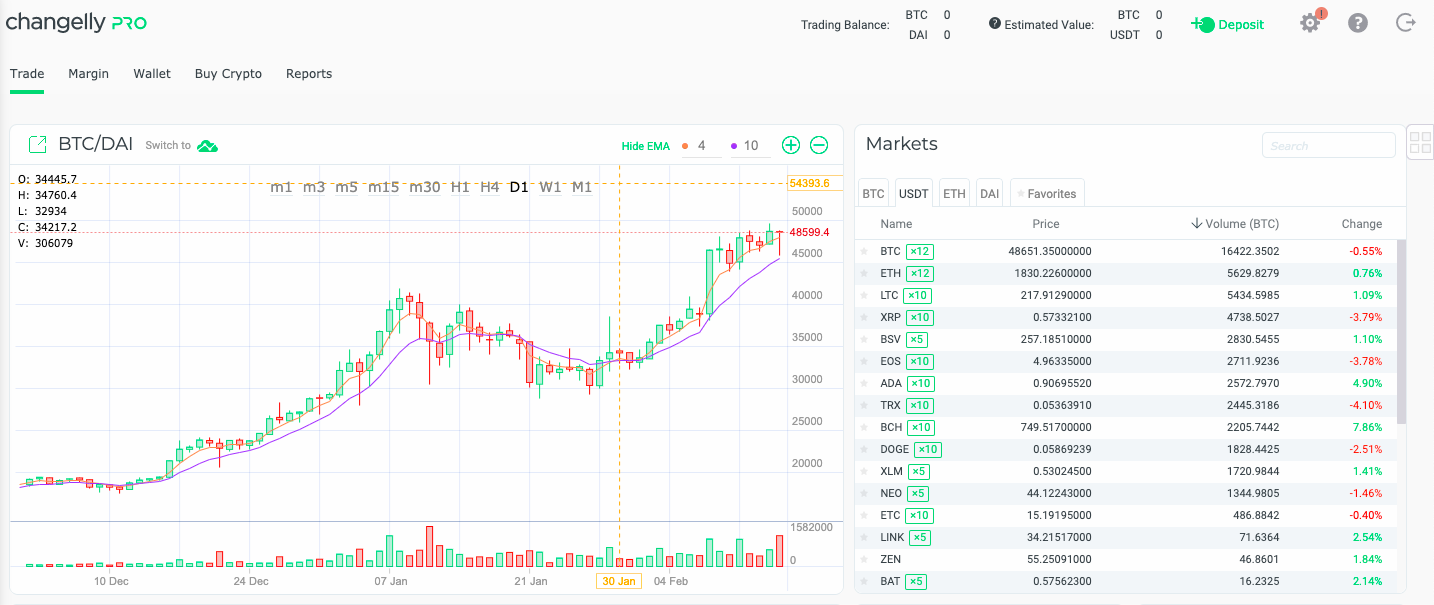

Changelly PRO

Perfect for beginners and expert cryptocurrency traders alike, Changelly PRO effortlessly combines advanced features with an easy-to-use user-friendly interface and an abundance of how-to guides.

Of course, there are many more cryptocurrency exchanges out there, and we encourage you to try trading smaller amounts on several exchanges to test them out before you commit to one. Some expert cryptocurrency traders actually prefer to trade on multiple exchanges at once, so even if you feel like you found a platform that seems perfect for you, don’t hesitate to check out other ones.

Whatever platform you choose, we recommend you always protect your account with 2FA and any other security measures offered by the exchange. Additionally, a secure crypto wallet that you can store your funds in is also essential for successful crypto trading.

Finally, make sure the cryptocurrency exchange you chose supports your preferred payment method – both for withdrawals and deposits. Additionally, make sure the platform has fair and transparent exchange fees.

Step 2: Fund Your Account

Next, you will need to deposit some starting funds into your account. As we always say, you shouldn’t invest more than you can afford to lose – this rule applies to trading, too. Carefully decide what sum you are ready to invest – if you’re a beginner, it’s better to start small. Learn how you can fund your account on Changelly PRO here.

Step 3: Learn How the Crypto Market Works

Learning how to trade, no matter whether cryptocurrencies or traditional assets like stocks, is all about getting the feel for the market.

We post all sorts of crypto-related guides on our blog – come check them out! If you’re a complete beginner, read our introduction to cryptocurrency. If you prefer auditory and visual learning to reading, then you can take advantage of the many educational crypto courses available for free on YouTube. We particularly recommend this amazing video made by 3Blue1Brown.

You may think that an in-depth knowledge of how crypto works may be unnecessary to being a successful cryptocurrency trader, but that’s not the case. The more you learn about crypto, the better you will be able to recognise which coins and tokens are destined for success, the easier it will become to identify buy/sell points that occur due to technical changes like hard forks, and so on. We highly recommend learning more about crypto in general, not just trading.

Once you amass enough general knowledge about cryptocurrency, it’s time to learn more about the market. Join crypto communities on Reddit, Discord, Twitter, or any other platform, subscribe to mailing lists, frequently check crypto prices, and so on. The goal is to not only keep with the crypto market but learn how it operates and reacts to the news even if you’re not trading the particular coin/token that is mooning or crashing at the moment.

Step 4: Pick a Cryptocurrency to Invest in

As we have already mentioned, there’s no one “best cryptocurrency” for trading. In fact, most cryptocurrency traders don’t trade just one crypto – after all, successful investment is all about diversifying your portfolio. This applies to crypto, too.

If you want to trade crypto both successfully and sustainably, as in getting profit in the long run, then it is essential to learn how to trade both small cryptocurrencies and big ones.

When you’re just starting out, go for something that isn’t as volatile, like Bitcoin or Ethereum. You can trade them together in a pair or against a stablecoin like USDT – the former is a bit more complex.

Be ready to lose money in those few days/weeks/months of trading – this is why we recommend starting with a small initial investment.

Either way, what matters the most at the start of your journey is gathering as much experience as possible, so don’t hesitate to try trading trending cryptocurrencies, ones that don’t seem to have much price movement, and so on. Be ready to lose money in those few days/weeks/months of trading – this is why we recommend starting with a small initial investment.

Step 5: Choose a Strategy

Once you’ve tested out the various features the exchange(s) you went for has to offer and decided what cryptocurrencies you will be trading in the near future, it’s time to get serious and think of an actual trading strategy.

First, establish your goals. Do you want immediate profit? Do you want long-term stable income? Or maybe you want to just learn how the market works? No matter what it is, you will need to pick a strategy that will suit your needs.

You will need to learn what things to look out for when choosing what cryptocurrency to trade, when to buy/sell, how far a price can rise, and more.

Some of the things that influence crypto prices are the cryptocurrency’s current supply, whether there are any technical updates planned for that coin/token, like hard forks, and more. Although the crypto market is not as heavily influenced by the actions of governments as fiat currencies or stocks, regulation or adoption news can cause the prices to fluctuate, so look out for those, too. You should also learn how to read the charts – the more you study them, the easier it will be for you to identify the current market sentiment (the general attitude of traders towards the market).

There is a wide variety of different trading indicators experts use as buy/sell signals. Learn more about some lesser-known metrics every crypto trader should be familiar with in this article.

Keep these things in mind when working on your crypto trading strategies and don’t forget to keep learning.

Trading Tips

The best way to become a successful crypto trader is to practice… a lot. While we encourage you to click around the exchange interface and try out all the features for yourself, here are some trading tips that can help you to get started.

You can also find other basic crypto trading tips on our blog.

Set Profit Targets and Make Use of Stop Losses

Stop-loss orders are essential to successful crypto and traditional trading. They allow you to place delayed orders that will sell/buy a cryptocurrency once it reaches a predetermined stop price.

Such orders are extremely useful on the crypto market as prices move very quickly – they can prevent you from losing money rapidly and can help to increase your profit.

Overcome FOMO

FOMO is the main villain in many traders’ journeys to success. The fear of missing out often pushes people to make rash, unthought-through decisions that often lead to some sort of loss. In trading, acting on FOMO often leads to losing one’s money.

Although the fear of missing out is a well-known enemy to rational decision-making and strategic thinking, it is especially dangerous when it comes to crypto trading. With the crypto market being so fickle and volatile, coins and tokens can moon one day and resoundingly crash the next. Often the crypto trends one sees are incredibly short-lived, sometimes not even lasting a couple of days.

Here’s an example: imagine there’s some unknown token, let’s call it ATONWT (which stands for “All The Other Names Were Taken”… seriously, it seems like there’s already a cryptocurrency for every single abbreviation out there).

ATONWT was listed on your favorite exchange quite a while ago, but you’ve always thought it to be a regular shitcoin, not worth your time. Then, you wake up one day to unbelievable news: ATONWT is aiming for the moon! The token has shot up 1234% in only two hours. Naturally, seeing these numbers, you and many others decide to jump on the bandwagon: the price of ATONWT rises a few percent, and then, as the people who initially pushed it to start selling it off, drops back to $0.0000001. You cry yourself to sleep that night.

This story is obviously exaggerated (and a bit brutal, sorry), but similar things have happened to people in the past. FOMO often drives people to buy crypto when it’s near its highest point: don’t fall for that trap. Learn how you can defeat FOMO once and for all in this article.

Utilise News

As we have already mentioned, it is very important to keep up with the latest crypto news.

Besides alerting you to possible trade entry points, they also often reflect the general mood of the market and the industry. Not to mention, many news aggregators often post price and market analysis: we don’t recommend blindly following it, but you should still keep an eye on what the experts are saying.

Technical Analysis

Technical analysis is a powerful tool many traders use to decide on their trades and establish their trading strategy. It uses past data to make conclusions about the possible future price movements for any given asset.

Doing your own technical analysis isn’t as daunting as it may seem at first glance – but if maths and stats aren’t your forte, you can always read such analysis made by other crypto experts.

Trade on Margin

Margin trading is an advanced trading feature that can help you to multiply your profit – or your losses.

There’s a good reason why margin trading on Changelly PRO and many other cryptocurrency trading platforms is locked behind KYC: you shouldn’t engage in it if you’re a complete beginner or are a casual trader. Basically, it allows you to “borrow” money from an exchange/broker, trading on leverage. It can multiply your profits tenfold with your initial investment remaining the same, but it is just as likely to multiply your losses.

You can try it out with a small sum to gain some experience, but we would recommend against engaging in crypto margin trading if you’re a beginner.

Learn more: How to start crypto margin trading?

Manage Your Risks

We’ve said this a few times already, but it’s worth repeating: the risks associated with trading cryptocurrency are quite high.

There are several ways to manage those risks. Firstly, you can diversify your portfolio – don’t make crypto trading your only source of income. Day trading should never be someone’s only form of investment. If you’re looking for more ways to invest or earn crypto, check out this article. Moreover, consider investing in other assets, possibly ones that are less liquid to balance out crypto.

Secondly, you should never fund your account with more cryptocurrency than you can lose.

Thirdly, don’t go for exceptionally risky trades. The high profit they can provide can be alluring, but often in the long run it’s better to make smaller, yet still profitable trades instead of big risky ones.

Of course, there are more ways in which you can manage risk when trading cryptocurrency, but those are the main three. As long as you keep your head cool and don’t rely too heavily on one asset, you should be fine.

Underlying Assets Create Volatile Market Conditions

One important thing all beginner crypto traders should remember is that all altcoin prices are tied to Bitcoin. The price movements may not always go in the same direction, but when something happens to Bitcoin price, then altcoins become affected, too.

Bitcoin, in turn, is influenced by fiat, the media, public opinion, and more – it is quite a volatile asset. We’ve all seen it lose almost half of its value over a few tweets. This is why the crypto market is so treacherous – a feature that scares some people off and attracts others.

Some experts advise halting all crypto trades while Bitcoin is volatile to avoid unnecessary risk. If you are a beginner, you should definitely heed to this advice – and if you’re an expert, then you likely know what to do in such situations without advice from other experts.

Don’t Buy Simply Because the Price Is Low

This is another trap many budding crypto traders fall for: buying up assets just because they used to cost a lot yet fell in the last few days/weeks. The crypto market is only cyclical when it comes to large, established cryptocurrencies like Bitcoin or Ethereum, but when smaller coins and tokens crash, they often don’t rise back up from the bottom.

Moreover, sometimes a higher/lower price doesn’t indicate the coin’s true level of success and prosperity. 1 Dogecoin may not be worth thousands of dollars, but it is still a coin that has good long-term prospects and that many people invest in.

Rather than price, pay attention to a cryptocurrency’s market capitalization, trade volume (higher volume indicates higher liquidity and genuine interest in the cryptocurrency), roadmap, team, community, and so on.

Conclusion

We’ve mentioned a lot of tips on how to trade cryptocurrency in this article but didn’t officially outline the most important one: practice.

Whether you’ve learned a new analysis technique, a new trading strategy, or discovered a new feature – try it out on an actual exchange. That’s really the best way to learn and the fastest way to become a successful crypto trader.

There are a lot of things we haven’t even touched on in this article – for example, the different ways to trade, such as day trading, binary options trading, margin trading, the futures market, CFD trading, short selling, derivatives trading… the list can go on and on. If you’re just starting out, don’t focus on these things too much – work your way up from the simplest features to the more advanced ones.

And if you feel like crypto trading isn’t your cup of tea, you can always buy, sell, and exchange crypto on our instant exchange platform Changelly.

Happy trading and good luck!

Frequently Asked Questions

How do you trade cryptocurrency as a beginner?

If you’re a complete beginner to cryptocurrency trading, we recommend starting small. Don’t deposit big amounts to your trading account.

That said, the first thing you’ll need to do is find a suitable cryptocurrency trading platform and get a secure crypto wallet. We recommend Changelly PRO – we’ve designed it to be the perfect crypto trading launchpad.

If you’re a complete beginner, don’t focus on profit yet. It is highly unlikely that you will be able to consistently make successful trades when you’re just starting out, so focus on gaining as much experience as possible while cutting your losses short.

How do you trade crypto for profit?

Just like with traditional trading, there’s a lot of money to be made by trading cryptocurrency. No matter how you trade crypto, there’s a way to make it profitable.

The first step to becoming a successful cryptocurrency trader is carefully setting your goals. Do you want to become a millionaire overnight? Do you want to have a secondary/primary source of stable, consistent income? If you answered “yes” to the first question, then let us be honest – you might as well go and buy a lottery ticket. Although quite a few people have become incredibly rich after they started trading cryptocurrency, just as many, if not more, lost everything they initially invested.

Keep a cool head on your shoulders, don’t get affected by FOMO and other such extreme emotions, diversify your portfolio, learn and practice – and you will become a successful crypto trader in no time.

Is trading cryptocurrency illegal?

Cryptocurrency trading is, in general, fully legal. Of course, a lot depends on the regulations in your country of residence – check them before you trade, purchase, or even just hold cryptocurrency.

Additionally, there may be some exchanges that operate under dodgy rules – be on the lookout for them. A huge red flag is an exchange not requesting their users to go through any sort of KYC/AML procedures even when withdrawing large sums of money. We talked a lot about the importance of those procedures in this article.

Can you get rich trading crypto?

Just like with traditional trading, it is possible to become rich when trading cryptocurrency. However, do not expect this to happen overnight – or happen at all, especially if you are just starting out. Trading is complicated, and mastering takes a lot of time and effort and requires you to invest your own time quite heavily in it.

There are plenty of examples of people who have gotten rich from trading cryptocurrency – one only needs to check Reddit and various crypto forums to find them.

When is the best time to trade cryptocurrency?

Unlike traditional exchanges, the crypto market is open 24/7 on a growing number of exchanges. The best times to trade cryptocurrency are those when global activity is at its highest – usually, that is the early morning. The timezone definition of that morning will depend on what area of the world most users on your exchange reside in.

The post How to Start Trading Cryptocurrency appeared first on Cryptocurrency News & Trading Tips – Crypto Blog by Changelly.

* This article was originally published here

No comments:

Post a Comment