Welcome to the world of BITmarkets – a leading cryptocurrency exchange offering a wide range of trading options for both retail traders and corporate clients. In this comprehensive review, we will explore the various features and services provided by BITmarkets, including spot trading, futures trading, and margin trading. Whether you’re a seasoned trader or just starting your cryptocurrency journey, BITmarkets has something for everyone. So, let’s dive in and discover what makes BITmarkets a top choice in the crypto trading industry.

What is BITmarkets?

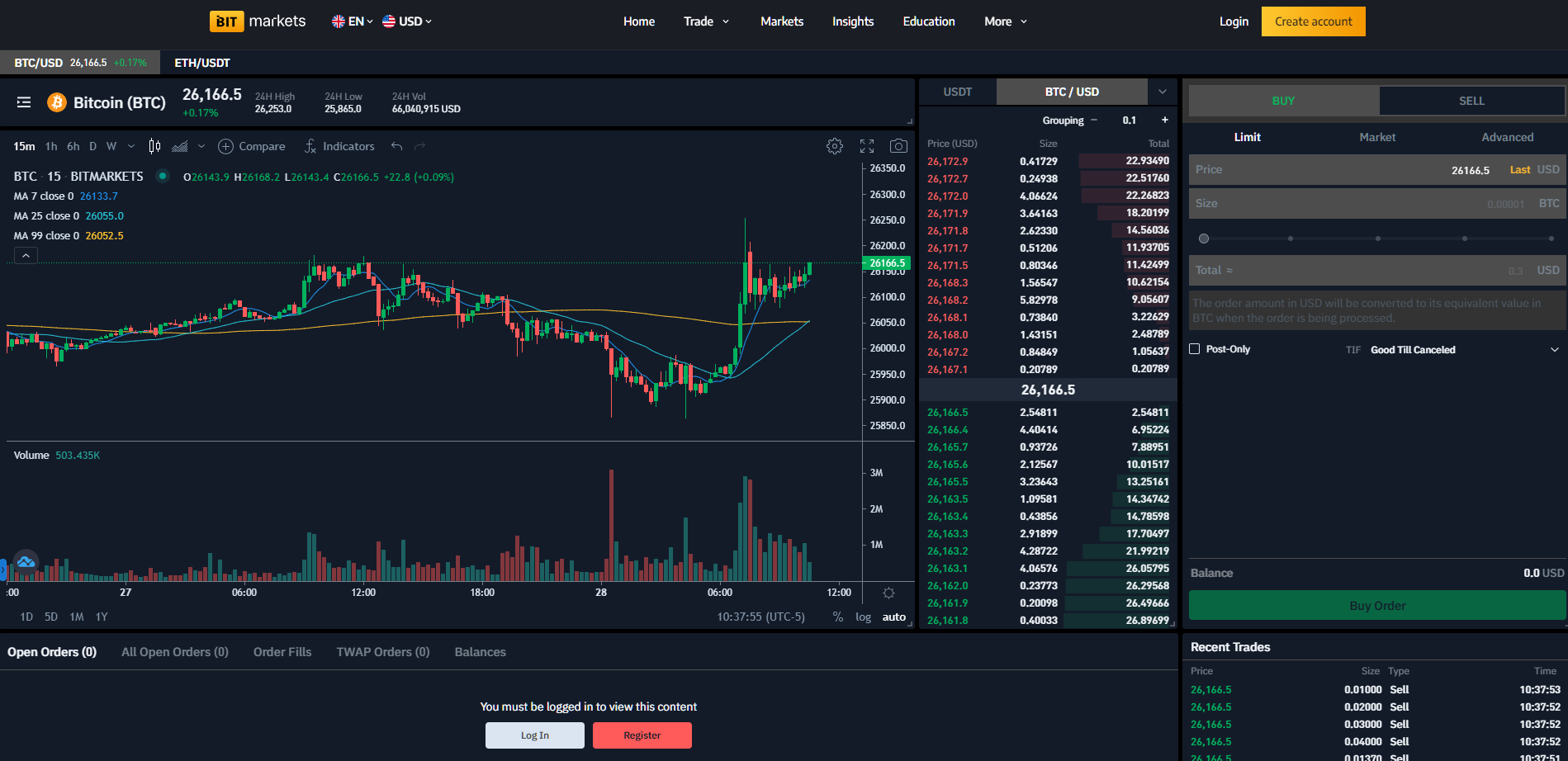

BITmarkets is a prominent cryptocurrency exchange that provides a platform for buying, selling, and trading over 100 cryptocurrencies. The BITmarkets exchange offers a user-friendly interface, advanced trading tools, and a secure environment for traders to execute their transactions efficiently. BITmarkets caters to both individual traders and institutional clients, providing a comprehensive suite of trading options to meet their diverse needs.

Spot Trading on BITmarkets

Spot trading is one of the primary features offered by BITmarkets. It involves the purchase or sale of cryptocurrencies for immediate settlement, at the current market price. This allows traders to take advantage of short-term price movements and capitalize on market opportunities. BITmarkets offers a wide range of cryptocurrencies for spot trading, including popular options like Bitcoin, Ethereum, and Ripple, as well as lesser-known altcoins.

Benefits of Spot Trading

Spot trading on BITmarkets offers several benefits for traders:

- Immediate Settlement: Spot trading allows for instant execution of trades, ensuring that traders can quickly take advantage of market movements.

- Market Price Exposure: By trading at the current market price, traders have direct exposure to the underlying asset and can benefit from its price fluctuations.

- Wide Range of Cryptocurrencies: BITmarkets offers an extensive selection of cryptocurrencies for spot trading, providing traders with ample choices to diversify their portfolios.

- User-Friendly Interface: The platform’s intuitive interface makes it easy for traders to navigate, execute trades, and monitor their positions.

Futures Trading on BITmarkets

In addition to spot trading, BITmarkets also offers futures trading, which allows traders to speculate on the future price movements of cryptocurrencies. Futures contracts are agreements to buy or sell an asset at a predetermined price and date in the future. This feature enables traders to take both long and short positions, depending on their market outlook.

How Does Futures Trading Work?

Futures trading on BITmarkets operates through the use of derivatives known as futures contracts. These contracts specify the quantity, price, and delivery date of the underlying cryptocurrency. Traders can profit from futures trading by accurately predicting the future price movements of the asset.

Advantages of Futures Trading

Futures trading on BITmarkets provides traders with several advantages:

- Leverage: BITmarkets offers leverage options, allowing traders to amplify their positions and potentially increase their profits.

- Hedging: Futures contracts can be used as a risk management tool to hedge against adverse price movements in the cryptocurrency market.

- 24/7 Market Access: BITmarkets provides round-the-clock trading, allowing traders to take advantage of market opportunities at any time, regardless of their geographical location.

- Price Discovery: Futures trading facilitates price discovery by providing a transparent marketplace for buyers and sellers to determine the future value of cryptocurrencies.

Margin Trading on BITmarkets

Margin trading is a feature that allows traders to borrow funds to increase their trading position. BITmarkets offers margin trading options, giving traders the opportunity to amplify their potential profits. However, it’s important to note that margin trading also carries increased risk, as losses can exceed the initial investment.

How Does Margin Trading Work?

Margin trading on BITmarkets involves borrowing funds from the exchange or other traders to increase the size of a trading position. Traders can choose the leverage ratio they wish to use, which determines the amount of borrowed funds relative to their own capital.

Benefits and Risks of Margin Trading

Margin trading offers several benefits and risks that traders should consider:

- Increased Profit Potential: By leveraging their positions, traders can amplify their potential profits if the market moves in their favor.

- Diversification: Margin trading allows traders to access a wider range of trading opportunities, as they can allocate their capital across multiple positions.

- Risk of Losses: Margin trading carries a higher risk, as losses can exceed the initial investment. Traders must carefully manage their margin positions to avoid significant losses.

- Margin Calls: If the value of a trader’s position declines significantly, they may be required to add additional funds to meet margin requirements or risk having their position liquidated.

Security and Regulation

BITmarkets prioritizes the security of its users’ funds and personal information. The exchange implements robust security measures, including two-factor authentication, encryption protocols, and cold storage for cryptocurrencies. Additionally, BITmarkets complies with relevant regulations and undergoes regular audits to ensure compliance and maintain trust with its users.

More Features

Conclusion

BITmarkets is a top-tier cryptocurrency exchange that offers a comprehensive suite of trading options for both retail traders and corporate clients. With features like spot trading, futures trading, and margin trading, BITmarkets provides a diverse range of opportunities for traders to capitalize on the cryptocurrency market. The exchange’s user-friendly interface, mobile platforms, advanced trading tools, and commitment to security make it an ideal choice for traders at all levels of experience. So, whether you’re a seasoned trader or just starting your crypto journey, BITmarkets has the tools and resources to help you succeed in the dynamic world of cryptocurrency trading, check out the exchange by clicking here.

The post BITmarkets – Spot, Futures, Margin Trading with 100+ Cryptocurrencies appeared first on CryptoNinjas.

* This article was originally published here

No comments:

Post a Comment